What happened to crypto and what to do now?

In the last three years, cryptocurrency has taken the global trading markets by storm. With humble beginnings, the cryptocurrency industry has grown to a massive $390 billion market capitalization with more than 20,000 different currencies currently in circulation.

The only problem: a six-month recession in the cryptocurrency industry as a whole. How can individual investors take advantage of this price drop, and should they?

The cryptocurrency market has seen a substantial downfall in the last six months, with market leaders like Bitcoin (BTC-USD) losing over 50% of its worth. But does this mean that crypto is a bad investment?

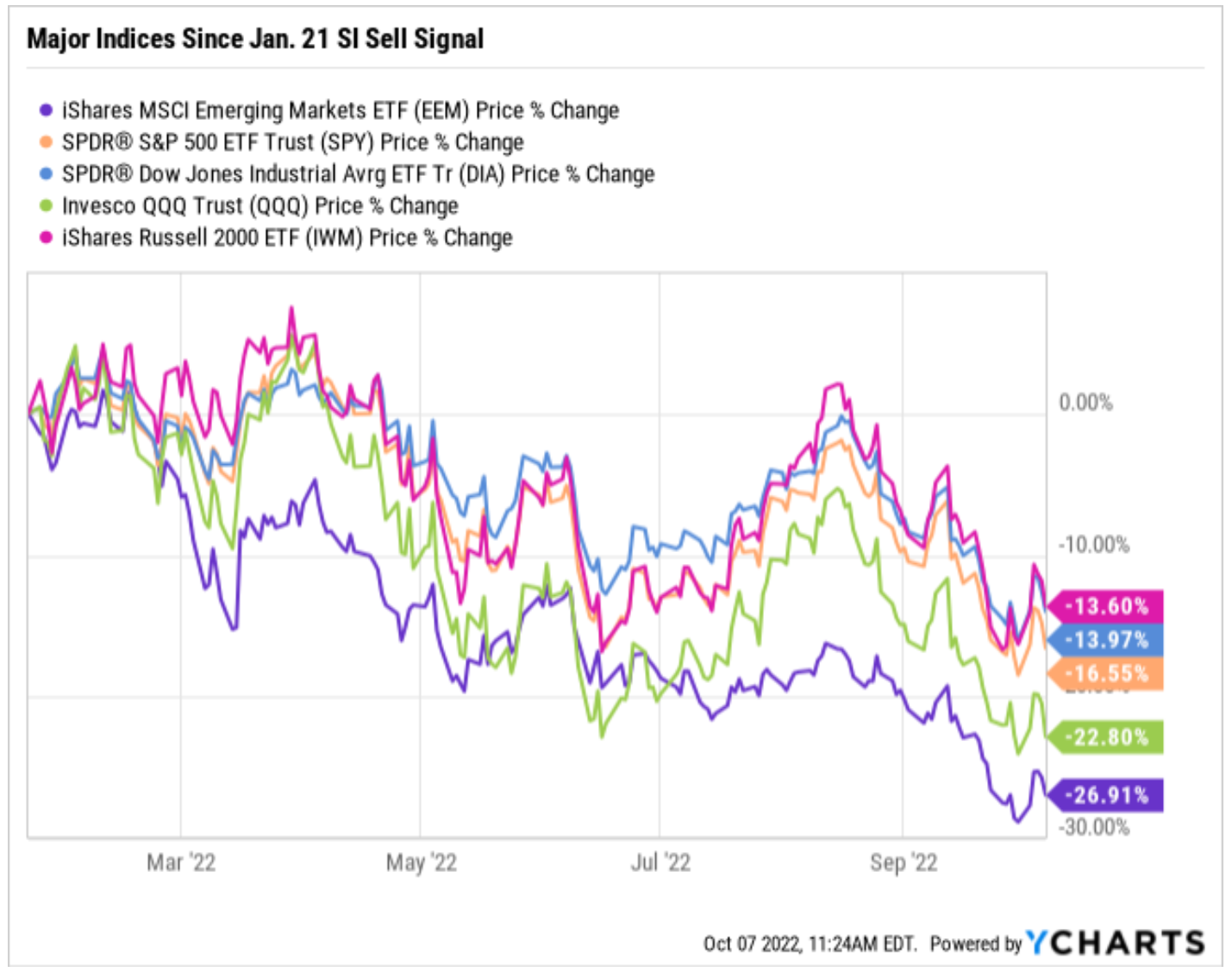

Expert stock picker and writer Jim Woods, who heads the Intelligence Report and technical-trading Successful Investing newsletters, believes that cryptocurrency is not only one of the strongest tools to find profits during today’s volatile market, but extremely easy for interested investors to pursue. A Successful Investing newsletter, also known as SI, issued a sell signal for subscribers on Jan. 21 that occurred before the bulk of the selloff in 2022.

What Happened to Crypto? Recently Gave up Big Gains

There is a large misconception that because crypto is a relatively new industry, it is an ill-advised investment for many personal portfolios, depending on the risk tolerance of each investor. Cryptocurrency offers some of the most tempting short-term and long-term profits that have been seen in the past decade. Time magazine wrote about when Bitcoin peaked and how people were able to take advantage of the high selling price.

