Six beverage stocks to buy for profits feature a London-based, multinational provider of premium alcohol, three U.S. soft drink companies, an energy drink maker and a creator of healthy coconut concoctions.

Beverage stocks are the top-rated consumer staples sub-sector, according to BofA Global Research. Household, beauty and personal care companies followed closely behind, among stocks that consumers typically reward during all economic conditions.

Britain’s Diageo plc (NYSE: DEO) received an upgraded rating of “outperform,” up from market perform, on Monday, Feb. 6, from Sanford C. Bernstein, a New York-based financial advisory firm. The investment firm projected a potential upside in the stock up close to 30%.

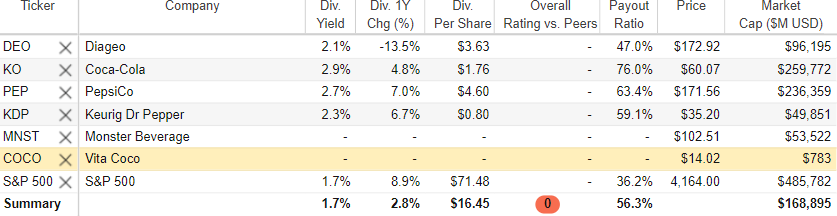

Courtesy of www.StockRover.com. Learn about Stock Rover by clicking here.

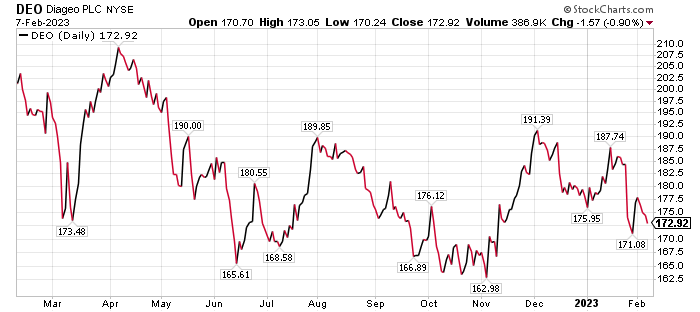

Six Beverage Stocks to Buy for Profits: Diageo Inc.

Diageo’s brands of alcohol feature Johnnie Walker, Crown Royal, JeB, Buchanan’s, Windsor and Bushmills whiskies, Smirnoff, Ciroc and Ketel One vodkas, Captain Morgan, Baileys, Don Julio, Tanqueray and Guinness. Its multinational reach encompasses the world’s biggest markets, including North America; Europe and Turkey; Africa; Latin America and the Caribbean; and the Asia-Pacific.

Jim Woods, who concurrently leads the Intelligence Report investment newsletter and the Bullseye Stock Trader advisory service, told me he likes the company’s prospects, especially after a recent pullback that reduces its valuation. Woods, whose trading service features both stocks and options, is an aficionado of fine dining and premium drinks. He has yet to recommend the stock but indicated to me he is keeping an eye on it.

Chart courtesy of www.stockcharts.com

Woods Picks His Favorite of Six Beverage Stocks to Buy for Profits

On Jan. 26, Diageo reported an 18.4% rise in net sales during the second half of 2022, compared to the same time the year before, primarily reflecting strong organic net sales growth as well as favorable impacts from foreign exchange stemming from a rising U.S. dollar. The company’s operating profit grew 15.2% to $3.86 billion, or £3.2 billion.

However, Diageo reported a drop in operating margin of 92 basis points, or .92%, for the last six months of 2022 compared to the comparable period the previous year, with organic margin expansion more than offset by one-time operating items and foreign exchange. Diageo also reported that its organic operating profit grew 9.7% in second-half 2022, compared to the same six months of 2021, and its organic operating margin expanded by 9 basis points, or .09%, driven by leverage on operating costs due to disciplined cost controls, despite inflation.

Price increases and supply productivity savings more than offset the impact of absolute cost inflation on gross margin, Diageo reported. Growth flowed across most categories, primarily scotch, tequila and beer, the company announced. Premium-plus brands contributed 57% of Diageo’s reported net sales and drove 65% of organic net sales growth.

Paul Dykewicz meets with Jim Woods, head of Bullseye Stock Trader.

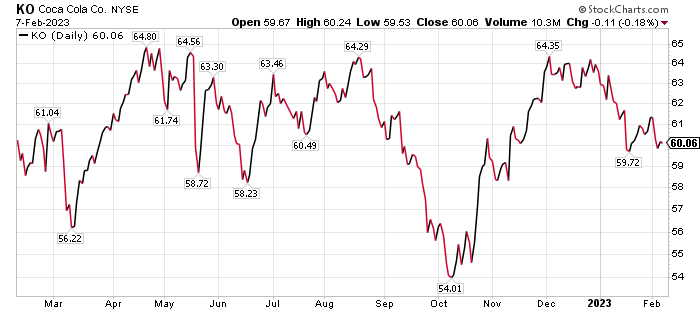

Six Beverage Stocks to Buy for Profits: Coca-Cola

Consumer staples food and beverage companies have shown “surprisingly inelastic” demand for their products, according to BofA. The investment firm foresees upside for gross margins, along with upgraded earnings revisions, as input inflation plateaus and the U.S. dollar weakens.

