Four best airline stocks to buy gain lift amid rising optimism within the travel industry during the post-COVID lockdown era.

During the low-travel period of the COVID-19 pandemic, airlines took a $370 billion financial loss, and the industry as a whole incurred a 96% drop in flight activity. So far in 2023, airlines are starting to return to pre-pandemic passenger traffic. As the demand for airline travel rebounds and consumer confidence increases, it is imperative to look at the best airline stocks for the upcoming summer travel season.

Four Best Airline Stocks to Buy, United is Number One

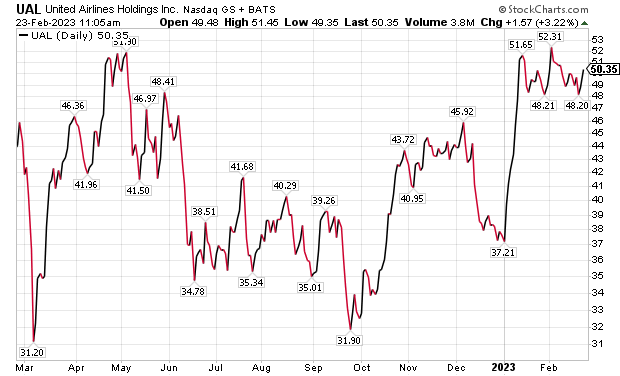

From Chicago, Illinois, United Airlines (NASDAQ: UAL) is one of the most recognizable companies worldwide. It operates with more than 1,400 aircraft and provides destinations in more than 60 countries. United is also an industry leader with greater than $40 billion in revenue in 2022 and a market capitalization of $16 billion. The company holds a strong financial position and has bounced back nicely from various government travel restrictions, with a 31% increase in stock price from January 2022 to January 2023.

United Airlines also has introduced innovations to enhance its customer experience in recent years. After the onset of COVID-19, United Airlines invested in ideas including touchless check-in, virtual customer service and its new virtual travel center.

Through these new additions, customers can book flights, hotels, car services, restaurant reservations and more, all accessed through the company’s website. When it comes to trying to lead the industry, airlines try to top each other by offering increasingly seamless services. United Airlines has recently taken it a step further than its rivals with its modern fleet and customer-focused efforts. With the increasing demand for travel, United Airlines is expected to show growth in the coming years.

Chart courtesy of www.stockcharts.com

Four Best Airline Stocks to Buy, Southwest Serves the Low-Cost Niche

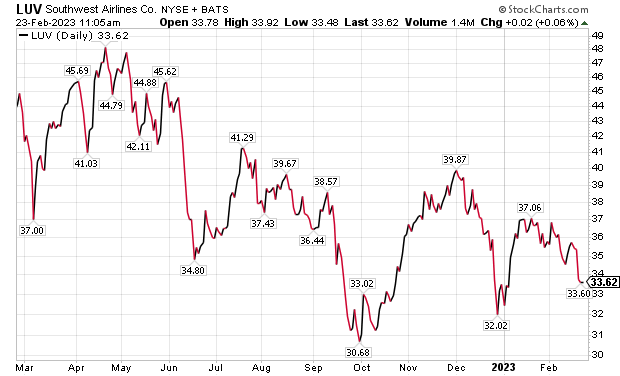

Dallas, Texas-based Southwest Airlines (NYSE: LUV) is another strong option for investing in the industry. Southwest has provided the United States with low-cost options in domestic flights and a few international destinations. Compared to other airlines in the sector, Southwest seeks to sustain its low-cost, high-value structure. Southwest has taken advantage of its recent growth to start adding more international destinations in places like Mexico and Canada. It is not out of the question to see Southwest expand towards other continents as it grows.

Another attractive Southwest quality comes in its financial security. Southwest’s balance sheet is known to be the strongest out of the sector and makes it a relatively safe investment for those looking to gain exposure to the airline industry. The company’s 2022 financial statements listed a 1.43 current ratio (Current Assets – Current Liabilities), meaning Southwest has a healthy amount of assets to cover short-term liabilities. That ratio reveals its financial stability and potential growth for the airline in coming years.

