By the time this column is emailed out to all my readers, the pivotal Consumer Price Index (CPI) report will have crossed the tape Tuesday morning. It will either confirm the fears in the bond market that inflation is sticky or provide a basis for buyers to resume buying into growth stocks.

Friday’s session was very mixed, with a number of cross currents at work. This is when letting the charts do the talking is most useful. When there is rampant confusion in the air, such as the present, the technical picture helps to provide clarity.

After a healthy selloff, the dollar index (DXY) got a decent bounce this past week and rallied back up to the downward-sloping 50-day moving average (MA), where that move will be tested this week. The bulls want to see the dollar continuing its downtrend, as it translates into bigger profits for the S&P 500 multinational companies.

Another big contributor to the five-week rally that ushered in the year was the presence of lower long-term bond yields. Both the falling dollar and lower-trending yields helped fuel the risk-on sentiment that propelled the Russell 2000, S&P 500 and Nasdaq above their respective 200-day moving averages on heavy volume. As of Friday, the S&P filled the gap to its 20-day MA and is still constructive.

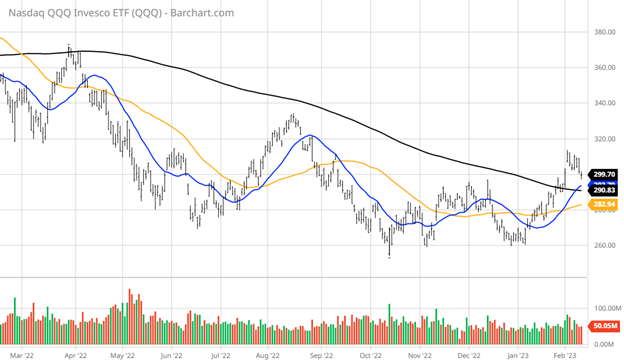

The same can almost be said for the Nasdaq, where the mega-cap tech stocks posted a set of Q4 top and bottom-line results that reflected slowing revenue and earnings growth. But investors who believed a peak in interest rate hikes and trough earnings have been priced in bought the tech leaders. Essentially, they are trying to anticipate a Fed pause followed by a pivot. Momentum fed on itself and short-covering fueled a strong move that took the tech-heavy index up through its 200-day MA, followed by a week of consolidation.

At the same time, the week ended with the market feeling vulnerable to rising selling pressure against a bond market that saw the 10-year yield reach 3.74% from 3.33% in the span of a week — its highest level in a month. So much for the warm and fuzzy interview last Tuesday between Fed Chair Jay Powell and David Rubenstein that triggered a failed attempt for the bulls to take out 4,200 for the S&P 500.

The move off of the 3.33% level for the 10-year bond also shows that the intermediate-term uptrend for the benchmark yield remains intact. Here, too, the bulls want to see the yield below 3.35% in order to break the trend line, which would invite fresh buying of equities.