Unlike last quarter, BofA broadly predicts earnings estimates for fiscal year 2023 will be in-line or advance due to a brightening outlook.

Atlanta-based Coca-Cola is recommended both by BofA and Mark Skousen, PhD, who leads the Forecasts & Strategies investment newsletter. Coca-Cola is among the Flying Five stocks that Skousen recommends by choosing five Dow Jones Industrial Average positions that have the lowest price from a list of the 10 highest-yielding companies in the index. His Flying Five recommendations have beaten the market most of the years he has used the strategy.

Mark Skousen, a scion of Ben Franklin and head of Fast Money Alert, meets Paul Dykewicz.

Coca-Cola’s total returns have reached 47.2% since Skousen recommended it on July 31, 2017.

Chart courtesy of www.stockcharts.com

Six Beverage Stocks to Buy for Profits: Coca-Cola’s Organic Growth Impresses BofA

BofA projects “solid organic sales growth” from Coca-Cola, aided by price hikes and strong demand. The investment firm set a $74 price objective on the stock, giving it a premium to non-alcoholic-beverage peers.

“In our view, a premium multiple is warranted by balanced and resilient organic sales growth,” BofA wrote in a research note.

Outperformance could occur with strong growth in developed and emerging markets, a weakening U.S. dollar compared to other currencies and improved free cash flow conversion, BofA opined. Risks to meeting that price target include volatility in developed and emerging markets, earnings per share (EPS) headwinds if the U.S. dollar strengthens and consumer concerns about sugar and calories, the investment firm wrote.

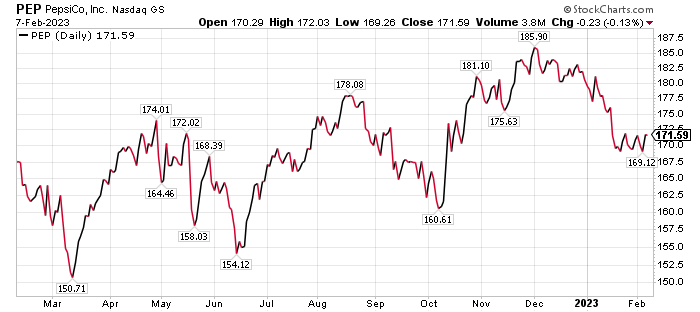

Six Beverage Stocks to Buy for Profits: PepsiCo

Harrison, New York-based PepsiCo (NASDAQ: PEP) is another major beverage stock. The company also owns the popular Frito-Lay brand of snack foods, as well as Quaker Oats. BoA put a buy recommendation on PepsiCo, along with a $205 price target.

“We expect PEP is set up for another quarter of strong organic sales growth, modeling 4Q22 organic sales growth of +8%,” BofA wrote.

PepsiCo received a premium valuation to its non-alcoholic-beverage peers that is “justified” based on the stock’s positioning to deliver against its long-term algorithm and return cash to shareholders via dividends and share repurchases, according to BofA’s research note. Further pluses for PepsiCo include low-to-moderate foreign exchange headwinds, growth opportunities and improving volume/price/mix in soft drinks.

Potential risks to reaching the price target include foreign exchange becoming a drag on results and Frito-Lay North America incurring a decline in volumes due to price hikes. As a personal fan of Quaker Oats products, I have noticed prices for those goods rising sharply to the point that I recently switched to buying store brands instead.

Chart courtesy of www.stockcharts.com

Six Beverage Stocks to Buy for Profits: ‘Pepsi Please,’ Connell Says

Michelle Connell, chief executive officer of Dallas-based Portia Capital Management, also recommends Pepsi. Even though inflation has caused many consumers to trade down with their consumer staple purchases and buy cheaper products, Pepsi has not felt this pressure, Connell commented.

While Pepsi had a strong performance in 2022, the stock is off 4.89% year to date. Wall Street analysts estimate that the stock has upside of 10-15% over the next 12 months, Connell told me.

Pepsi can no longer be considered a pure beverage play, Connell said. Convenience foods represent 55% of the company’s sales, while beverages account for the remaining 45%.

“So, every time you walk into a convenience store and grab a package of Lays, Cheetos or Doritos, you are purchasing a Pepsi product,” Connell told me.

Michelle Connell leads Dallas-based Portia Capital Management.

