What a difference a data point makes.

Last Friday’s ISM report came in as forecast on a numerical basis, but underneath the hood revealed further stubborn inflationary pressures at work. But the market gave the benefit of the doubt to the notion that, just maybe, inflation might be starting to flatten.

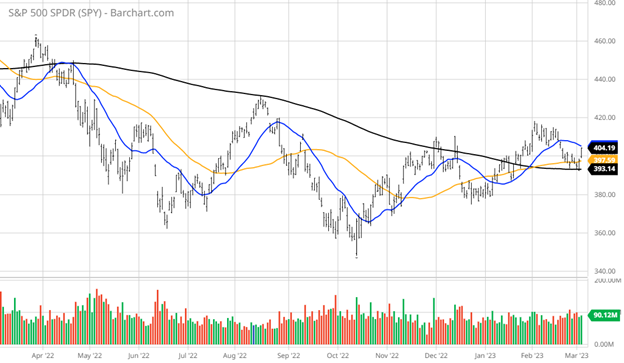

There is a raging appetite to buy the market well before the Fed pauses and pivots, because quite simply, most investors are not very good at individual stock picking and just want to buy “the market.” And with the major averages holding their 200-day moving averages as rates tick higher, the greater investing community is in total flux as to whether the Fed will overtighten resulting in another “head fake” bear market rally.

For most of February, the data that crossed the tape was generally negative as it showed inflation wasn’t only sticky, it reared back up in some areas of the economy, and put a halt to the market’s strong start to 2023. The Fed’s most watched inflation indicator, Personal Consumption Expenditures index, was especially sour in that it showed an increase in many forms of services and yet strips out the cost of housing. This is likely why the bond yields took another leg higher, figuring the Fed was set to extend the business of raising rates as far out as September.

Against this backdrop, not only were the January gains at risk of vanishing, the technical progress made with all four of the major indexes trading above their respective 200-day moving averages, were being tested. The benchmark S&P 500 index retraced back to its 200-day moving average (MA) twice at 3,940 and held. As of Friday’s close, the S&P traded at 4,045 and, for the moment, well out of trouble. But again, some market-moving reports lie ahead that will most definitely define the short-term trend.

There is plenty of both empirical and anecdotal evidence to argue strongly for a no landing, soft landing and hard landing scenario. In this kind of market, stock and asset selection are at an extreme premium. But I will say that the technical picture, while challenged this past week, did not break down and showed some genuine eagerness by investors to buy the successful test of the 200-day moving averages. It shows that investor optimism still rules the emotional pendulum on a historical basis, which gives the market the benefit of the doubt, sometimes seemingly against all odds.

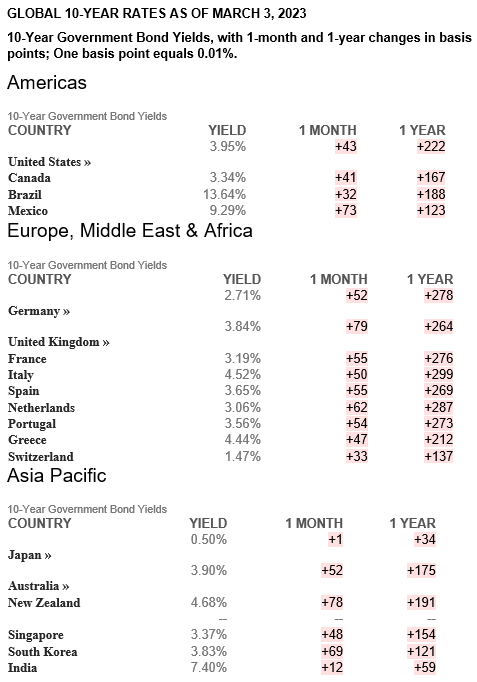

To be sure, it is important to note that higher interest rates aren’t just a domestic problem. Rates are moving higher around the world — in most cases, up more than 2% in most key regions. The largest central banks around the globe need to work in concert with each other to provide for stability and avoid fissures that are easily triggered by the some-$632 trillion dollars (not a typo) in financial derivatives at the midpoint of 2022. The heavy hand of risk aversion on this scale can cause severe imbalances.

The old Wall Street maxim of “the bond market trades on fear, and the stock market trades on greed” couldn’t apply more than at any time in recent memory. There are smart people with a strong history of analyzing inflation who believe the terminal rate is going to be above 6%. There are some large bets in the bond futures market that confirm this speculation. And they will pay off huge if they are right.