Chart courtesy of www.stockcharts.com)

The chart below shows the stock price of United Airlines (NASDAQ: UAL), Southwest Airlines (NYSE: LUV), Delta Airlines (NYSE: DAL) and Frontier Group Holdings (NASDAQ: ULCC) from October 2022 to February 2023.

Chart provided by Yahoo Finance

Four Best Airline Stocks to Buy, Delta’s Extensive Cost-Cutting

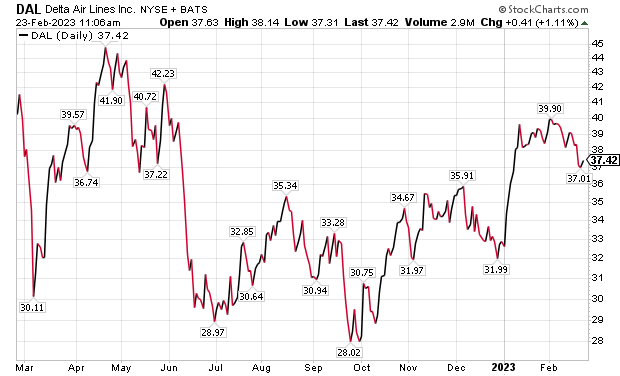

Delta Airlines (NYSE: DAL), of Atlanta, Georgia, reflects the consistency of the top airline companies in the last 20 years. As one of the first airlines established in 1925, Delta has had a strong financial track record and arguably set the industry benchmark for adapting to COVID-19 through cost-cutting measures and streamlining its flight schedules. For those looking for consistent returns, Delta is worth considering.

Delta has set itself up nicely to benefit from increased demand in airline travel. With a market capitalization of $24.9 billion, Delta reported 2022 revenue of $45.6 billion, which is a $19.1 billion increase from the prior 2021. After cutting costs, Delta is primed to compete with other large airlines in the sector.

Chart courtesy of www.stockcharts.com

Four Best Airline Stocks to Buy, The Future Frontier

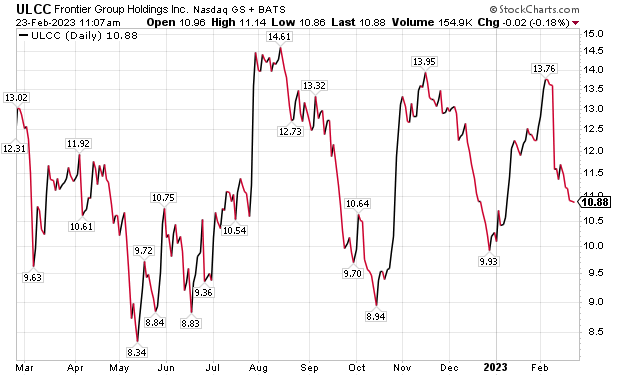

Frontier Airlines (NASDAQ: ULCC) from Denver, Colorado, is another potential investment in the industry. Established in 1994, Frontier’s low-cost structure and its frequency of domestic flights have helped it gain name recognition in the United States.

Frontier is a riskier investment than some other airlines because of its lack of international operations, but is still one of the largest U.S-based domestic airlines. Frontier’s 2021 revenue ending in May 2021 exceeded $2 billion and the company most recently reported a quarterly revenue of $906 million ending November 2022. With airlines getting back up to speed with travel, it will be exciting to see how Frontier expands its reach.

Chart courtesy of www.stockcharts.com

Four Best Airline Stocks to Buy

United, Southwest, Delta and Frontier are some of the best stocks to buy due to their financial stability, operational efficiency, growth prospect and customer satisfaction. With the 2023 summer coming close, these four best airline stocks to buy offer ways for investors to pursue profits from the travel industry.

Jordan Ellis writes for www.stockinvestor.com

![[Airbus A380 airplane]](https://www.stockinvestor.com/wp-content/uploads/2683262154_05c21978ec_b.jpg)