Three leisure stocks to buy as people increasingly travel and fly feature an amusement park and entertainment giant that just lured back an esteemed former chief, an aquatic entertainment company and a global mountain resort operator.

Increased energy costs and a shift toward leisure spending have become trends that should continue in the months ahead, according to BofA Global Research. Pent-up interest in leisure as the economy grows and employment remains high could propel each of these companies that endured the fallout of a global pandemic from 2020 until now.

However, according to aggregated BC credit and debit card data, total card spending slowed in September across goods categories, and spending on leisure services was flat, which may signal the reopening tailwinds on discretionary services are fading, according to BofA. The BofA US Economics team expects a recession, accompanied by a labor market slowdown and further weakness in consumer spending during first-quarter 2023.

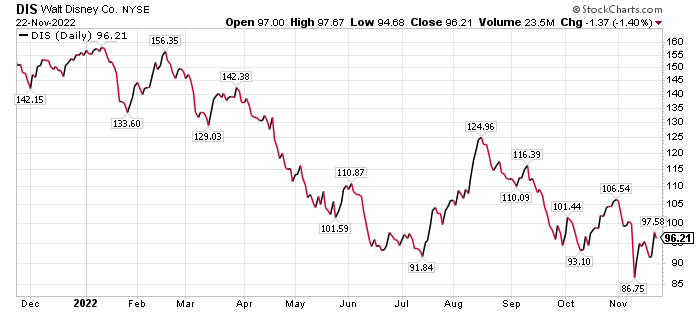

Return of Bob Iger to Lead Disney Lifts One of Three Leisure Stocks to Buy

Walt Disney Co., (NYSE: DIS), a Burbank, California-based media and entertainment company, enticed Robert A. Iger, its former chief executive officer, to return to that role effective Sunday night, Nov. 20. Iger, who spent more than four decades at the company, including 15 years at the helm, agreed to serve as Disney’s CEO for two additional years, accepting a mandate from the board of directors to set the strategic direction for renewed growth and to develop a successor to lead the company at the completion of his term.

Iger replaces Bob Chapek, his hand-picked successor, who stepped down from his position in a surprise move. BofA wrote a research report that rated Disney a buy and gave the company a $115 price objective that offers roughly 25% upside from current levels. Iger is expected to fully re-evaluate several of the recent strategic initiatives and corporate restructurings.

The company’s share price had been trending down for the past year but perked up after news spread about Iger’s return.

Chart courtesy of www.stockcharts.com

Successor Struggled Amid COVID Crisis and Political Fallout Due to Controversial Content

Chapek, who took over the helm at Disney in February 2020, incurred concurrent crises shortly after he began that included the COVID-19 pandemic, significant management turnover and several public relations missteps, such as contract disputes with talent and a public battle with the governor of Florida about the company’s content. The leadership change comes on the heels of “disappointing” results in the company’s latest quarter, BofA wrote.

“To Chapek’s credit, he oversaw several transformational changes in Theme Parks, which drove a healthy recovery in revenue and operating profit exiting the pandemic,” BofA reported. “Chapek also took over as CEO during a very challenging time for the industry as it managed the transition toward streaming.”

Despite Iger’s track record and experience at the company and industry, he is expected to fully re-evaluate several recent strategic initiatives and corporate restructurings since his departure. As a result, investors should expect some near-term uncertainty about the company’s direction.

Iger Could Rejuvenate Disney as One of Three Leisure Stocks to Buy

Iger’s first priority likely will be to articulate his strategic priorities for Disney, BofA wrote. Several of Chapek’s recent initiatives and restructurings will be reviewed. They include a move to restructure the company’s Media and Entertainment Distribution segment to centralize budgetary power for content and distribution, as well as raise prices in Theme Parks and DIS+.

“Iger has made public comments recently on the secular challenges in the linear TV ecosystem, which, coupled with accelerating linear subscriber declines, could signal a potential openness to reevaluate strategic alternatives,” BofA wrote. “We also would not be surprised if this announcement prompts another wave of management turnover.”

Near-term catalysts for Disney could include any update on the strategic direction of the company, continued robust theme park demand with several levers for future growth, price increases for Disney+ and Hulu, the roll-out of Disney+’s ad-supported tier on Dec. 8 and possible sports betting at ESPN, BofA forecast.

