Three large-cap oil stocks to buy in the wake of OPEC+ counties cutting output include companies that appear undervalued.

The three large-cap oil stocks to buy, as the 23 oil-producing countries known as OPEC+ nations announced the biggest cut to production since the start of the COVID-19 pandemic, have benefitted recently from petroleum prices climbing as Russia President’s Vladimir Putin presses ahead with his invasion of Ukraine and attacks of power plants in the neighboring nation. Even though the move, led by Saudi Arabia and Russia, sparked criticism from President Joe Biden and other leaders in Washington who expressed worries about rising energy prices and the economic impact, members of the oil-producing bloc defended the decision by warning a weakening economy could depress oil demand.

The “easy money” for many of the “old energy,” oil-weighted stocks has been made three years after a “generational recovery” began in 2020, according to BofA Global Research. However, exceptions include market recognition of value through asset quality, growth in sustainable free cash flow or balance sheet rehabilitation, the investment firm opined.

Despite natural gas-weighted exploration and production (E&P) companies offering the greatest absolute value opportunity in the United States energy industry, large-cap oil stocks should benefit from increasing prices. The recent intervention by OPEC+ may be an early signal of future oil price support, BofA added.

Macro-Economic Trends Show Inflation Weighing on Markets

Interest rates are rising rapidly, with mortgage rates close to 7%, according to the Forecasts & Strategies investment newsletter led by Mark Skousen, a presidential fellow in economics at Chapman University. The 10-year Treasury rate is 4.24%, higher than the 30-year rate of 4.15%, indicating the beginning of a negative yield curve that is “bad news for the economy,” Skousen wrote in his latest edition.

Mark Skousen, Forecasts & Strategies chief and Ben Franklin scion, meets Paul Dykewicz.

“The Fed is famous for overdoing it, both when fighting recession by sending rates too low and fighting inflation by sending rates too high,” cautioned Skousen, who also heads the Home Run Trader advisory service that features both stock and option recommendations.

The U.S. central bank is largely responsible for the boom-bust cycle in the economy and on Wall Street, Skousen warned. The latest employment report was especially robust, adding 263,000 jobs as the unemployment rate slid to a multi-decade low of 3.5%, he added.

“This labor report confirmed what I have been saying with my gross output (GO) statistic, arguing that the United States is not in a recession quite yet, but it’s moving in that direction,” Skousen wrote.

The Fed has set its aim at clamping down on high inflation that has topped 8% in the past year. Those who initially may have been inclined to trust the Fed’s previous view that price hikes were “transitory” should note that the U.S. money supply rose 40% during the pandemic. Plus, Social Security payments will rise 8.7% in January 2023, boosting the buying power of 70 million American retirees but exacerbating inflation.

Devon Energy Enters into Three Large-cap Oil Stocks to Buy

President Biden put a little bullish fuel into the energy sector with comments that have been called the president’s “put.” His pledge that the federal government would buy crude oil for the U.S. Strategic Petroleum Reserve (SPR) near $70 a barrel was bullish from a “price floor” standpoint, according to Jim Woods, who leads the Bullseye Stock Trader advisory service.

Paul Dykewicz meets with Jim Woods.

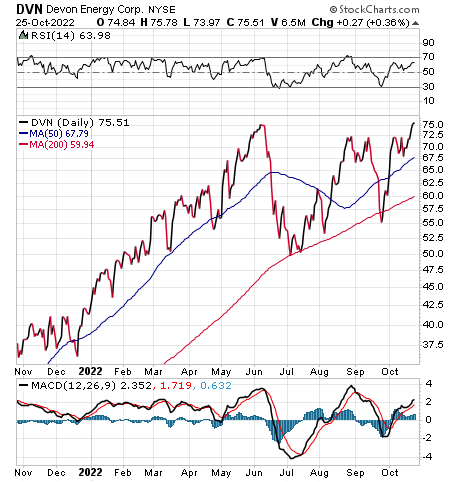

The president’s announcement gave oil traders a new reason to take long positions in the sector, Woods said. From his momentum-oriented analysis, one of the best stocks in the energy space is Devon Energy Corp. (NYSE: DVN), a large independent exploration and production company headquartered in Oklahoma City, Oklahoma.

The company’s asset base is spread throughout onshore North America and includes exposure to the Delaware, Eagle Ford, Powder River Basin and Bakken sites. At year-end 2021, Devon’s proved reserves totaled 1.6 billion barrels of oil equivalent. Furthermore, net production that year was 572 thousand boe per day, of which oil and natural gas liquids made up 74% of production, with natural gas accounting for the remainder, Woods wrote.

Chart courtesy of www.stockcharts.com

“Devon is a stock displaying all the qualities I look for in a Bullseye Stock Trader play,” Woods wrote to his subscribers. “It’s got fantastic earnings growth in the top quintile compared to all other stocks. Last quarter, the company grew earnings per share by 332%. It’s also near the top of the list in terms of relative price strength — its 79% gain over the past 52 weeks puts it in the top 2% of all stocks on a relative strength basis. The company also is one of the top companies in the strongest industry on the market right now.”

Although BofA’s last update on Devon rated it neutral, Bryan Perry, chief of the Cash Machine investment newsletter, has been recommending the high-income stock profitably since May.