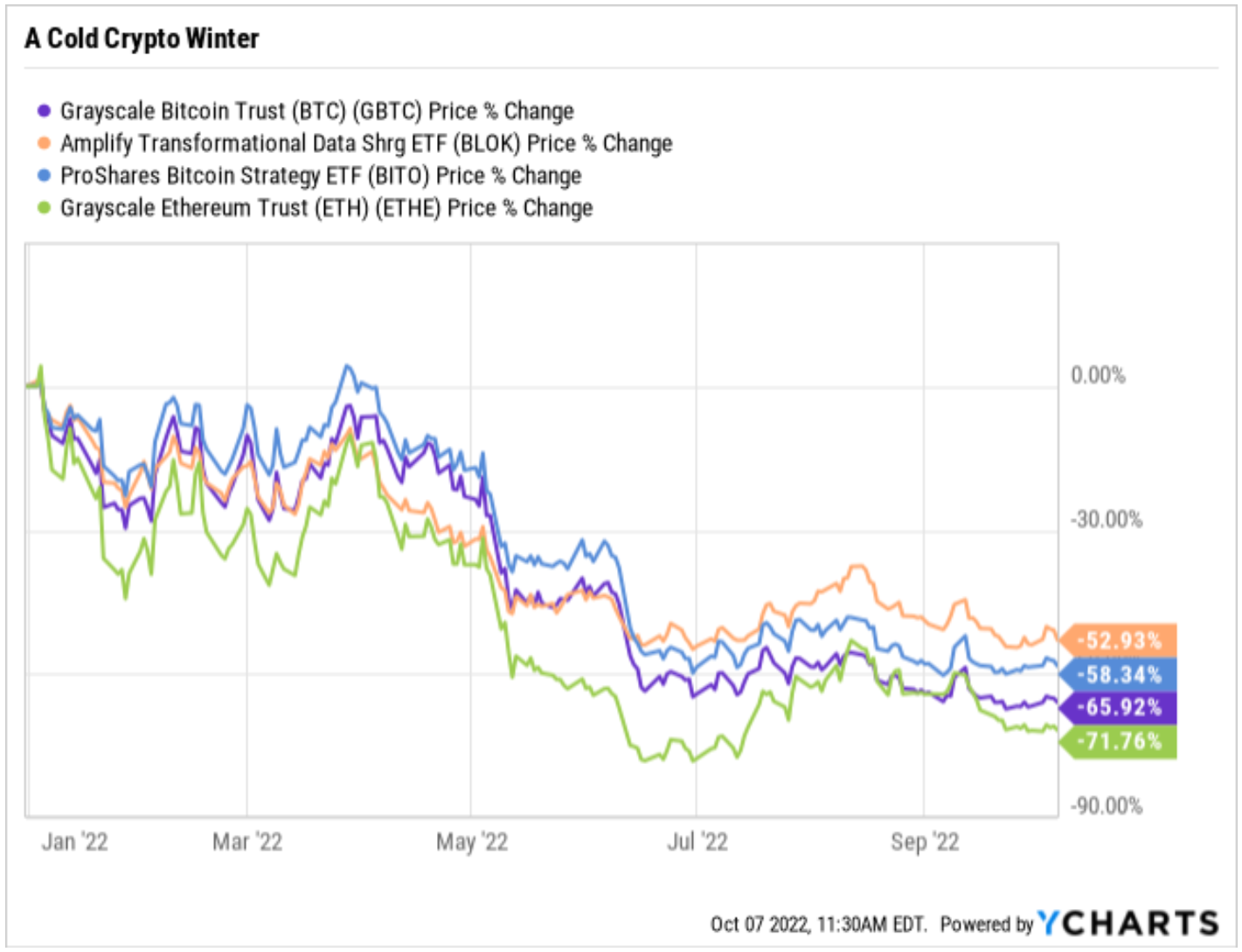

While crypto has attained tremendous growth, it recently has given up much of its gains. Woods described the recent downturn in the market as the “crypto winter,” and said that this pullback is not industry specific. Reduced interest by investors in “risk assets,” which carry bigger than normal volatility, led to a substantial drop in cryptocurrency, Woods added.

The U.S. stock market has underperformed this year because of rising interest rates and the pandemic. With crypto tied to risk assets like the U.S. stock market, both fell. Beyond that, crypto holders wanted to take advantage of cryptocurrencies, causing a massive sell-off.

Even though the market is down so far this year, Woods sees much potential for the crypto market. As for what to do now, Woods said that this recession is a normal occurrence; it is how you deal with it that makes the difference.

What Happened to Crypto? It Is Here to Stay

Cryptocurrency’s biggest downside is also its greatest upside… it’s new! While regulation is usually a negative for the market, having safe legislation guarantees that crypto can be a regulated risk asset.

Simply, cryptocurrency regulation would allow big corporations and institutional investors to gain confidence in such assets.

Crypto regulation helps stabilize the market and may boost profits at the same time. This idea was first proposed to Woods by Kevin O’ Leary, Shark Tank entrepreneur and avid investor. Woods spoke about the crypto investing on his podcast, The Way of the Renaissance Man, with O’ Leary.

