Do you ever feel like everyone else is beating the market but you?

Or that you aren’t coming close to earning what you should be?

Chances are, you’ve bought into the hot load of garbage packaged for retail investors as “financial education.”

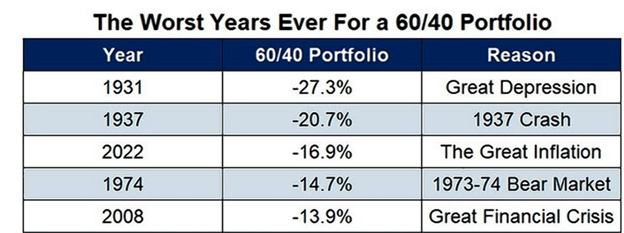

It’s the same bologna taught at our universities by academics who are mediocre investors at best. They survive by charging a second mortgage to tell students the secrets of the 60/40 portfolio.

Meanwhile, our kids gobble it up and graduate poorer and less educated than just a generation ago.

It is time to take control of our financial future.

Buy and hold is out the window.

You can’t rest on your laurels and hope to ride another decade to boomtown.

In a stock-picker’s market… the 60/40 portfolio won’t take you to the promised land.

In fact, if you want any chance of outperforming the market this year… you’ll need to deploy outside-the-box strategies.

Fortunately, you’re at the right place. We asked our experts to share their best under-the-radar strategies for building a bulletproof portfolio.

And here’s what they told us…

Give Yourself More Than One Way To Win

Have you ever researched a stock, loved the sector it was in and its fundamentals… but it had one major problem.

The stock price was relatively high.

A disciplined investor will wait and hope it comes back down to buy. An aggressive trader will buy and hope it continues to rise.

But why “hope” when there is a better way to play this scenario?

For example, on Jan. 18, Bryan Perry noticed that Cardinal Health, Inc. was oversold, trading at $76.40.

But instead of buying stock and tying up capital or gambling on buying calls, he did something most traders don’t even think about.

He decided to sell in-the-money puts, choosing the $80 put strike expiring on Feb. 17 and collecting a premium of $4.39.

If you are not an options trader, let us explain.

When you sell put options, it is a bullish trade. The maximum you can make on the trade is the income you collect from selling the premium. For example, one put contract sold would have allowed you to collect $439.

Break Even: The strike price minus the premium collected.

Since Bryan was selling the $80 puts and collecting $4.39, his break-even price was $75.61.

Risk: If Bryan held the options till the expiration date and the stock closed below his strike price of $80, he would have been assigned 100 shares for every put option he was short. However, since he collected a premium and received income on the trade, he wouldn’t lose money until it went below $75.61.

Upside: Bryan’s maximum profit from this trade is the premium he collected.

How It Played Out: CAH chopped around and drifted higher to $79. If you owned the stock, it would have had mild profits.

However, the beauty of selling puts is that you can make outstanding profits from the time decay.

Despite the stock chopping around for a few weeks, Bryan was able to exit this trade for a whopping 65% profit, buying back his put options for $1.40 on Feb. 14.

Yes… 65% returns in less than a month, and the stock barely moved.

And those are the types of plays that Bryan routinely dishes out to his Quick Income Trader subscribers.

While Bryan utilizes this strategy to make monthly income, it is also viable if you’re a long-term investor.

The idea works the same. Find a stock you like at a price you want to own it. Sell puts and collect a premium. If the stock dips below the strike price, you can own the stock at the price you want.

If the stock doesn’t move much or trades higher, you collect the premium and earn income.

Selling put options is a conservative strategy if you don’t abuse the leverage of options.

Don’t Be Scared To Swing For The Fences

You should keep a small allocation of funds for more speculative plays. And that’s exactly what Mark Skousen does with Fast Money Alert.

Mark has been a long-term investor for 40 years. But he is a master at risk vs. reward. And when there’s blood running in the streets, that’s when he gets aggressive.

When Tesla’s sentiment got overly bearish in January, he recommended buying May $135 calls. Tesla shares are now trading north of $200. But Mark is not a greedy trader, he recommended closing the trade for 201% and 340% returns.

His Home Run Trader service has delivered seven triple-digit-percentage winners in the last three months, thanks to his uncanny ability to get aggressive at the right times.

Buying options can be seductive. Some investors get lured in because of the high-profit potential they offer. But the truth is, a lot of option buyers lose money.

That’s why we like Mark’s approach, because he’s very selective about when to play them.

Cash Is Trash Again

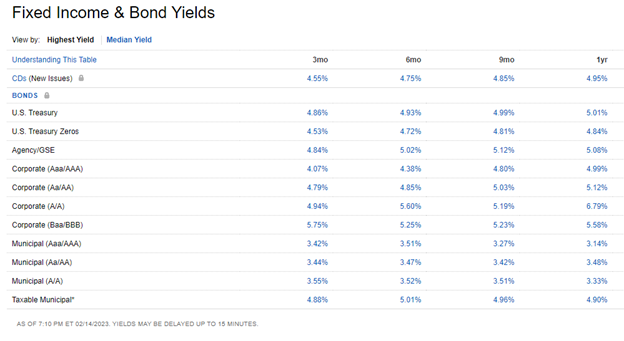

When inflation is running hot and interest rates are high, parking your money in the bank is a waste.

Why?

Because you can earn better risk-free returns with money market funds.

Fixed income is attractive, which could be why stocks haven’t surged this year.

Don’t Be Afraid To Bet Against Bad Companies

Three out of four stocks will move with the market. Even good stocks get sold in a bad market. That’s why you need to be open-minded about betting against crappy stocks.

After all, it’s easier sometimes to find a bad company than a good one.

That’s something Jim Woods from High Velocity Options isn’t afraid to do.

Jim knows that unprofitable companies will struggle in a rising interest rate environment.

Take Affirm Holdings (AFRM) as an example. The buy now, pay later company has a profit margin of -55.1%, and an operating margin of -77.7%.

Not to mention, the company is drowning in debt. The stock tanked on its latest earnings report. According to Jim, there’s more downside from here.

But it’s too risky to short stocks naked. That’s why Jim prefers to use puts instead. The great thing about buying puts is knowing your risk upfront. It’s limited to the premium you spend.

Mark’s latest play involves buying May $12.50 puts in AFRM.

Many of these crappy stocks rallied due to the January effect. And some of them are still trading at an elevated price.

Don’t be afraid to look for plays on the downside in this market.

You Must Be Nimble and Open-Minded to New Strategies In 2023

You can’t just invest and forget about it in a stock-pickers market. You have to be an active investor. Be selective with your stock selection and open-minded to applying options strategies.

While we would all love our stocks to appreciate, we have to pursue strategies that will bring in income, whether investing in high-yielding dividend stocks, fixed income, or selling put options.

There’s too much uncertainty to believe the market will go straight up this year, so you should also look at ways to be strategically short.

The 60/40 portfolio was a disaster in 2022, and while it’s doing okay this year, you can’t rely on it in this market. You’ve got to put your hands on the wheel and take control.