There is so much noise and confusion about when the market is going to vault out of its primary bear trend with purpose and begin the next leg of the secular bull market — which is still very much intact.

Looking at the 30-year chart of the S&P 500 ETF (SPY), the yellow line represents a crucial support level that held in March 2020 and again in October 2022 during severe periods of panic selling pressure. This rising line now sits at around 360 or 3,600 for the S&P 500 index, roughly 220 points, or 5.7% below where the market closed out the year last Friday.

The market enters 2023 beset by the same problems that began the year — hawkish Fed monetary policy, the Russian invasion and COVID outbreaks. One can argue that the S&P will test the 3,600 level again, as well as the nerves of investors looking for bluer skies for stocks.

While the war in Ukraine is a heinous act of intrusion by Putin’s forces, the market isn’t preoccupied with it. As to China, and the new rapid spread of COVID, the market isn’t that worried about it either, at least not yet, unless it causes widespread shutdowns of factories and sparks new large-scale supply chain bottlenecks.

For the record, when looking at the charts, the Dow is trading above its 200-day moving average, whereas the S&P, Nasdaq and Russell 2000 are not. The current market landscape is one where the biggest value stocks are attracting the most risk capital, and a good number of those names are in the Dow Jones Industrial Average.

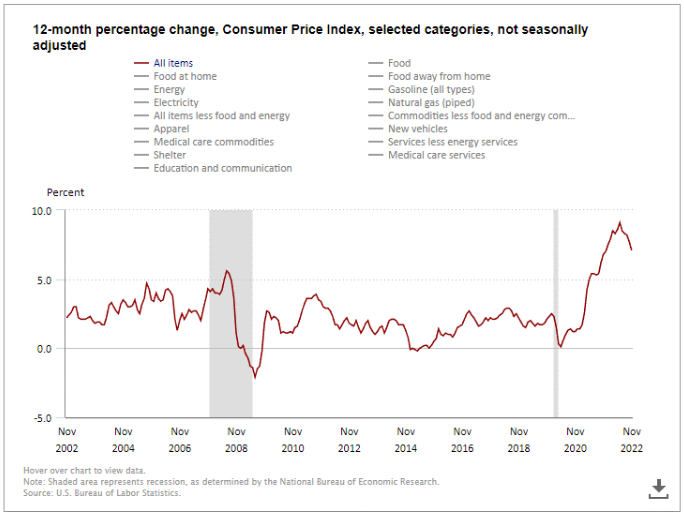

In my opinion, the green light for the market, and for all the indexes, to pivot higher and commence a new broad-based uptrend will be when the annual rate of inflation is at a lower level than that of the short-term Treasury yields. At present, the yield on the 1-year Treasury Bill is at 4.75%, whereas the Consumer Price Index (CPI), on a year-over-year basis, was up 7.1% in November, versus 7.7% in October, and core CPI was up 6.0%, versus 6.3% in October.

Inflation is decelerating and it is now showing up in the labor statistics, with initial weekly jobless claims and continuing jobless claims rising to levels last seen in February. Since the Fed is targeting wage inflation as a primary inflation catalyst, this latest report is a move in the right direction in terms of Fed policy. Food, energy and home prices are coming down, but rents and professional services costs remain elevated.

My position is that when CPI gets down to 5.0% and 1-year Treasury Bills yield 5.25%, the market will view this setup as “liftoff” for the growth stocks that occupy such big weightings in the indexes. But in reality, if the market senses that these two data points are going to intersect at the 5.0% level, it will be “go time” for the bulls and time to get fully invested in the leadership stocks.

I emphasize “leadership stocks” because investors should own those stocks that are going to be the companies that big institutional money will pour into. This also means buying some index ETFs as well, but the right mix of individual stocks on the next big turn higher for the market will easily outperform the major averages.

To be sure, the data for inflation and the rest of the economy released in January will set the tone for the next Fed meeting slated for Feb. 1 and for the balance of the first quarter. Current investor sentiment is more bearish than the historic norm. So, the setup for a strong upside move is in place if the data can swing favorably.

The market is technically oversold, but also very vulnerable to another wave of selling if earnings season brings with it broadly reduced forward guidance by companies that provide caution about future earnings. Turning the page on the calendar doesn’t remove the problems besetting the market.

There is always a tone of optimism on Wall Street when it can close the books on a tough year and look for better things ahead if conditions warrant it, and not until then.