Paul Dykewicz interviews Bryan Perry, head of the Cash Machine newsletter.

APA Corporation Added to Three Large-cap Oil Stocks to Buy

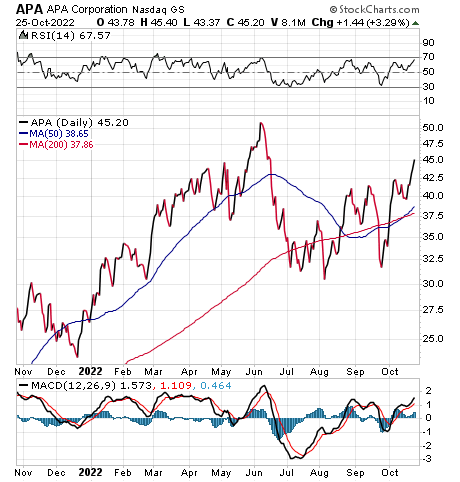

BofA has a buy recommendation and a $65 price objective on Houston-based APA Corporation (NASDAQ: APA), an exploration and production company for oil and natural gas in the United States, Egypt and the United Kingdom, as well as offshore Suriname and in the Dominican Republic. Potential ways to outperform the BofA price target for APA include 1) higher commodity prices, 2) exploration success in Suriname and 3) exploration success and increased drilling activity in Egypt.

On the other hand, those potential strengths may not be manifested, BofA acknowledged in a recent research report. Risks to achieving the BofA price objective are 1) lower commodity prices, 2) Egyptian political uncertainty and 3) exploration challenges in Suriname.

APA will host a conference call to discuss its third-quarter 2022 results at 11 a.m. Eastern time, Thursday, Nov. 3. Earlier in October, the company gave guidance that it expected to be above the high end of the third-quarter range it provided in August of 212 Mboe per day.

International volumes are expected to be below the low end of the third-quarter guidance range of 171 Mboe per day. With respect to international volumes, the shortfall is related to North Sea production, which was approximately eight Mboe/d below guidance due to significant unplanned downtime in August and September, the company reported.

Chart courtesy of www.stockcharts.com

Hess Hops into Three Large-cap Oil Stocks to Buy

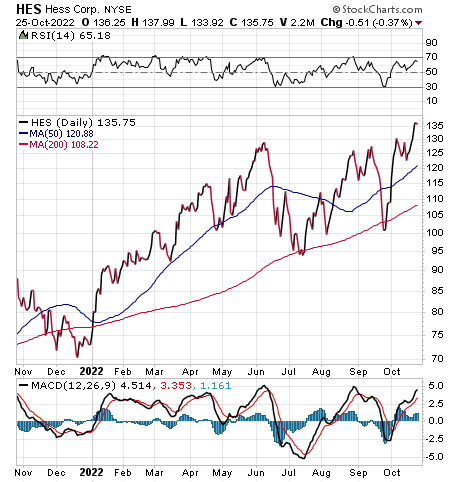

A third entrant among the three large-cap exploration and production oil stocks to buy is BofA recommendation Hess Corp. (NYSE: HES). The New-York-based company has begun to advance lately.

Its risks are similar to those of Exxon Mobil (NYSE: XOM), except that the news flow around HES’ exploratory and appraisal drilling activities could hurt the stock. Upside risks to the price objective are higher oil and gas prices.

Hess is expected to report 1Q22 results on Wednesday, Oct 26. BofA expects earnings per share of $1.85, below consensus of $2.02. The company’s free cash flow outlook is the only growth story among the U.S. E&Ps, BofA wrote in a recent research note. While the near-term multiple on Hess is high versus its peers, it is not high enough, according to BofA. The investment firm has a price objective on the stock of $175.

Chart courtesy of www.stockcharts.com

Bivalent COVID-19 Booster Vaccines Could Aid Oil Demand

A new bivalent COVID-19 booster in the United States gives increased protection against the omicron BA.5 variant, now the predominant strain of the virus. As a resident of Maryland, I followed up on an Oct. 11 phone call from the state’s health department advising me of the booster’s availability at pharmacies near my house. I arranged to receive the vaccine on Oct. 16.

Even though COVID cases and deaths can hurt supply and demand for oil stocks, availability of a new booster to enhance the vaccine’s efficacy should help. Cases in the country totaled 97,268,173, as deaths hit 1,068,297, as of Oct. 26. America has amassed the most COVID-19 cases and deaths of any nation.

Worldwide COVID-19 deaths totaled 6,581,722, as of Oct. 26, according to Johns Hopkins. Global COVID-19 cases reached 628,616,953.

Roughly 80% of the U.S. population, or 265,591,330, have received at least one dose of a COVID-19 vaccine, as of Oct. 19, the CDC reported. People with at least the primary doses total 226,594,560, or 68.2%, of the U.S. population, according to the CDC. The United States also has given at least one COVID-19 booster vaccine to almost 111.4 million people.

The three large-cap exploration and production oil stocks to buy are starting to rebound after the OPEC+ countries chose to cut supply. Despite high inflation, Russia’s continued attacks in Ukraine and rising recession risk after 0.75% rate hikes by the Fed in June, July and on Sept. 21, the three exploration and production oil stocks to buy should appreciate further in the coming months.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for multiple-book pricing.