The view is that once crypto can safely trade as a regulated risk asset, investors will be more incentivized to own such assets, and the market will see growth once again.

Woods said that cryptocurrency is here to stay. The scariest risk is volatility but getting in early and diversifying your portfolio is typically smart, added Woods, who said he holds his own cryptocurrency along with his stock investments.

The shock of plunging crypto prices did not cause Woods to become a seller. One idea is to invest in the companies and technology behind the cryptocurrency, Woods said.

He recommended, among others, Grayscale Bitcoin Trust (OTCMKTS: GBTC) and the Grayscale Ethereum Trust (OTCMKTS: ETHE). Crypto offers more than just investing in a coin, and with these options, it is possible to invest in larger portions of the market.

Another alternative is to invest in the Amplify Transformational Data Sharing ETF (NYSEARCA: BLOK). This ETF offers crypto exposure through the blockchain companies behind it, without high volatility.

What Happened to Crypto? Woods Predicts It Will Bounce Back

For Woods, cryptocurrency is here to stay.

No matter what, Woods said the “crypto winter” will end, and a massive catalyst will help jump start the currencies back into high profits. While Woods is a firm believer in a positive future for crypto, investing in companies and ETFs that are tied to cryptocurrencies can help lower volatility for investors. Cryptocurrency has its negatives and positives, but overall is a viable, yet risky for aggressive investors to add to their portfolios.

Jordan Ellis is an intern who writes for www.stockinvestor.com.