After a grand start for the stock market this month, there is so much that remains unanswered amid mixed economic data and a fourth-quarter reporting period that is drawing investors who apparently like the soft-landing narrative back to the market.

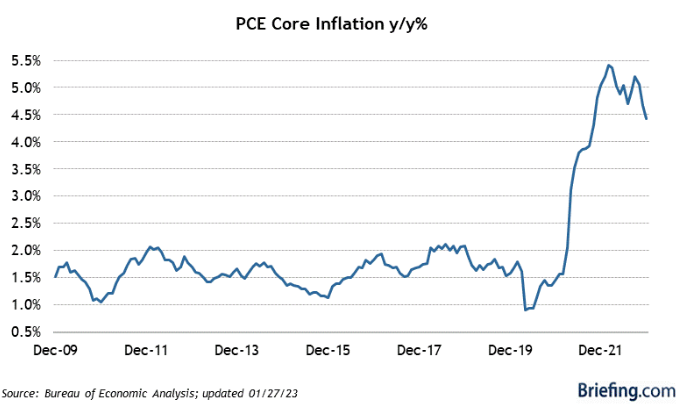

This narrative has gained steam in light of China’s reopening and the sharp decline in Europe’s natural gas prices. There is a general view that although inflation data isn’t uniform in trending lower, there is enough of it to convince Wall Street and most everyone else that we’re on the other side of peak inflation, the risk of reinflation and the Fed potentially curbing future rate hikes.

There is now a better than 98% chance of a quarter-point hike in the Fed Funds rate this week to 4.50-4.75%, thanks to a tame Personal Consumption Expenditures (PCE) report last week showing a rise of 0.3% in December, aligning with consensus. The 4.4% year-over-year (YOY) read on Core PCE continues the decline from November, thanks to a big dip in energy prices.

The market truly glommed onto this report, but also took on a more bullish tone when big-name companies missed earnings and issued cautious guidance only to see their share prices get bid higher. This price action is the behavior of a market that shows an earnings trough in the fourth quarter or the current first quarter. Investor expectations signal that improved top and bottom-line results will emerge in Q2 and pick up speed thereafter.

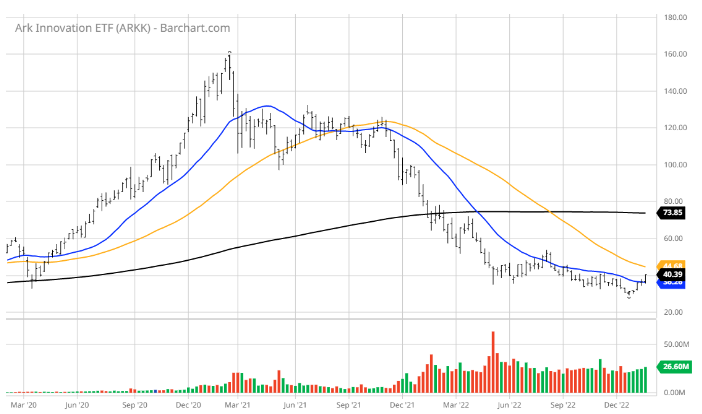

Stock prices always rally in anticipation well before the numbers justify the move higher, sending stock analysts scrambling to adjust their estimates to quantify upgrades and price target revisions. This is all well and good if the macro picture is indeed improving to the extent that the market is justified in bidding Cathie Wood’s Ark Innovation Fund ETF (ARKK), loaded with sky-high price-to-earnings (P/E) or no-P/E stocks, up by 32% year to date (YTD).

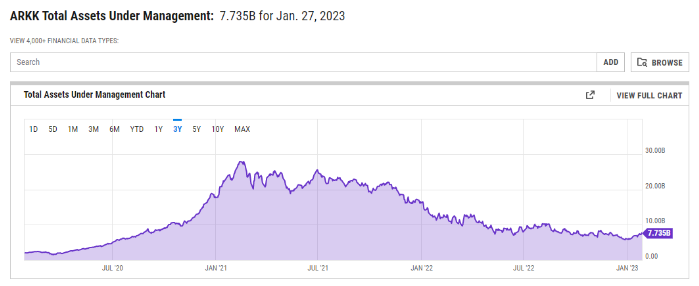

But it’s all relative. Shares of ARKK are still down over 48% YOY and 73% from the January 2021 high. That plunge is hardly something to celebrate or get excited about when 81% of over $27 billion in invested capital is eviscerated peak to trough in the span of 24 months. Current assets under management total about $7.5 billion, down 73% from $27.7 billion. Investors that put capital in ARKK in late 2000 will have to see the value of this fund soar by about 400% to get back to even.