Wall Street expects Pepsi to beat the company’s guidance when it reports results on Feb. 9. Pepsi has been able to pass on price increases caused by inflation. Sales have not diminished, as Pepsi has raised prices, since consumers largely are shunning generic beverages, she added.

“The company has also been able to increase its beverage market share, especially in the water and athletic beverage categories,” Connell continued.

One area of potential weakness is negative currency effects from a strong U.S. dollar, Connell counseled.

International markets have become increasingly significant for Pepsi’s future, Connell said. Currently, 40% of the company’s sales and one-third of its operating income come from outside the United States.

“Emerging markets have younger consumers that are just turning the corner from poverty to middle class status,” Connell said. “Disposable income allows these individuals to purchase more foods and beverages more in line with those of their developed market peers.”

In addition, economic forecasts indicate emerging market countries may be the only nations to report positive gross domestic product (GDP) this year. They include China, India and several others in Asia, she added.

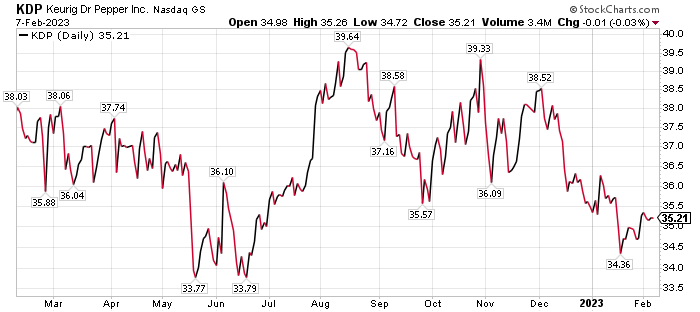

Six Beverage Stocks to Buy for Profits: Keurig Dr Pepper

Keurig Dr Pepper (NASDAQ: KDP), of Burlington, Massachusetts, is another BofA recommendation. The investment firm placed a $45 price target on the stock. The valuation takes into account KDP’s “attractive portfolio” of products that can grow sales and earnings, particularly with the addition of the C4 energy drink brand, BofA wrote.

Potential to outperform the price target could come from additional synergies, reduced volatility in the coffee business, increased adoption of Keurig brewers and pods, as well as attractive mergers and acquisitions (M&A) candidates.

Several risks could create headwinds to attain the price objective, according to BofA. They include any industry shifts away from single serve coffee, which could lead to slower than anticipated de-leveraging, along with weak consumer spending around the holiday season that could negatively impact sales of the Keurig brewers.

Chart courtesy of www.stockcharts.com

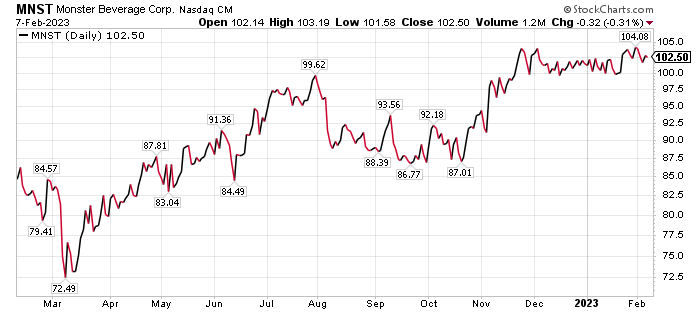

Six Beverage Stocks to Buy for Profits: Monster Beverage

Corona, California-based Monster Beverage Corporation (NYSE: MNST) is a holding company for its consolidated subsidiaries that develop and market energy drinks, including Monster Energy. BofA rated the stock as a “buy” and gave it a $125 price objective.

At 35x BofA’s 2024 estimated earnings per share (EPS) forecast, the stock is valued at a premium to both the large-cap beverage group trading at 25x and to other consumer staples growth companies trading at 21x.

“We believe the premium multiple is warranted, given its faster relative growth and favorable margin structure,” BofA wrote.

However, risks remain for Monster Beverage that investors should consider. They are its role in a maturing category that could be losing share, uncertain impact of new product launches, reduced benefit from international expansion, a rotation from defensive names into value names, greater-than-expected impact from COVID-19 global headwinds and negative currency movements.

Chart courtesy of www.stockcharts.com

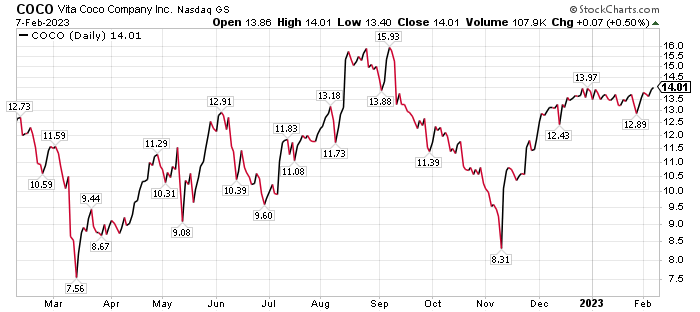

Six Beverage Stocks to Buy for Profits: Vita Coco (NASDAQ: COCO)

New York-based Vita Coco (NASDAQ: COCO) offers brands that provide coconut water, Vita Coco, clean energy drink Runa, sustainable enhanced water and protein-infused water. Vita Coco and Captain Morgan announced an agreement on Feb. 1 to team up to sell Vita Coco Spiked with Captain Morgan spiced rum. Both companies are No. 1 in their respective beverage niches.

