Five gold stocks to purchase amid recent bank failures offer a proven path to hedge against economic weakness.

The five gold stocks to purchase are poised to profit despite several big bank collapses in recent weeks due to inept risk management. Gold traditionally serves as a reduced-risk asset class in times of heightened uncertainty.

The BofA Global Research Commodities team and other prognosticators forecasted weeks ago that the price of gold will climb past the $2,000 per ounce. Since gold futures dipped to $1,630.90 less than six months ago on Nov. 3, the price has jumped 22.11%, reaching $1,991.50 on Tuesday, March 28.

Five Gold Stocks to Purchase Amid Banks Going Bust

The rising price of gold has been tapped into by Bob Carlson, a pension fund chairman and leader of the Retirement Watch investment newsletter. As a risk-averse investment leader, Carlson has recommended iShares Gold Trust (IAU), which has risen 1.71% in the past week, 8.12% in the last month, 9.38% in the past three months and 2.60% since the same last year.

Carlson described gold as a “crisis hedge.” The Fed’s nine consecutive rate hikes since 2022 have boosted borrowing costs. Last week’s 0.25% rate increase on March 24 put the Fed’s current level at 4.75-5%, up from 0.25-0.50% a year ago.

“Tight monetary policy is likely to trigger financial crises, such as last year’s problems in U.K. pension funds and the recent collapse of Silicon Valley Bank,” Carlson wrote to his subscribers in his April 2023 issue of Retirement Watch. “Global political conflicts also are a reason to hold gold as insurance.”

Retirement Watch head Bob Carlson discusses investing with Paul Dykewicz.

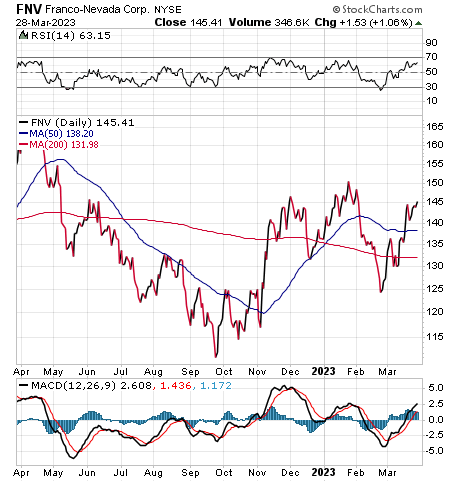

Franco-Nevada Leads Five Gold Stocks to Purchase as Banks Falter

A recent Fast Money Alert trading service recommendation, Toronto-based Franco-Nevada (NYSE: FNV), jumped 3.08% on March 28. It also topped 14% in the past month, 4% in the past three months and 6% so far this year.

The Fast Money Alert trading service, featuring both stocks and options, is led by Jim Woods and Mark Skousen, PhD. Skousen also heads the Forecasts & Strategies investment newsletter, which is up more than 22% with its recommendation of SDR Gold ETF (NYSE: GLD), rising 0.82% on March 28 and about 8% for the past month, three months and year to date.

Jim Woods co-heads Fast Money Alert.

The precious-metals-focused investment company owns a diversified portfolio of gold, silver and platinum, along with their royalty streams. The company does not operate mines, develop projects or conduct exploration. Franco-Nevada’s short-term financial performance is linked to the price of commodities and the amount of production from its portfolio of assets.

Mark Skousen heads Forecasts & Strategies.

Fellow Fan of Franco-Nevada Picks It as One of Five Gold Stocks to Purchase for Profits

Michelle Connell, head of Dallas-based Portia Capital Management, said the instability of regional banks has enhanced the appeal of gold and other precious metals mining companies as safe havens. Investors have been flocking to them and the prices have been appreciating, she added.

“One interesting way to play precious metals is focusing on those companies that provide capital to the mining companies in exchange for the option to purchase the precious metals at lower prices,” Connell counseled. “These companies are seen as less risky than the mining pure plays. They have large portfolios of mining companies as clients and therefore are less risky than owning one or two individual mining companies.”

Michelle Connell leads Dallas-based Portia Capital Management.

Franco-Nevada is one of the companies that competes effectively in the mining financing business, Connell continued. The company offers a “unique way” to gain exposure to precious metals, she added.