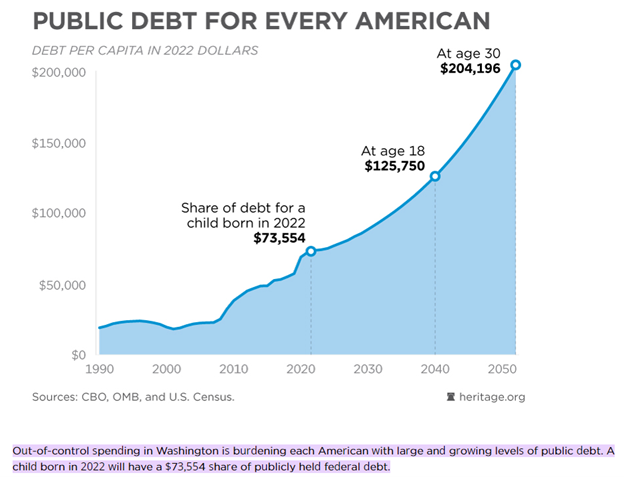

To be sure, one of the main reasons the Fed, in my view, is aggressively raising rates at a pace that has yet to see the hikes work fully through the financial system is because it puts huge stress on financing the $31.5 trillion in government debt at 5% interest rates, which so happens to be that of the six-month T-Bill. If sustained at this level, rates threaten to deplete government spending on vital programs dramatically. And hiking the debt ceiling even further to accommodate this situation puts the value of the dollar at future risk. I believe this is the elephant in the room that is isn’t getting the attention it deserves. The Federal Reserve employs over 400 PhDs, and I have to believe that this is the biggest water-cooler topic of discussion, which permeates that institution.

There is a tipping point where the math, such a debt-to-gross domestic product (GDP) in an economy that accounts for 24% of global GDP starts to gain the attention of currency traders, calls into question the “king dollar” syndrome that has dominated markets for so long. It is imperative the Fed maintains the full confidence of its currency and debt obligations but can only do so with a more thrifty spending program by Congress. And I’m not so sure this part of the puzzle is feasible without some sort of leadership by the Fed instructing Congress that continuing to raise the debt ceiling is a very bad idea.

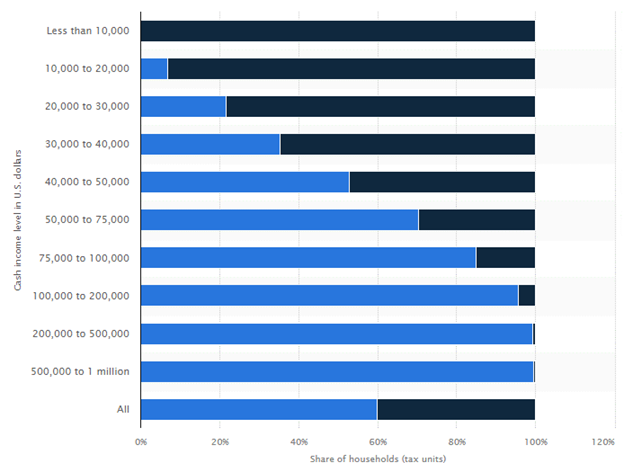

This issue is now on the minds of many more millions of Americans than ever before and is talked about in high places, hair salons and everywhere in-between. I think at least the 60% (see chart below) of Americans that do pay income taxes are trying to save and manage inflation in their lives. They seem to have a strong sense of what rising interest rates can do to risk the future of not only their standard of living, but that of the common purpose to keep our society moving forward without wallowing amid soaring interest on debt.

I’m pretty certain, that every reader of this column is a conscious steward of their finances, or at least tries to be. When we see out-of-control spending, as if some bank gave you an unlimited line of credit where the payback would be extended out for the next 50 or 75 years, it just might move you. That means your grandchildren will be responsible for paying for your mismanagement of the household budget. My third grandson, Rhett Perry, was born on Friday, March 3, and came into the world already owing the Federal government over $73,000 on day one.

Who would do that to their children and generations to come thereafter? Congress. That’s who. And the numbers only skyrocket from here if not somehow harnessed. Even if current and future presidents have big spending plans, such as what we will see this week from President Biden, it is incumbent upon Congress to not bankrupt the country.

The federal government has run a budget deficit every year since 2000, forcing it to borrow money and add to a national debt that now sits at $31.5 trillion. The Committee for a Responsible Federal Budget recently estimated that it would require $14.6 trillion in deficit reduction to balance the budget over the next decade. Fat chance with this sitting Congress.

Are our elected officials that far gone off the financial reservation that we don’t have the stones to slash spending in the right places and raise some taxes in the right places to balance and begin to take a sledge hammer to the debt? Does the idea of rearranging the deck chairs on the Titanic come to mind? When our leaders live in a delusional state and refuse to face the eventual truth, history has shown it can repeat itself in a very bad way.

Write to your members of Congress and/or your senators to tell them you don’t want your grandkids to pay for the unforgiveable financial mismanagement of today. There will be a breaking point, but it doesn’t have to be as damaging. Spread the word. Let’s balance the books.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)