The energy market is facing what is popularly called a “Catch-22.”

While the worldwide desire to shift to cleaner sources of energy to preserve the standard of life that humanity has grown accustomed to has put pressure on the desire to shift away from hydrocarbons and to hydro, wind and solar power, the problem is that those green sources of energy still do not have the capacity to generate and store enough energy to fully meet the world’s needs.

Thus, natural gas is viewed by many observers as a bridge source of energy between oil and coal, whose combustion greatly damages the environment. The desire to shift to cleaner energy also has taken center stage in the conflict regarding Russia’s invasion of Ukraine, as Russian President Vladimir Putin is attempting to dissuade foreign support for the Ukrainians by throttling its natural gas shipments to the rest of the continent and the free world is trying to wean itself off Russian oil, whose purchase is helping to fuel his invasion.

Thus, all the evidence suggests that cleaner energy, in whatever form it takes, will remain an important source of energy for many years to come.

Of course, there are exchange-traded funds (ETFs) that will do well as a result of this shift to cleaner energy. One such fund is the SPDR S&P Kensho Clean Power ETF (NYSEARCA: CNRG).

This ETF’s portfolio is composed of two sub-indexes. One follows the technology that is used in renewable energy, and the other follows companies that offer goods and services that are related to renewable energy. To find these stocks, the portfolio’s managers pore through company documents and Securities and Exchange Commission (SEC) filings to find the key terms that signal inclusion in the index. Then, companies that meet the cut are sorted into “core” and “non-core” baskets, depending on whether clean energy is the central focus of the company.

The top holdings in the portfolio are First Solar, Inc. (NASDAQ: FSLR), Plug Power Inc. (NASDAQ: PLUG), Array Technologies Inc. (NASDAQ: ARRY), Enphase Energy, Inc. (NASDAQ: ENPH), SunPower Corporation (NASDAQ: SPWR), Shoals Technologies Group, Inc. (NASDAQ: SHLS) and Bloom Energy Corporation Class A (NYSE: BE).

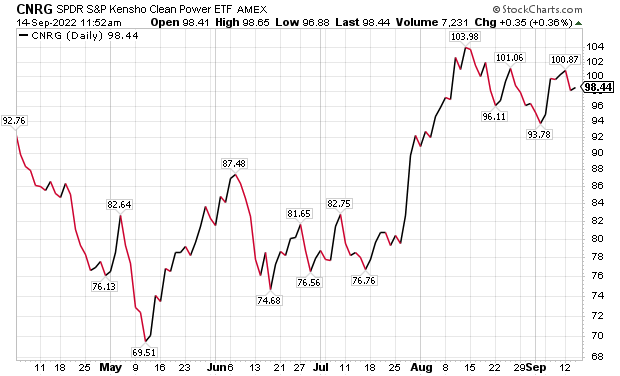

As of Sept. 14, CNRG has been down 5.66% over the past month and up 26.02% for the past three months. It is currently up 9.52% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $365.28 million in assets under management and has an expense ratio of 0.45%.

In short, while CNRG does provide investors with access to green energy, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.