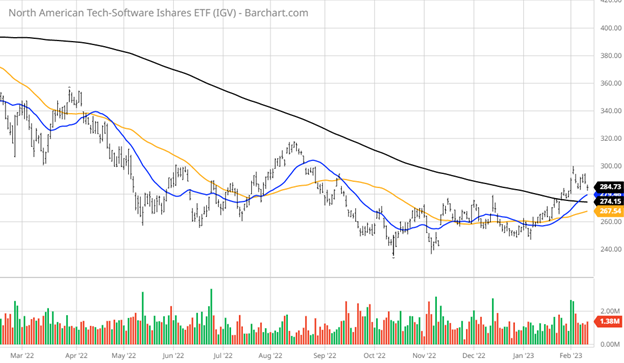

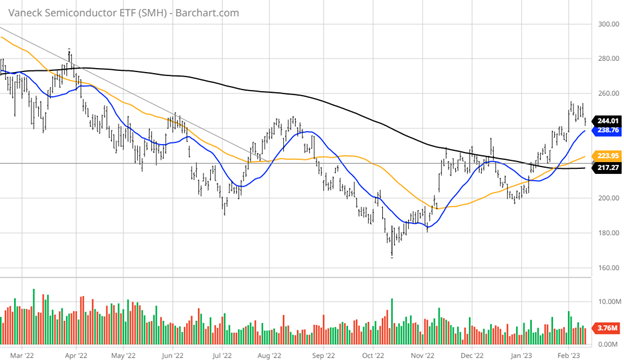

This sudden gap higher in bond yields removed the steady bid from growth trades, but it has yet to undo the bullish charts that underly the big-cap software sector as represented by the iShares Expanded Tech-Software ETF (IGV) and the VanEck Semiconductor ETF (SMH).

Investors went into the weekend wondering if this was a healthy pullback or the start of something more bearish. Professional opinions are all over the map, with very little consensus from what was being aired and written over the weekend.

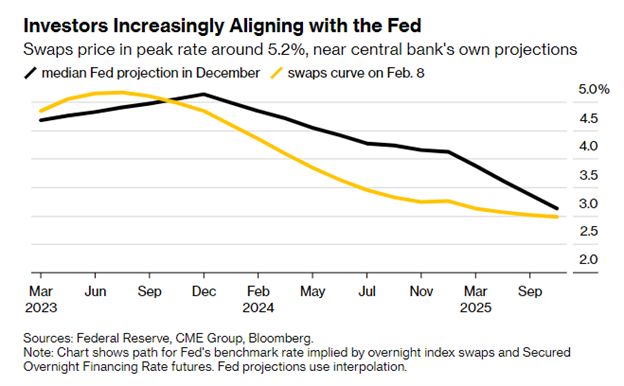

One new development that went largely unreported, and that I believe triggered selling in the bond market, was a shift in sentiment on Federal Reserve policy emerging in the trading of interest-rate options, where several big wagers on the central bank’s benchmark rate reaching 6%, nearly a percentage point higher than the current consensus, showed up last week.

This course of thinking runs radically counter to the current school of thought that the Fed is near the end of its tightening cycle, and it implies further interest rate hikes out till September. Bloomberg reported on Feb. 8 that preliminary open-interest data from the Chicago Mercantile Exchange confirmed an $18 million wager placed Tuesday in Secured Overnight Financing Rate (SOFR) options set to expire in September, targeting a 6% benchmark rate. That’s almost a full percentage point more than the 5.1% level for that month currently priced into interest-rate swaps. That $18 million trade would pay out $135 million if it just happens to be correct.

The swaps market is still holding the view that the Fed’s benchmark will peak at 5.2% sometime around July and begin to slide later in the year. At the same time, this eyebrow-raising set of wagers on a 6% overnight rate was based on the hot jobs report and Powell’s comments during the Tuesday interview. This suggests that the latest monthly jobs numbers may necessitate more tightening than previously anticipated.

The Bloomberg story went on to state, “It’s the latest in a series of big wagers that show no signs of letting up even as the Fed has slowed down a tightening cycle that has been the fastest since the early 1980s. Last month, SOFR options bets made CME Group history, recording the biggest inflows on record into any product traded on the exchange. And it marks a sharp turnaround from the big theme in the market last week, before the strong jobs data came out: Traders were betting on sharp rate cuts in the second half of 2023.”

This type of out-of-step trade with conventional thinking can act as a trigger mechanism that excites the artificial-intelligence-driven algorithm-based funds that rule daily volatility, and they make for the triple-digit-percentage intra-day point moves for the Dow that are now almost a daily occurrence. For those looking for a reason behind what drove yields up so quickly on the long end of the yield curve, I think this set of new wagers on more interest rate hikes was the catalyst.

With CPI due out Tuesday, producer prices out next Thursday and the Fed’s favorite indicator, the Personal Consumption Expenditures Price Index (PCE), due out Friday, Feb. 24, investors and the market will have plenty of inflation data to work with. At this juncture, the charts for stocks are constructive. While this is less true for the bonds, that can change in a New York minute, depending on the data.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)