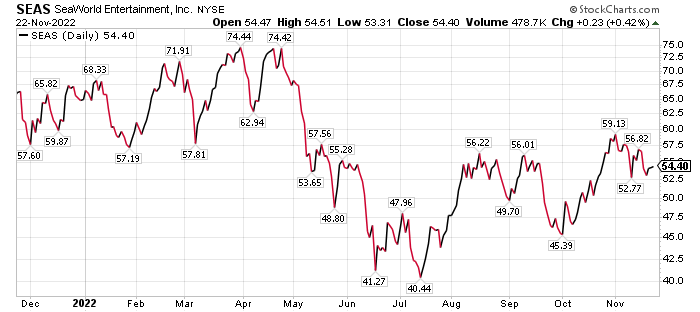

SeaWorld Jumps Among Three Leisure Stocks to Buy

Mark Skousen, who leads the Forecasts & Strategies investment newsletter and advisory services that include Home Run Trader, recommends SeaWorld Entertainment (NYSE: SEAS), of Orlando, Florida. The theme park and entertainment company is a “big beneficiary” of the new post-pandemic economy, he added.

Mark Skousen, Forecasts & Strategies chief and Ben Franklin scion, meets Paul Dykewicz.

SeaWorld’s revenue hit $1.7 billion over the last 12 months, while its third-quarter earnings jumped 32% on an 8.4% increase in sales. Plus, shares of SeaWorld have soared nearly 300% over the past five years, despite the pandemic, Skousen said.

With the lockdowns over and consumers choosing to spend more on experiential services, the outlook for SeaWorld is exceptional, Skousen recently wrote to his Home Run Trader subscribers.

Chart courtesy of www.stockcharts.com

Insider Buying Boosts the Second of Three Leisure Stocks to Buy

SeaWorld’s Treasurer and Chief Financial Officer Michelle Adams recently purchased 39,000 shares at $51.03, an investment of nearly $2 million. She now owns more than 75,000 shares.

In addition, Chief Commercial Officer Christopher Finazzo purchased 8,950 shares a couple weeks later. He owns over 72,000 shares.

These are “two savvy insiders,” Skousen wrote to his subscribers. He advised that they own the stock, too.

Another reason Skousen said he likes SeaWorld is that his daughter Hayley, a professional figure skater, is performing in a principal role in SeaWorld’s Christmas Celebration in Orlando, Florida. She provided the following link that shows her doing a backflip. Her husband, Pablo, also works there as a musician.

The company’s recognized brands include SeaWorld, Busch Gardens and Sea Rescue. The latter unit saves and rehabilitates marine animals that are ill, injured or abandoned, with the goal of returning them to the wild.

During SeaWorld’s 50-year history, it has built 12 destination and regional theme parks in key markets across the United States, hosting an average of more than 20 million visitors a year.

SeaWorld Shines as One of Three Leisure Stocks to Buy

Guests at SeaWorld attractions receive a variety of up-close experiences with wildlife, as well as thrill rides and shows. Unlike the controversy Disney has encountered, SeaWorld has produced Parent’s Choice and Emmy-Award-winning shows like Sea Rescue and The Wildlife Docs that celebrate the natural world.

“The pandemic was a big negative for entertainment parks, of course, as they were forced to shut down,” Skousen wrote to his subscribers. “But most of them are coming back in a big way. And SeaWorld is no exception.”

Revenue hit $1.67 billion over the last 12 months and sales are up 15% year-over-year, Skousen noted. With the pandemic receding, the outlook remains positive, he added.

Skousen not only recommended the stock, but call options, too. His Home Run Trader service offers both ways to profit.

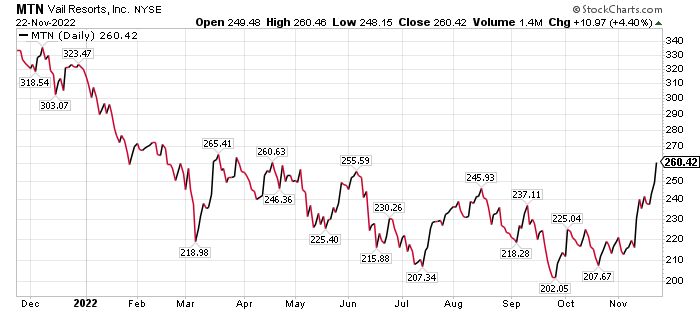

Vail Resorts Joins Three Leisure Stocks to Buy

Another BofA recommendation that also is favored by the Baron Funds is Vail Resorts (NYSE: MTN), of Broomfield, Colorado. Vail’s focus includes using data to drive a unique, advanced customer commitment for a recurring business model. MTN is also well positioned to benefit from high-end, pent-up leisure demand in the coming ski season.