Source: www.ycharts.com

I’m picking on the ARKK fund because I just find this an interesting tell on just how fast risk is willing to pile back into the most speculative stocks when so many of Wall Street’s premier chief market strategists are waving red flags of caution and “look out below” signs. Something isn’t right with this picture, and that is why current views and opinions are so diametrically opposed right now. I mean, the divisions of very bright and highly respected people are wide and contentious. There is tremendous pressure at the professional level to not miss the market’s pivot to a new and sustainable bull leg.

I chalk a lot of this confusion up to inexperience dealing with first-time situations like the pandemic, global supply chain disruptions, too much money in the system that is now being drained, geopolitical and domestic political brinksmanship, soaring debt levels, the launching of a proxy war in Ukraine and the moral hazard of dealing with all of these and other issues that compromise sound thinking in shaping the right policies that are wise and timely. But here, again, the market of late is ignoring any warning signs, forging ahead and creating a fear of missing out (FOMO) among cash-rich, nervous investors.

Fed policy and moral hazard risk aside, price action reveals much, and truth be told, this year’s rally has been led by low-quality and heavily shorted stocks. It also has witnessed a strong move into cyclical stocks relative to defensive ones. This cyclical rotation is convincing investors they are missing the bottom and must reposition. It has been a powerful shift, but bear markets have a long history of fooling investors into a new uptrend before they are done. This is a time when investors must trust their stock due diligence and avoid the broader noise. Great stocks rally even in tough markets.

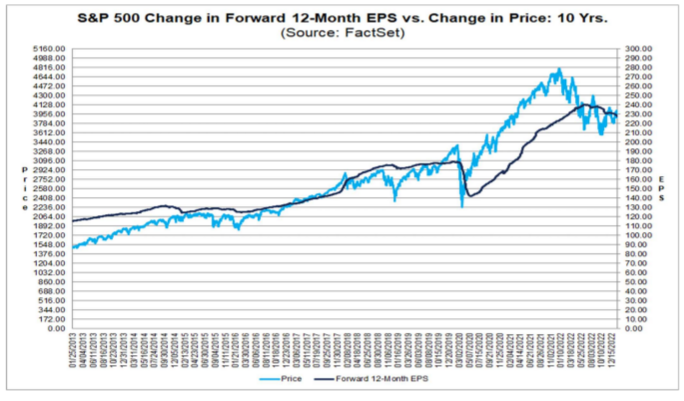

Calls for the market to give back the January gains are predicated on margin erosion that will lead to a deep slide in S&P 500 earnings by mid-year. When costs are growing faster than sales, margins erode. By the end of the current earnings reporting season, investors will know whether forward sales and earnings will miss current consensus expectations. The forward consensus for S&P earnings per share of $230 will come under serious scrutiny in about two weeks, when roughly 85% of S&P companies will have reported Q4 2022 numbers.

Source: www.factset.com

The current forward price-to-earnings (P/E) ratio of 17.8 for the S&P is fairly valued on a historical basis and makes a strong case for the S&P to be trading around 4,100. If the skeptics are right and S&P earnings for 2023 come in around $200-$210, then a case for 3,400-3,600 is valid. But if the bulls are right and the S&P puts up $230-$240 in earnings, then there is room for the market to rally 4,800 as the P/E will expand to about 20x on rising optimism, implying a 25%+ year for the benchmark index.

At the moment, the market favors the latter outcome, and so far, so good. But there are multiple cross currents unfolding that will likely determine if the bear market low has been already reached or whether a retest of the lows during the first quarter or sometime in the second quarter will mark the ultimate bottom.