Three energy stocks to fuel performance for investors have the potential to power through market volatility and rising interest rates.

Energy stocks show no signs of running out of steam, since they provide the fuel that keeps society moving. Two key types of energy stocks are upstream and downstream companies.

Upstream energy companies primarily engage in the exploration of oil or gas reserves. In contrast, downstream energy companies refine and process oil and gas products for delivery to consumers.

The three energy stocks to fuel performance are upstream energy companies Occidental Petroleum (OXY), Devon Energy Corp. (DVN) and EQT Corp. (EQT).

Three Energy Stocks to Fuel Performance: Introducing Occidental Petroleum (OXY)

Occidental Petroleum (OXY) is a Houston-based energy company that primarily conducts its oil exploration and production in the United States, the Middle East and North Africa. Within the United States, it has operations in Colorado, Texas and New Mexico, as well as offshore in the Gulf of Mexico.

OXY does a little bit of everything in the energy sector and operates in three segments: oil and gas, chemicals, midstream and marketing. The oil and gas segment searches for, develops and produces oil, natural gas liquids (NGLs) and natural gas. The chemical segment, known as OxyChem, focuses on manufacturing and marketing basic chemicals. Occidental Petroleum’s last segment is marketing and midstream. That segment purchases, markets, gathers, processes, transports and stores oil along with NGL, natural gas, carbon dioxide (CO2) and power.

OXY has a market cap of $65 billion and earnings per share (EPS) of $12.01. The company released its third-quarter earnings report on Nov. 8 and delivered strong results, which led to increased full-year guidance for all three segments and an improved outlook for its OxyChem and marketing and midstream segments.

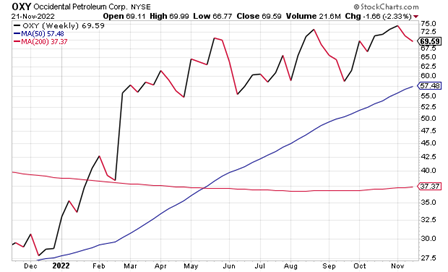

As of Monday afternoon, Nov. 21, shares of OXY traded at $69.54, which is not far from the high end of the company’s 52-week range. As is visible from the chart below, Occidental has had a very strong year thus far and has shown nothing but growth since June.

Three Energy Stocks to Fuel Performance: Seizing Second is Devon Energy Corp. (DVN)

Devon Energy Corp. (DVN) is an independent energy company headquartered in Oklahoma City, Oklahoma, focused on the exploration, development and production of oil, natural gas and NGLs onshore in the United States. DVN operates within five core areas of the United States: the Delaware Basin, Eagle Ford, Powder River Basin, Anadarko Basin and Williston Basin.

Devon’s Delaware Basin operates roughly eight oil rigs to broaden its opportunities for exploration and development from geologic reservoirs including the Wolfcamp, Bone Spring, Leonard and Delaware formations.

The Eagle Ford operations are situated in DeWitt County, Texas. The Powder River Basin segment focuses on oil opportunities in the Turner, Parkman, Teapot and Niobrara formations. DVN’s Anadarko Basin operates mainly out of Oklahoma’s Canadian, Kingfisher and Blaine counties. Finally, Devon Energy’s Williston Basin is solely based on the Fort Berthold Indian Reservation and consists of approximately 85,000 net acres.

On Nov. 1, the company released a positive third-quarter earnings report, which included an increased year-over-year operating cash flow of 32% to $2.1 billion. Moreover, each of its five operating segments saw an increase in production.

Devon has a $45 billion market cap and pays an annual dividend of $5.40. Shares of DVN are currently trading at $67.70, which, much like OXY, is not far from the high end of its 52-week range. The chart below tells a story of a strong year and an impressive summer spike. Though it saw a dip in July, it has regained that ground and then some.

Three Energy Stocks to Fuel Performance: Finalizing with EQT Corp. (EQT)

Founded in 1888, Pittsburgh-based EQT Corp. (EQT) is a natural gas production company engaged in the supplying, transmitting and distributing natural gas with operations concentrated on the Marcellus and Utica Shales of the Appalachian Basin.

EQT primarily deals with MarkWest Energy Partners, L.P. in the processing of its natural gas and extraction of heavier hydrocarbon streams from produced natural gas. These streams consist primarily of ethane, propane, isobutane, normal butane and natural gas.

EQT is focused on the execution of combination-development projects, meaning it works on the development of several multi-well (gas) pads at once. The company has approximately 25.0 trillion cubic feet equivalents of proved natural gas, NGLs and crude oil reserves throughout roughly 2.0 million gross acres, including approximately 1.7 million gross acres in the Marcellus Shales.

EQT owns or leases approximately 610,000 net acres in Pennsylvania, 405,000 net acres in West Virginia and 65,000 net acres in eastern Ohio.

The company has a $15.6 billion market cap and earnings per share of $6.25. It pays a dividend of $0.60 and has a price-to-earnings ratio of 6.79. The stock traded on Monday afternoon, Nov. 21, at $40.82, which is little more than $11 off its 52-week high.

Three Energy Stocks to Fuel Performance Show Growth

The chart below is proof of EQT’s strong growth through the current year. Starting in February, shares of EQT began to climb and did not stop. Much like DVN, its shares saw a July dip, but they made an impressive bounce back and have had continued momentum since August.

Net income rose to $687.5 million for EQT during the third quarter of 2022, compared to a loss of $1,977 million for the same period a year ago. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) reached $973.6 million in the third quarter for EQT, almost double 2021 3Q’s figure of $565.1 million.

OXY, DVN and EQT all reported strong third-quarter earnings results. EQT also doubled its ’22-’23 share repurchase authorization to $2.0 billion and has repurchased $380 million in common stock since inception of the repurchase program, reducing its share count by approximately 13.5 million.

EQT also boosted its year-end 2023 debt reduction target from $2.5 billion to $4.0 billion, maintaining a 1.0-1.5x long-term leverage target. In addition, EQT gained a place in the S&P 500 index, joining top companies across all sectors of the U.S. economy

EQT previously announced its agreement to acquire Tug Hill’s upstream assets and XcL Midstream’s gathering and processing assets for consideration of approximately $2.6 billion in cash and 55.0 million shares of EQT common stock, subject to customary closing adjustments. The transaction is expected to close in the fourth quarter of 2022, with an effective date of July 1, 2022.

EWT also announced a collaboration with the State of West Virginia and various leading energy and technology companies to form the Appalachian Regional Clean Hydrogen Hub (ARCH2), said its President and CEO Toby Z. Rice. Appalachia is well suited to “lead the charge” in clean hydrogen production in the United States, he added.

Three Energy Stocks to Fuel Performance: Conclusion

In conclusion, investors looking to lift their portfolio returns may be interested in the three energy stocks to fuel performance. Each of the three upstream energy stocks has ample resources, property and exploration tools.

In a volatile market, energy stocks may be just the fuel investors need to forge ahead. For investors looking for a profitable niche, the three energy stocks to fuel performance are worth considering.

Emily Mirabelli is an editorial staffer who writes for www.stockinvestor.com.