While large-cap stocks are often seen as more consistent and safer, and small-cap stocks have the best potential for growth if an investor chooses the right one, a middle ground can allow investors to use both of these elements in their portfolio at once.

The iShares Morningstar Mid-Cap Growth ETF (IMCG) is one investment that plays into such a strategy. This fund focuses on domestic mid-cap stocks whose earnings are expected to grow at an above-average rate relative to the market.

Growth stocks typically focus on returns over dividends and possess the power to propel top- and bottom-line revenues. This fund holds $1.4 billion in assets and has strong liquidity characteristics.

IMCG holds upwards of 300 stocks in total. Its 0.83% yield is not surprising given its strategy, but easily wipes out the low 0.06% expense ratio and leaves investors with some cash.

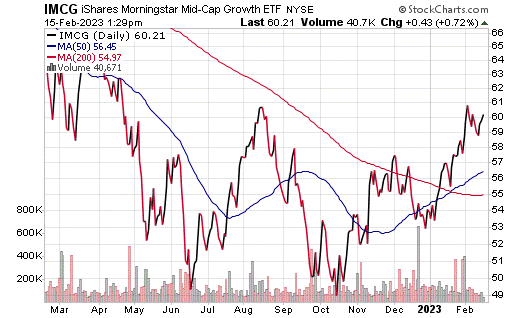

During the last 12 months, the fund’s performance is approximately in line with the S&P, posting a loss of 6.6%. However, it has been trending upward for most of the current year.

Chart courtesy of www.StockCharts.com

Top holdings include MSCI Inc. (MSCI), 1.10%; Block Inc. (SQ), 1.01%; Arthur J. Gallagher & Co. (AJG), 1.01%; IDEXX Laboratories (IDXX), 1.01%; and Ross Stories Inc. (ROST), 1.00%. As these figures demonstrate, the distribution of fund holdings is relatively even, as no one or handful of companies compose an outsized proportion of IMCG’s holdings. The top ten holdings make up only 9.64% of assets.

The fund’s greatest sector weighting lies in technology at 24%, followed by industrials, 19%, and health care, 12%. Traditionally stable sectors such as utilities and energy are the least prevalent, which makes sense given the fund’s tilt towards growth stocks.

For investors looking to tap into mid-cap growth stocks, judging by its impressive assets under management, iShares Morningstar Mid-Cap Growth ETF (IMCG) is a popular option.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)