BofA put a buy recommendation on Vita Coco and a $16 price objective on the stock. The investment firm valued Vita Coco’s shares in line with “platform companies,” concluding a premium is not warranted despite expecting COCO generate stronger earnings before interest, taxes, depreciation and amortization (EBITDA) growth. Indeed, the forecast is highly dependent on the ocean freight market, which is beyond COCO’s control.

A chance exists that Vita Coco could exceed its price objective if ocean freight rates decline faster than expected and result in meaningful margin expansion, if growth in the product category remains strong and COCO keeps growing market share. Risks to Vita Coco meeting its price objective are inflationary pressures worsening and delaying margin recovery, volume growth slowing meaningfully in a recession, competition stiffening and COCO losing market share.

Chart courtesy of www.stockcharts.com

Russia’s War Against Ukraine Intensifies

The six beverage stocks to buy for profits are largely protected from the ferocious fighting now taking place in Bakhmut, Ukraine, where Russian forces are seeking to seize control of a key highway and capture that important transportation route. Russian airborne units have joined Wagner mercenary fighters in the battle for the city.

Russia’s troops are “leveling Bakhmut to the ground, killing everyone they can reach,” Pavlo Kyrylenko, a Ukrainian prosecutor and politician who also is the current Governor of Donetsk Oblast, wrote on Telegram. Russia claimed on Tuesday, Feb. 1 to have captured a village just to north of Bakhmut as it tries to surround the city and seize control.

The U.S. State Department accused Russia of violating a key nuclear arms agreement by refusing to allow inspections of its nuclear facilities. The only agreement left to regulate the nuclear arsenals of the United States and Russia is the New START treaty, but inspections have been on hold since 2020 due to the COVID-19 pandemic.

Russia is sustaining its onslaught of increased strikes that began in October, targeting Ukraine’s energy and civilian infrastructure. Ukraine is seeking and receiving additional tanks by its allies to fend off Russia’s unrelenting onslaught.

President Biden, in his State of the Union to a Joint Session of the U.S. Congress on Tuesday night, Feb. 7, said Russia’s President Vladimir Putin ordered a “murderous assault” against Ukraine, evoking images of the “death and destruction” Europe suffered in World War II. During the speech, President Biden recognized the presence of Ukraine’s Ambassador to the United States Oksana Markarova.

“She represents not just her nation, but the courage of her people,” Biden said. “Ambassador, America is united in our support for your country. We will stand with you as long as it takes,”

President Putin launched what he called a “special military operation” in eastern Ukraine on February 24, 2022, by attacking his neighboring nation in violation of international law.

China’s Officials Admit to 82,000 COVID Deaths in Past Two Months

China continues to be criticized for its lack of transparency in reporting the COVID-19 cases and deaths in its country. Its officials tweaked the country’s death toll to include those caused by COVID-related illnesses, bringing the total to 82,000 deaths in the last two months. However, only people who died in hospitals are counted, not those who perished at home, news reports indicated.

President Biden recently announced plans to end the current U.S. public health emergency declaration due to COVID-19 this May. However, worldwide COVID-19 deaths rose to 6,846,764 people, with total cases of 672,033,032, Johns Hopkins reported on Feb. 7. COVID-19 cases in the United States totaled 102,645,744, while deaths reached 1,112,124 as of Feb. 7, according to Johns Hopkins University. Until recent reports that China had more than 248 million cases of COVID-19, America had ranked as the nation with the most coronavirus cases and deaths.

The U.S. Centers for Disease Control and Prevention reported that 269,064,626 people, or 81.0% the U.S. population, have received at least one dose of a COVID-19 vaccine, as of Feb. 1. People who have completed the primary COVID-19 doses totaled 229,719,115 of the U.S. population, or 69.2%, according to the CDC. The United States has given a bivalent COVID-19 booster to 49,078,211 people who are age 18 and up, equaling 19% as of Feb. 1, compared to 18.8% as of Jan. 26, 18.5% on Jan. 18, 18.2% on Jan. 11, 17.7% as of Jan. 4, 17.3% on Dec. 28, 16.8% the previous week, 16.3% the week before that one and 15.5% the preceding week.

The six beverage stocks to buy for profits offer refreshing investment opportunities when the market overall has been struggling in the past year to find sustained strength.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Special Holiday Offer: Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases.