Five agricultural investments to purchase amid Russia’s raging war against Ukraine feature an industry fund, the world’s largest farm equipment manufacturer, a tractor supply company, a fertilizer business and a potato grower.

The five agricultural investments to buy offer ways to pursue profits amid the latest threatening rhetoric and military actions from Russia against Ukraine and the decimation of the latter nation’s role as a provider of precious grain to Europe and other regions of the world. Feb. 24 marks the one-year anniversary of Russia’s full-scale invasion of Ukraine, killing at least 8,000 non-combatants and injuring nearly 13,300, according to United Nations Human Rights Office (OHCHR) data. The true numbers likely are substantially higher but they are difficult to document, OHCHR staffers have said repeatedly.

Before Russia launched a broad-scale assault of its neighboring nation in February 2022, Ukraine had been one of the world’s largest grain producers, according to the United Nations Food and Agriculture Organization. Ukraine provided for nearly 15% of global exports of wheat, maize and barley in 2021, while also exporting 6% of all food calories globally.

People in the Middle East, as well as North and Eastern Africa, are highly dependent on Ukrainian exports. Russia’s continued war against Ukraine is forecast to leave 13 million people facing chronic hunger globally through 2023, almost double the figure of seven million people from before the onslaught began a year ago, according to the UN Food and Agriculture Organization.

The UN, a leader in international efforts to defeat hunger and improve nutrition and food security, blames most of the problem on supply-chain disruptions caused by the war. In an effort to mitigate the hunger crisis and preserve a critical part of Ukraine’s economy, the European Union (EU) established EU-Ukraine Solidarity Lanes to facilitate the transport of Ukrainian agricultural products to markets. The initiative preceded the UN-brokered Black Sea Grain Initiative to facilitate food and agriculture exports from Ukraine.

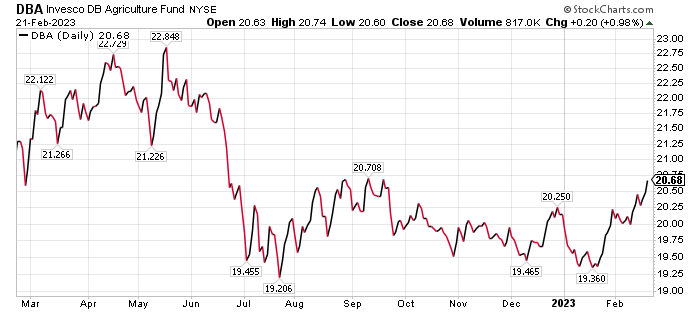

Five Agricultural Investments to Purchase: DBA

Investors seeking exposure to agricultural stocks can invest in diversified industry commodities through Invesco DB Agriculture (DBA), an exchange-traded fund (ETF), said Bob Carlson, a pension fund chairman who also leads the Retirement Watch investment newsletter. The ETF seeks to track changes in the DBIQ Diversified Agriculture Index Excess Return. The fund earns interest income from cash it invests primarily in U.S. Treasury securities, as well as money market investments, while holding them as collateral for the futures contracts.

Bob Carlson, head of Retirement Watch, talks to Paul Dykewicz.

The fund is designed for investors who seek a cost-effective and convenient way to invest in commodity futures. The Index is rules-based and composed of futures contracts on some of the most liquid and widely traded agricultural commodities. DBA and the Index are rebalanced and reconstituted annually in November.

Top holdings and percentages of the fund, as of Feb. 17, were sugar, 13.4%; live cattle, 12.63%; coffee, 12.23%; soybeans, 12.16%; corn, 11.77%; cocoa, 11.68%; and wheat, 11.29%. The fund’s total expense ratio is 0.91%, but its share price has risen 2.63% so far in 2023 through the market’s close on Feb. 17.

Chart courtesy of www.stockcharts.com

Many Struggle to Survive Each Day

“Across the world, 222 million people are experiencing high acute food insecurity, almost one in five of whom are struggling to access enough food to survive the day,” according to the UN Food and Agriculture Organization.

Extreme weather, especially droughts and floods, war in Ukraine and proliferation of other conflicts, along with growing uncertainty about global food and agriculture markets, put acute food insecurity at new highs, the UN reported. As 2022 neared an end, almost one million people faced “immediate threat of starvation” — roughly double the numbers of 2021.

“In the Horn of Africa alone, struggling with an unprecedented drought — an event not seen in 40 years — between 23 and 26 million people are projected to be in urgent need of humanitarian assistance, and acute food insecurity is expected to continue intensifying by February 2023,” the UN found.

The world is enduring an “anticipated, unprecedented sixth consecutive season of drought,” the UN Food and Agriculture Organization found. Further fallout comes from a steady rise in the cost of food since the onset of COVID-19, with international food commodity prices hitting a 10-year high, the agency added.

That occurred before the war in Ukraine sent further shockwaves through the food supply system, according to the UN. While prices in international staple foods have fallen recently, consumer prices remain high, with significant implications for the poorest people seeking to purchase power and food, the agency noted.

“Conflicts and political instability continue to ravage lives and livelihoods across the world, forcing people to flee their homes and abandon their farms, boats, livestock — pushing them into destitution and total reliance on external assistance,” the UN reported.

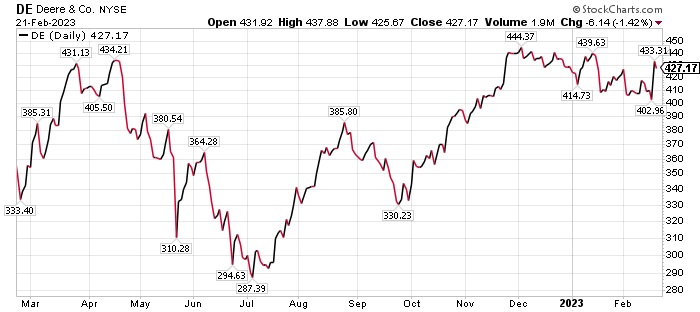

Five Agricultural Investments to Purchase: Deere

Deere & Company (NYSE: DE), of Moline, Illinois, is the world’s largest producer of agricultural equipment. It has manufactured agricultural machinery since 1837 under the iconic John Deere brand, displaying its signature green and yellow color scheme.

The agricultural business has been highly fertile for Deere. The company reported first-quarter net income of $1.959 billion, or $6.55 per share, for the period ended Jan. 29, driven by a 34% gain in net sales from the same quarter the prior year. Net income in the same quarter the year before was less than half, totaling $903 million, or $2.92 per share.

Net sales at Deere for the quarter ending Jan. 29 reached $11.402 billion, compared with $8.531 billion in 2022. Deere’s management team spoke of a current market environment supported by positive business fundamentals and healthy demand for farm and construction equipment.

For the first quarter ended January 29, 2023, Worldwide net sales and revenues increased 32 percent, to $12.652 billion. Another positive sign was enhanced guidance from Deere’s management for 2023, with a full-year net income forecast to reach $8.75 billion-$9.25 billion.

Chart courtesy of www.stockcharts.com

Ben Franklin Scion Recommends Deere as One of Five Agricultural Investments to Purchase

“Deere’s first-quarter performance is a reflection of favorable market fundamentals and healthy demand for our equipment, as well as solid execution on the part of our employees, dealers and suppliers to get products to our customers,” said John C. May, chairman and chief executive officer, in a prepared statement when the company reported its latest financial results. “We are, at the same time, benefiting from an improved operating environment, which is contributing to higher levels of production.”

The company has had a rising dividend policy since 1988, and it most recently boosted its payout on Dec. 29, said Mark Skousen, PhD, who recently recommended the stock in his Five Star Trader advisory service. He also heads the Forecasts & Strategies investment newsletter.

Selling under 16 times forward earnings, Deere has a return on equity (ROE) of 37%. According to Zacks Research, Wall Street estimates have been rising recently, with earnings growth expected to increase by 20% during fiscal year 2023.

Skousen recommended Deere & Co. in January to his Five Star Trader subscribers and set a protective stop. For those willing to take increased risk to pursue significantly enlarged potential profits, Skousen also recommended specific call options in Deere, which can ascend much faster than the stock price.

Mark Skousen, a scion of Ben Franklin and head of Five Star Trader, meets Paul Dykewicz.

Skousen Drove a Deere Tractor Growing Up as the Son of a Farmer

Skousen grew up on a 50-acre farm outside Portland, Oregon, where he drove the Deere tractor of his father, Leroy Skousen. The important role of farming is rewarding but requires much hard work, Skousen said.

Other fans of Deere are BofA Global Research and Michelle Connell, the head of Dallas-based Portia Capital Management. Deere has done an “excellent job” supporting its stock price by repurchasing 25% of its shares outstanding in the past 10 years.

The company is known for buying shares when valuations are low and using their cash for these purchases, Connell continued. There have been some concerns regarding Deere’s insider sales of approximately $4 million in 2022, she added.

“These don’t bother me,” Connell counseled. “Executives frequently have tight windows for the sales of their shares, and estate planning may also be part of the executives’ strategy. I like DE because it takes advantage of the fact that that as a population increases, the demand for affordable food increases as well.”

Michelle Connell leads Dallas-based Portia Capital Management.

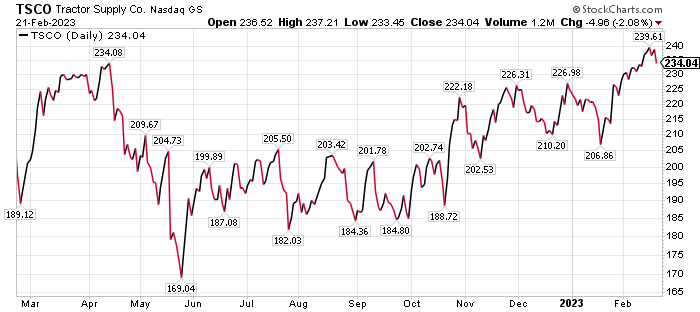

Five Agricultural Investments to Purchase: Tractor Supply

Tractor Supply Co. (NASDAQ: TSCO), of Brentwood, Tennessee, sells products for agriculture, lawn and garden maintenance, home improvement, livestock, equine and pet care for recreational farmers and ranchers, pet owners and landowners. The stock received a buy recommendation and a $260 price objective from BofA Global Research, which wrote a research note late last month listing TSCO as one of 11 top buys for investors in 2023. TSCO was the one and only pick for the list from the consumer discretionary sector.

Chart courtesy of www.stockcharts.com

An “Open House” held by Tractor Supply for the investment community in Nashville, Tennessee, on Jan. 30-31, included a store tour of the company’s new Project Fusion and side lot format. BofA is predicting that Tractor Supply to step up its expansion into the lawn and garden arena to keep the company’s revenue growth “chugging along” in 2023 and beyond.

“Our surveys suggest that lawn and garden is the most popular category within consumers’ medium-term home improvement plans,” BofA wrote in its research note.

Tractor Supply’s product mix of primarily non-discretionary products, such as livestock & pet supplies, hardware/tools/truck supplies and workwear, leaves the retailer less vulnerable to the pullback in spending endured by many retailers in recent months, BofA wrote. The largest U.S. operator of retail farm and ranch stores differentiates itself through its broad product lines that span multiple industries aimed mainly at rural customers.

“TSCO is a growth company with opportunities to improve margins over time,” BofA wrote. “We now view TSCO’s valuation as attractive, as investment positives do not appear fully priced in.”

The stock could top its price objective with boosts from significant economic improvement in its core rural markets, stronger-than-expected comparable growth aiding operating margins, increasing the company’s store additions above current plans and price and gross margin inflation of its products. Risks that could prevent the stock from attaining the price target set by BofA are stepped-up reinvestment, inability to offset wage inflation, a slow-down in demand for discretionary rural lifestyle products and increased competition from mass merchants and online retailers in TSCO’s core categories.

Tractor Supply is rated as BofA’s top consumer discretionary stock for 2023.

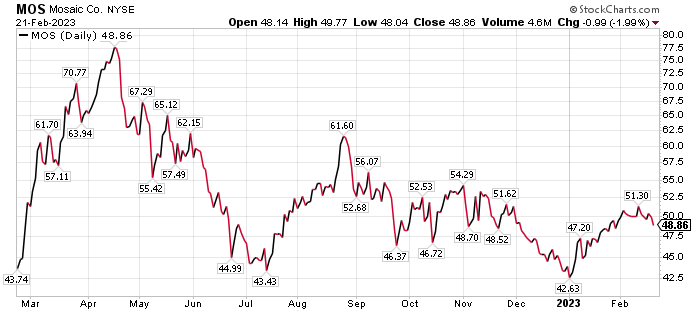

Five Agricultural Investments to Purchase: Mosaic

Amid a tight potash market, pure-play fertilizer giant Mosaic Company (NYSE: MOS) is another of the top 11 stock recommendations for 2023 by BofA Global Research. As a Fortune 500 company headquartered in Tampa, Florida, Mosaic specializes in mining phosphate, potash and urea. It is the largest U.S. producer of potash and phosphate fertilizer, operating through business segments such as international distribution and Mosaic Fertilizantes.

BofA chose Mosaic for a place among 11 top stocks aligned with its 2023 themes that include quality, value, free cash flow generation, domestic vs. global exposure and dividend growth potential. The list also targets stocks that show earnings resilience given the expected recession. The investment firm seeks either top-down strength and/or margin stability.

Mosaic became a recommendation of Jim Woods to subscribers of his High Velocity Options advisory service for 14 days last year when he advised buying call options to capitalize on his view that the company’s stock was on the ascent. Subscribers who followed his guidance and bought and sold when he recommended could produce a profit of 124%. That triple-digit-percentage gain exemplifies how options can be such big money makers.

Paul Dykewicz meets with Jim Woods, head of Bullseye Stock Trader.

Patriotic American investors also may like the idea of supporting Mosaic as a competitor to Russian companies. Russia is a big producer of potash, a key crop nutrient that is used in agricultural production.

Chart courtesy of www.stockcharts.com

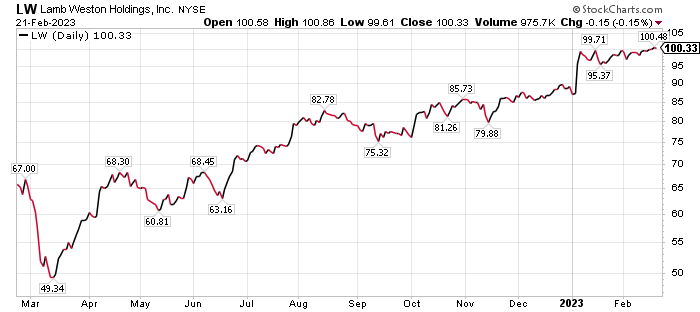

Five Agricultural Investments to Purchase: Lamb Weston

Lamb Weston Holdings, Inc. (NYSE: LW), of Eagle, Idaho, grows and supplies potatoes. The company delivers frozen potato, sweet potato, appetizer and vegetable products to restaurants and retailers worldwide. For more than 60 years, Lamb Weston has introduced uniquely presented products to more than 100 countries.

The company has manufacturing operations in the Pacific Northwest, primarily in the Columbia River Basin, arguably the world’s best potato-growing region. Lamb Weston employs more than 7,000 people worldwide in sales offices, manufacturing plants and corporate offices.

BofA gave Lamb Weston Holdings a price target of $115, a premium to the packaged food index. The investment firm wrote that the higher valuation compared to peer companies is warranted, since Lamb Weston is poised to approach pre-COVID levels with favorable demand trends and margin potential in fiscal year 2023 and 2024.

Chart courtesy of www.stockcharts.com

Could Lamb Weston Roar Like a Lion?

Reasons why Lamb Weston could top its $115 price target include demand rebounding faster than expected and category growth staying above 3% with tight industry supply expected to continue in the medium- to long-term. Tight supply lets providers hike prices to both global and food service customers, BofA wrote.

Risks to reaching the $115 price target include higher-than-expected potato costs, unforeseen problems propelling price increases to cover inflation and restore margins, any influx of new industry capacity and a slowdown in on-premise sales activity if consumers face reduced spending power.

