Do U.S. stocks offer the best way to invest?

In the ups and downs of the global market during the last four years, the United States has endured COVID-19 challenges just like other countries that have had their economies affected. But individual investors may wonder whether the United States offers the best investments.

Since the onset of the pandemic, investors understandably may have intensified assessing how U.S. stocks relate to the rest of the world. That does not only mean in terms of safety and preserving your investment capital, but also about how to create the best investing strategy for the long term.

Do U.S. Stocks Offer the Best Way to Invest? Seasoned Investor Jim Woods Says…

The view shared by Jim Woods, a seasoned market professional and a U.S. military veteran, is that the United States often outperforms the investments of other countries, especially in emerging markets. Most, if not all, investors are looking to make deep value trades, especially in chaotic times when the market has high volatility.

While other countries’ markets may outperform at some points, they are not nearly as safe as American stocks. This is partly because the American currency is extremely stable. In October 2021, the American currency has had a dollar index level of 75 since the housing crisis of 2008, according to the Federal Reserve. This is miles above the average in comparison to other countries.

Do U.S. Stocks Offer the Best Way to Invest? Yes, Compared to Taiwan

In our interview, Woods cited the example of Taiwan’s market, which has been one of the highest grossing emerging markets in the last 10 years. In that time, the market saw about 100% growth, roughly doubling an initial investment.

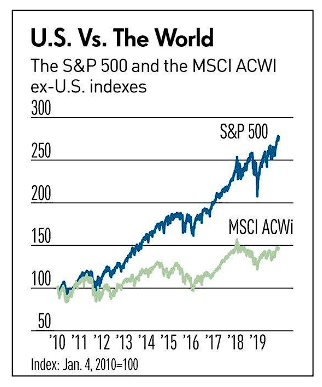

But, while this return might seem optimal, with such high volatility, the market can change on the drop of a dime. This is shown in the preceding graph from Bloomberg, exhibiting the mass fleeing of the Taiwan stock market in 2020-2021. If an investor could go back and make the same investment in the NASDAQ 100 (QQQ), today it would have more than quadrupled the original investment. From a historical viewpoint, U.S. stocks are still the best, Woods said.

Do U.S. Stocks Offer the Best Way to Invest? Consider Transparency

One of the reasons Woods said U.S. stocks are best is their transparency. An investor can access needed information whenever desired due to corporate disclosure requirements. With emerging markets across the world, it is harder to find trustworthy information.

Woods recommended staying away from foreign emerging markets, except when using exchange-traded funds (ETFs). Especially in uncertain times, there are countless benefits to investing in domestic markets compared to emerging markets. The United States has an extremely respected legal system, as well as one of the strongest bond markets in the world.

These benefits make the United States the best spot to take refuge during rough times. Woods describes this situation as “the U.S. having the best house in a bad neighborhood.”

Do U.S. Stocks Offer the Best Way to Invest? Remember American Exceptionalism

Woods stated that “American exceptionalism” is one reason that U.S. stocks are the best way to invest. The phrase, at least to Woods, recalls the idea that the United States protects individuals’ rights. This differentiation of the United States compared to other countries is based on the idea that the United States protects its citizens through the rights of free speech and bearing arms, etc.

How does this make domestic markets better? Because those ideas offer freedom to move between economic classes by working harder and producing a positive outcome. That concept created U.S. companies like Google (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), Netflix (NASDAQ, NFLX), Apple (NASDAQ, AAPL), etc.

More importantly, America offers stability to these companies and investors who rely on them. By giving people and companies these rights, the U.S. domestic market is effectively holding up a sign saying, “Your investments are not going anywhere.”

Do U.S. Stocks Offer the Best Way to Invest? America Encourages Innovation

The United States encourages innovation to create and enhance products and services. The drive for improvement comes from the idea of American exceptionalism and the protection of individual rights. While on the worldwide scale, there are emerging markets in other countries that are on the rise, America has and always will beat them out because of the strength of protection the United States gives to the individual investor, as well as U.S. companies, Woods said.

U.S. stocks offer the best way to invest not only because of the economic growth the United States attains year over year, but also because of the protection that the U.S. government offers individual investors, while still letting companies innovate and create freely.

Jordan Ellis is an editorial intern who writes for www.stockinvestor.com.

![[U.S. flag in shape of U.S.]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_117505006.jpg)