One shareholder of Vail Resorts is the Baron Growth Fund (BGRFX). BofA rates Vail Resorts as a buy, as does Michelle Connell, the chief executive officer of Portia Capital Management, of Dallas, Texas.

Michelle Connell heads Portia Capital Management, of Dallas, Texas.

Connell’s key reasons for investing in MTN include:

- Strong growing revenues in a softening economy. Despite MTN increasing ticket prices 7.5%, the company’s revenue from ski passes was already up 7% for the year through the end of September 2022.

- $320 Million Invested for Improved Consumer Experience. Just in time for the 2022-23 ski season, MTN has invested $320 million to install 19 new chairlifts across 14 of its resorts.

- Investment in Data Infrastructure. MTN has also invested heavily so that the online experience of its consumers is smoother and faster.

- MTN should appeal to the environmentally conscious young investor who also skis. The company is ahead of schedule to meet its target of 2030 to have a zero net (carbon) operating footprint.

- Estimated 12-month upside for MTN: 15-25%.

Chart courtesy of www.stockcharts.com

Vail Resorts has a long history in the ski industry, starting with the opening of Vail Mountain in 1962. It now has 37 resorts in 15 states and three countries, including some of the world’s most iconic destinations, as well as travel-centric retail and hospitality businesses.

The company’s subsidiaries operate destination mountain resorts and regional ski areas such as Beaver Creek, Breckenridge, Keystone and Crested Butte in Colorado; Park City in Utah; Heavenly, Northstar and Kirkwood in the Lake Tahoe area of California and Nevada; Whistler Blackcomb in British Columbia, Canada; Perisher, Falls Creek and Hotham in Australia; Stowe, Mount Snow and Okemo in Vermont; Hunter Mountain in New York; Mount Sunapee, Attitash, Wildcat and Crotched in New Hampshire; Stevens Pass in Washington; and Liberty, Roundtop, Whitetail, Jack Frost and Big Boulder in Pennsylvania. Vail Resorts owns and operates a variety of world-class luxury resorts for spa vacations or adventurous mountain lodges for relaxing after a day on the slopes.

Bivalent COVID-19 Vaccine Could Lift Leisure Activities Due to Enhanced Protection Against New Variant

The new bivalent COVID-19 booster provides superior protection against the omicron BA.5 variant, now the predominant strain of the virus. I received the new booster on Oct. 16 after it became available at pharmacies near my house.

However, 200-plus million Americans who are eligible have yet to accept the syringe of that new booster. New cases and deaths can hurt demand for leisure activities, so a bivalent booster could enhance both public health and the economy.

Cases in the country totaled 98,386,225 and deaths reached 1,077,020, as of Nov. 22. America has the dreaded distinction of amassing the most COVID-19 cases and deaths of any nation. Worldwide COVID-19 deaths totaled 6,623,547, as of Nov. 22, according to Johns Hopkins University. Global COVID-19 cases reached 638,978,541.

Roughly 80.6% of the U.S. population, or 267,476,279, have received at least one dose of a COVID-19 vaccine, as of Nov. 16, the CDC reported. People who obtained the primary COVID-19 doses totaled 228,154,832 of the U.S. population, or 68.7%, according to the CDC. The United States also has given a bivalent COVID-19 booster to 33,831,057 people who are age 18 and up, accounting for 13.1% of the U.S. population in that age range.

Despite Russia’s continued attacks against Ukraine that began on Feb. 24 as a so-called “special military operation,” people elsewhere still are able to enjoy leisure activities. Investors interested in a potentially good run may want to consider the three leisure stocks to buy as people increasingly travel and fly.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Special Holiday Offer: Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great holiday gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases.

![[U.S. flag in shape of U.S.]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_117505006.jpg)