Supreme Court student debt forgiveness case outcome could affect how soon borrowers could shift funds to invest in the markets that otherwise may be needed to pay off their federal education loans.

The Supreme Court first must decide whether the plaintiffs in two cases before it have legal standing to pursue relief from the Biden administration’s attempt to offer student debt forgiveness without Congressional approval. If either of the two cases pending before the Supreme Court is found to have legal standing, the justices then will be able to decide if the Biden administration has the authority to continue its student-loan forgiveness program.

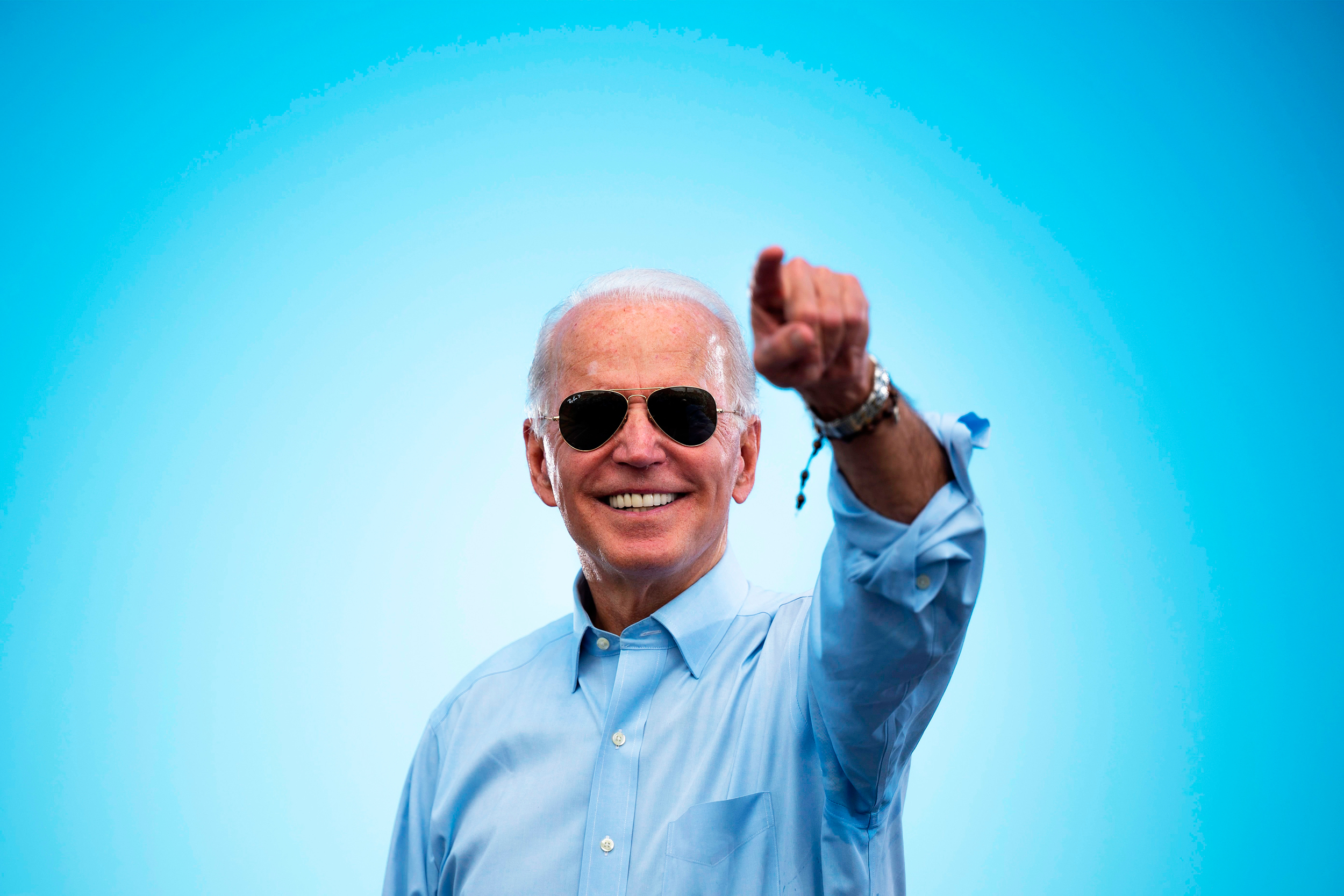

Supreme Court Student Debt Forgiveness Case: U.S. Solicitor General Defends Biden Administration

Borrowers who took out federal student loans have benefitted collectively by saving more than $150 billion over the three-year course of the U.S. Department of Education’s forbearance program as they received “absolutely critical relief,” said U.S. Solicitor General Elizabeth B. Prelogar. During oral arguments for the case of Department of Education vs. Brown, Prelogar represented the Biden administration and said the arguments for the plaintiffs, Brown and Taylor, run counter to “precedent and principle.”

As to whether they have legal standing to sue, their “asserted injury” is a complete mismatch for the relief they seek, Prelogar said. They claim to want greater loan forgiveness than the plan provides, but they ask the court to hold that the HEROES Act that took effect to help people who needed it during the COVID-19 crisis does not authorize loan forgiveness at all, she added.

“A win on that theory would mean that no one could get any HEROES Act relief, not Brown, who would get nothing for herself, not Taylor, who would lose $10,000, and not any of the millions of borrowers who need this critical relief,” Prelogar argued. “Respondents lack standing to seek that result.”

Supreme Court Student Debt Forgiveness Case: Chief Justice Roberts Raises Issue of Fairness

Chief Justice John Roberts raised the issue of fairness by mentioning how the program would give different treatment to two high school graduates who could not afford college, with one taking out a student loan and the other not doing so to set up a lawn care service. If that latter person took out a bank loan, at the end of four years statistically the person with the college degree is going to do “significantly financially better” over the course of life than the person without a college education, he added.

“And then along comes the government and tells that person: You don’t have to pay your loan,” Chief Justice Roberts said. Nobody’s telling the person who is trying to set up the lawn service business that he doesn’t have to pay his loan. He still does, even though his tax dollars are going to support the forgiveness of the loan for the college graduate, who’s now going to make a lot more than him over the course of his lifetime.”

In response, Prelogar said it is undisputed that there will be “millions of student-loan borrowers” who are not going to pay off their debt if the loan forgiveness program is ended.

Supreme Court Student Debt Forgiveness Case: Nebraska’s Solicitor General Represents Six States

Nebraska’s Solicitor General James Campbell appeared before the court to represent six states that filed a separate lawsuit seeking to have the loan forgiveness program overturned to avoid financial fallout. Based on oral arguments, the state that appears to have the best legal standing is Missouri, which has a federal student loan servicing entity that would lose tens of millions of dollars in revenues if the loan relief plan of the Biden administration stays in effect. The other four states joining Nebraska and Missouri in that case are Arkansas, Iowa, Kansas and South Carolina.

On behalf of the Biden administration, Prelogar positioned the program as a financial lifeline for millions of people who are receiving loan forbearance and potential forgiveness.

“Over the past three years, millions of Americans have struggled to pay rent, utilities, food, and many have been unable to pay their debts,” Prelogar said. “To head off immediate harm for student-loan borrowers, two Secretaries across two administrations invoked the HEROES Act to suspend interest and payment obligations for all Americans with federally held loans. But, if that forbearance ends without further relief, it’s undisputed that defaults and delinquencies will surge above pre-pandemic levels.”

Supreme Court Student Debt Forgiveness Case: Department of Education vs. Brown

That case, Biden vs. Nebraska, turns on the same issue as Department of Education vs. Brown, about whether the HEROES Act authorizes the debt forgiveness program, said J. Michael Connolly, an Arlington, Virginia-based attorney who spoke on behalf of two student-loan borrowers, Brown and Taylor, seeking redress for their claims of unfair treatment and damages.

“I’d like to focus here on three issues specific to this case,” Connolly continued. “First, the HEROES Act is the [Education] Secretary’s only excuse for not adopting the program through negotiated rulemaking and notice and comment. If that Act does not apply, there is no dispute that the program is procedurally improper. Second, on standing, the government makes one argument, that if Respondents prevail, the Secretary won’t provide debt forgiveness to them under the HEROES Act. But that isn’t the proper inquiry. Respondents need only show that there was some possibility that the relief they seek will prompt the Secretary to forgive their debts. On that question, there is no debate. Debt forgiveness is a top priority of this administration. The parties agree that the Secretary can forgive debts under the Higher Education Act, and the Secretary has never denied that he may follow the proper procedures and forgive Respondents’ debts after his current program is declared unlawful.”

Finally, on the merits, Congress did not authorize the Education Secretary to create a $400 billion debt forgiveness program behind closed doors with no public involvement, Connolly argued.

“The whole point of negotiated rulemaking and notice and comment is that the individuals most affected by student loan regulations, like the Respondents, must have a meaningful voice in the regulatory process,” Connolly contended. “But here, the Respondents were deprived of their procedural rights, and their finances suffered. Brown got nothing, and Taylor received only $10,000, even though high-income individuals making more than five times as much got $20,000.”

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)