Top three food stocks to ride out the recession offer opportunities for wary consumers and investors to pursue profits despite continued chatter regarding an economic slowdown.

So, investors may be interested in filling their pantries and their portfolios with these top three food stocks to ride out the recession. Food stocks have multiple benefits for investors, including diversification and dividend payouts, in the case of these three stocks.

Moreover, food stocks are a great investment choice in the face of an impending recession or a market downturn. As food is a constant need, certain stocks can provide a bit of protection and continued growth.

In this case, the three stocks featured in this article, PepsiCo (NYSE:PEP), Tyson Foods, Inc. (NYSE:TSN) and General Mills, Inc. (NYSE: GIS) have the added bonus of being strong and familiar brands. Because of this, they will always retain a solid consumer base. The higher their output, the lower their production costs. This is key due to current inflation rates and supply chain costs on the rise.

Top Three Food Stocks to Ride out The Recession: Pepsi Packs a Punch

While many people know PepsiCo (NYSE:PEP) as the worldwide soda behemoth, it’s not as well known that the company is also the owner of another popular brand, Frito-Lay, which is one of the world’s most prominent snack businesses.

The company’s addition of the snack business gives it a two-tiered growth formula. The two product types go together when it comes to supply chains, marketing and cross-promotion. From a market standpoint, with the snack business, Pepsi has an edge over Coca-Cola since it is less reliant on solely selling beverages, which gives it a clearer long-term outlook in terms of generating profits.

Over the past three, five and 10 years, the stock has shown tremendous stability with an annualized rate of more than 11%, respectively. Moreover, it has a long-standing reputation for consistently generating value for its shareholders, including a quarterly dividend of $1.15 and an annual dividend yield of 2.71%.

When reporting results for its last two quarters, the $234-billion company displayed surprising strength in its earnings. In the company’s last reported quarter, it announced earnings of $1.97 per share, which beat Zacks consensus estimate of $1.85 – representing a 6.49% gain.

The company has confirmed that its next quarterly earnings report is scheduled for Feb. 9, and analysts’ expectations are positive, with earnings per share (EPS) estimates of $1.64, up 11 cents from reported EPS of $1.53 in the same quarter last year.

The stock’s performance chart shows Pepsi’s prowess to recover and maintain upward progress. While its 200-day moving average is currently down, it shouldn’t make investors too wary as it almost always is followed by a large spike. Further, it’s 50-day moving average remains steady and has gradually regained a good amount of ground from this time a year ago.

Courtesy of Stockcharts.com

Top Three Food Stocks to Ride out The Recession: Tyson Foods Takes Second

Widely known as the “chicken nugget” brand, Tyson Foods, Inc. (TSN) also produces and distributes pork products, frozen seafood products and snacks. TSN is one of the leading meat companies in the United States with processing plants throughout North America and a growing international presence. Its popularity and international growth potential, alone, are two reasons why Tyson Foods is considered a strong stock.

The company ended 2022 with solid sales numbers in its fourth-quarter earnings report. Its total sales came in at $13,737 million, which was up 7.2% from its year-ago quarter. TSN’s top line beat Zacks Consensus Estimates of $13,289 million and its gains from the average price change were 5.1%, while total volumes rose 2.1%.

Currently, the stock is still enjoying some early-year strength, with its shares gaining 5.75% over the past month and outpacing the Consumer Staples sector’s loss of 1.82% and the S&P 500’s gain of 4.57% within the same timeframe.

Heading into its first-quarter earnings report for 2023, which is scheduled for Feb. 6, Tyson Foods is looking to display its strength in the report. As of now, Zacks Consensus Estimates is calling for quarterly revenue of $13.1 billion, which is up 1.31% from the year-ago period. For full-year estimates, the current projection for share-price earnings is lower than a year ago, but its revenue projection of $54.08 billion is up 1.5% from Q1 2022.

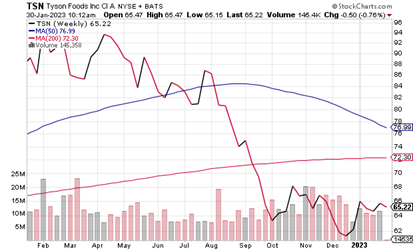

While the chart below shows a sharp plunge in late 2022, its current upward climb is an indicator that not only is the stock able to recover quickly, but it also is starting the year on the right foot.

Moreover, the stock’s uptrend just ahead of its first-quarter earnings report is a sign of investor positivity. As of the market close on Friday, Jan. 26, the stock was trading at $65.72, up 0.35% from its open. Tyson’s has a market cap of $23.5 billion, an annual dividend yield of 2.29% and offers a quarterly dividend of $0.48.

Courtesy of Stockcharts.com

Top Three Food Stocks to Ride out The Recession: Jetting Out with General Mills

Founded in 1866, General Mills, Inc. (NYSE: GIS) is a long-standing powerhouse. Its continued product launches and acquisitions have allowed it to grow its portfolio to over 100 well-known brands that are sold in more than 100 countries, worldwide. A few of its most notable brands include Pillsbury, Cheerios, Blue Buffalo pet food and Progresso.

In its latest earnings report, for the second quarter ended Nov. 27, the company boasted a net sales increase of 3.9% year over year, for a total of $5.2 billion. Being the well-known brand it is, the company was able to implement price hikes to compensate for rising inflation without losing customer loyalty and therefore organic volume fell only 6% for the quarter.

Moreover, GIS pays out a quarterly dividend of $0.54 and has an annual dividend of 2.77%. While the yield is nothing too exciting, it’s solid and beats the S&P 500’s 1.8% yield.

The company is slated to report earnings on March 22 and, according to Zacks Investment Research, based on eight analysts’ forecasts, the consensus EPS forecast for the quarter is $0.88, up from an EPS of $0.84 for the same quarter last year.

The chart below is further proof that GIS is a strong stock. It has made a significant climb from last March. While it started off the year on shaky ground, it already is recovering and has surpassed its 200-day moving average by more than 10 points. With a $46 billion market cap and strong trading volume, GIS should be able to continue its move up.

Courtesy of Stockcharts.com

Wrapping Up the Top Three Food Stocks to Ride out The Recession

Overall, investing in food stocks has multiple benefits for investors, including diversification, continued growth and a stable annual dividend yield. Further, food stocks have the potential to help shield one’s portfolio during market downturns as they are a staple and may be more protected from market volatility compared to other sectors.

Additionally, not only do PepsiCo (NYSE:PEP), Tyson Foods, Inc. (NYSE:TSN) and General Mills, Inc. (NYSE: GIS) all pay a quarterly dividend, they have the added bonus of being familiar brands, which in turn, leads to their continued consumer loyalty.

So, with the chances of a looming recession, continued rate hikes and supply chain constrictions, the above stocks may be of interest to investors who are looking for something less flashy, but potentially more stable. However, investors are urged to pursue their own research into these stocks prior to making any portfolio additions.

Emily Mirabelli writes for www.stockinvestor.com and www.dividendinvestor.com.

![[woman shopping at grocery store]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_133181729.jpg)