Bond and equity markets are in a much better place than how they ended 2022, with further evidence of slowing inflation providing the bullish catalyst.

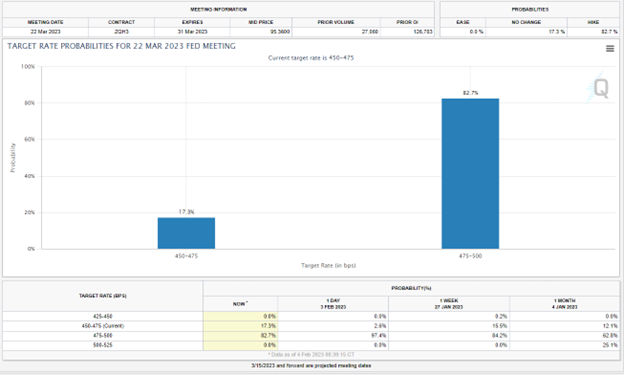

Aside from what is an impressive labor market that is adding more jobs than forecast, data on manufacturing, factory orders, housing, retail and productivity are all trending lower — which is right in line with the Fed’s directive to soften economic growth without inciting a recession. Last week, the Fed raised the overnight federal funds rate by a 25 basis points to 4.50-4.75% and there is currently a better than 82% probability for another quarter-point hike to 4.75-5.00% at the next Federal Open Market Committee (FOMC) meeting scheduled for March 22.

In addition, there is a 48% chance of another quarter-point hike at the May 3 FOMC meeting, taking Fed Funds up to 5.00-5.25%. Given the strength of the job market and the overall economy, I think there is a good chance the Fed leaders will take the federal funds rate up to 5.25-5.50% before they cease the increases.

It is pretty clear the Fed is fixated on the tight labor market. Last Friday’s stunning non-farm payrolls data showed 517,000 workers were added to payrolls, as the unemployment rate fell to 3.4%, solidifying the notion that the Fed will keep hiking rates and likely maintain them there for longer than the bond market is predicting.

Powell commented, “I continue to think that it is very difficult to manage the risk of doing too little and finding out in six or 12 months that we actually were close but didn’t get the job done, inflation springs back, and we have to go back in and now you really do have to worry about expectations getting unanchored and that kind of thing. This is a very difficult risk to manage. Whereas… of course, we have no incentive and no desire to overtighten, but if we feel that we’ve gone too far, and inflation is coming down faster than we expect we have tools that would work on that.”

The Fed also continues to shrink its balance sheet to the tune of $95 billion per month, but it still stands at an elevated level of $8.5 trillion, with the goal of reducing it to $5.9 trillion by the end of 2025. This is a key metric that doesn’t get much mention, but the M2 money supply is showing negative growth, which means less money for banks to lend. It is not having a negative impact on the market, but bears watching.

The economic reopening of China is being viewed as a huge offset to the orchestrated slowing taking place in the United States and Europe. Their resumption of growth will help both Europe, the United States and other countries that trade heavily with China to avert recessions. At least, this is how the market currently reads it. What is not priced in the market, I think, is the upcoming major offensive by Russia in Ukraine in the months ahead. This risk, along with fresh tensions due to launching spy balloons and the future of Taiwan, highlights persistent geopolitical risks to the market.

And then there is fear of missing out (FOMO) back at work that has had the bears and high-profile recession forecasters on their heels. The economy appears strong enough to handle a 5%+ federal funds rate, which is triggering a sudden shift in sentiment and pulling money off the sidelines from investors who fear the train has left the station without them. When stocks trade higher after companies miss their sales and earnings estimates, it generates that “uh oh” moment where investors sense the market has priced in the trough in earnings that will be followed by a resumption in revenue and profit growth by the third quarter.

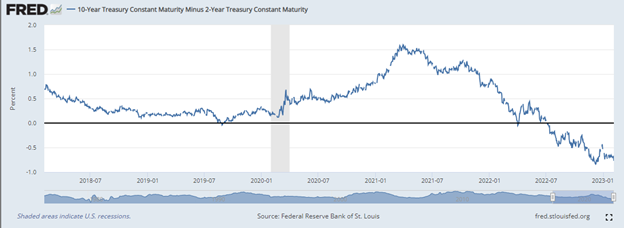

There are some serious disconnects in the market landscape. The yield curve remains highly inverted with the 2yr/10yr spread at -77 bps, and near the -84 bps seen on Dec. 7, when the economy appeared to be sliding into a recession and stocks were cratering. Clearly, the bond market isn’t biting on the current rally, and, in fact, is signaling the Fed will pivot hard later this year and embark on reduced rates.

On the other hand, the Dow Jones Transportation Average (DJTA) is breaking out, hitting a six-month high this past Wednesday. According to Dow Theory, leadership by the transports is bullish for the broader industrial sector — hardly the stuff of recessions.

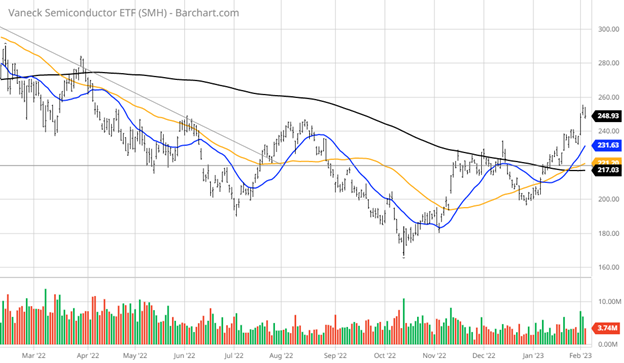

The chip and chip equipment sector are also on the rise, trading up and through its 200-day moving average like a hot knife through butter. Such as move historically is a strong indicator that further gains in the Nasdaq are in store. This upside breakout also coincides with some of the leading companies posting underwhelming fourth-quarter results and issuing cautionary guidance. And yet, semiconductors jumped regardless.

Wall Street’s most prominent bears are Morgan Stanley’s Mike Wilson, Bank of America’s Michael Hartnett and JPMorgan Chase’s Marko Kolanovic. All have been rated five-star analysts for calling last year’s bear market. In recent comments put out in the past week or so, Wilson stated “the rally is a trap and the bear market’s final leg looms.”

Harnett claimed investors are “sleepwalking into a selloff,” while Kolanovic cautioned “stocks have a 10% plus drop ahead: things have to get worse before they get better.”

They all claimed the fundamentals (earnings) are going to crumble. However, halfway through earnings season, the numbers are coming in better than forecast.

The bottom line is that global equity funds had $44.7 billion of inflows in the past four weeks, according to the note, citing EPFR Global data. Stocks have rallied since the start of 2023 on signs of cooling inflation, optimism about China’s reopening and hopes that slower economies will force global central banks to pause hiking rates. As time progresses, the balance of earnings season and forward economic data will begin to determine whether the “three bears” are right or those going long in equities.

But after such a powerful rally, look for the market to consolidate for a time to relieve the overbought technical condition of most leading stocks, for some fluff to come out of the high-beta stocks and for the market to reconsider further rate hikes and other factors. Some back and filling is constructive and sets up the market for further gains if the fundamentals hold up. The early money is betting the fundamentals will do so.