Bryan Perry, the leader of the Cash Machine investment newsletter and the Breakout Options Alert trading service, recommended Lamb Weston call options in the latter, options-only service. The related stock has jumped 12.59% so far this year, as of the close on Feb. 21.

Paul Dykewicz interviews Wall Street veteran Bryan Perry, of Breakout Options Alert.

Russia’s Invasion of Ukraine Intensifies

Russia’s President Vladimir Putin appeared on domestic television in his state-of-the-nation address on Tuesday, Feb. 21, declaring he will not relent in his invasion of Ukraine that began on Feb. 24, 2022. Putin, whose words and deeds indicate the war he launched against Ukraine will continue indefinitely, has called his country’s attack of Ukraine a “special military operation” and claimed the West began the raging conflict even though he ordered 200,000 troops into his neighboring nation in violation of international law when he launched his attack.

Russia’s leader also announced he is suspending his country’s participation in the New START treaty — the last nuclear arms control pact remaining with the United States. President Joe Biden acknowledged in a statement on Tuesday, Feb. 21, that Russia’s war created global economic disruptions but that the United States and its allies have adopted initiatives to stabilize food supplies and energy markets.

“And we supported our partners as they opened their homes and communities to millions of Ukrainians seeking refuge,” Biden said.

The United States is delivering critical equipment, including artillery ammunition, anti-armor systems and air surveillance radars to help protect the Ukrainian people from aerial bombardments, President Biden said.

“And I will share that later this week, we will announce additional sanctions against elites and companies that are trying to evade or backfill Russia’s war machine,” Biden continued. “Over the last year, the United States has built a coalition of nations from the Atlantic to the Pacific to help defend Ukraine with unprecedented military, economic and humanitarian support — and that support will endure.”

President Biden traveled to Poland to meet President Duda and the leaders of America’s Eastern Flank Allies, as well as delivered remarks on how the United States will continue to rally the world to support the people of Ukraine and the core values of human rights and dignity in the UN Charter that unite us worldwide.

The United Nations General Assembly voted overwhelmingly last year to condemn Russia’s attempts to annex four regions of eastern Ukraine. The UN resolution was supported by 143 countries, while 35 states, including China and India, abstained.

The five agricultural investments to purchase have been spared from fallout of ferocious fighting in Bakhmut, Ukraine, where Russian forces are seeking to seize control of a key highway and a key transportation route. Russian airborne units have joined Wagner mercenary fighters in battling for the city.

Diabetes Increases Risk of Severe COVID, Report Indicates

A new medical report found that diabetics who have high blood sugar levels face a significantly greater risk of being hospitalized with severe illness from COVID-19, according to the International Diabetes Federation (IDF). Headquartered in Brussels, Belgium. the Federation reported “poor glycemic control was a risk factor for adverse COVID-19 endpoints.”

Worldwide COVID-19 deaths rose to 6,864,223 people, with total cases of 674,266,379, Johns Hopkins reported on Feb. 21. COVID-19 cases in the United States totaled 103,168,534, while deaths reached 1,117,820 as of Feb. 21, according to Johns Hopkins University. Until recent reports that China had more than 248 million cases of COVID-19, America had ranked as the nation with the most coronavirus cases and deaths.

The U.S. Centers for Disease Control and Prevention reported that 269,332,266 people, or 81.1% of the U.S. population, have received at least one dose of a COVID-19 vaccine, as of Feb. 15. People who have completed the primary COVID-19 doses totaled 229,914,797 of the U.S. population, or 69.2%, according to the CDC. The United States has given a bivalent COVID-19 booster to 49,932,850 people who are age 18 and up, equaling 19.3% as of Feb. 15, compared to 19.2% on Feb. 8, 19% on Feb. 1 and 18.8% as of Jan. 26.

The five agricultural investments to purchase are showing resilience when many other sectors are straining to bounce back from sagging share prices in 2022. Agricultural investments are helping to supply good for people worldwide and offer humanitarian value, as well as the chance to pursue profits.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Special Holiday Offer: Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases.

![[tractor mowing wheat]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_48384775.jpg)