Franco-Nevada is “very strong fundamentally” and has generated annual cash flows of more than $500 million over the last 10 years, Connell said. The company also pays a modest dividend with a yield of roughly 1%. The stock’s potential upside during the next 12-18 months could be 20% or greater, she added.

Chart courtesy of www.stockcharts.com

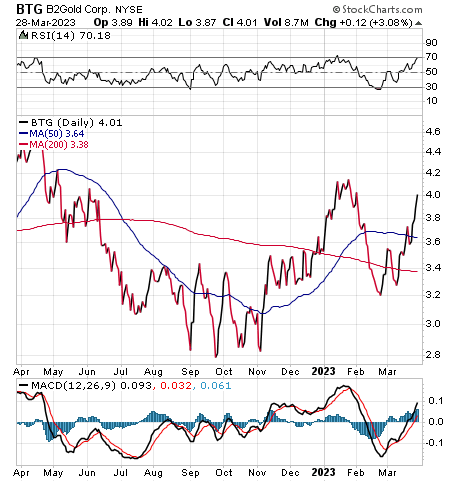

Five Gold Stocks to Purchase for Profits and Protection: B2Gold Corp

Vancouver, Canada-based B2Gold (NYSE: BTG) is another of the five gold stocks to purchase. Founded in 2007, the company is a low-cost international senior gold producer with mines in Mali, Namibia and the Philippines.

B2Gold engages in numerous exploration and development projects in countries such as Mali, Colombia, Finland and Uzbekistan. The company forecasts total consolidated gold production of between 1,000,000 and 1,080,000 ounces in 2023.

On Feb. 13, B2Gold announced plans to acquire Sabina Gold & Silver Corp. for approximately $810 million. The purchase will give B2G control of Sabina’s 100%-owned Back River Gold District in Nunavut, Canada.

The Back River Gold District consists of five mineral claims blocks along an 80-kilometer belt. The most advanced project in the district, Goose, is fully permitted, construction ready and has been de-risked with significant infrastructure currently in place, according to B2Gold’s management.

B2Gold further has strong northern construction expertise and experience to deliver the fully permitted Goose project and the financial resources to develop the significant gold resource endowment at the Back River Gold District. Company management spoke of turning the district into a large mining complex.

BofA Backs B2Gold as One of Five Gold Stocks to Purchase

BofA Global Research rates B2Gold as a “buy” and noted the stock is trading at 1.25x estimated net asset value (NAV) based on a 10-year average gold price of $1,869. North American precious metal stocks have traded between 1.0x and 3.0x NAV and between 1.0x and 2.0x more recently with a median of 1.25-1.50 times, with unhedged, growth-oriented producers in the upper end of the range.

BofA uses a 1.25x NAV multiple for BTG vs. mid-tier gold producer peers’ target multiples at 0.65x-1.75x due to its superior free cash flow generation, partly offset by low production growth.

While BofA’s gold price forecast is a key driver of its rating for B2Gold, there are risks. They include political risk from Mali, Nicaragua, the Philippines, Namibia and Colombia, mine plan estimates in excess of BTG reserves, lack of commodity diversification, mine plans that are based on outstanding permits or approvals and potential unfavorable changes in currencies.

Other key risks are unforeseen increases in input costs such as the price of oil and labor and the possibility it could lose its social license to operate at any of its mines or projects. Upside could come from gold price increases, the possibility BTG could be acquired and unexpected exploration success.

Chart courtesy of www.stockcharts.com

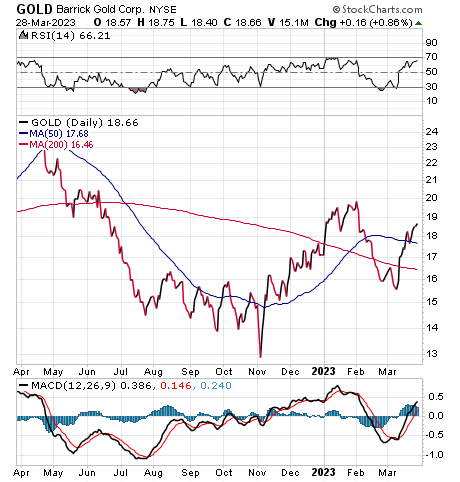

Five Gold Stocks to Purchase for Profits and Protection: Barrick Gold

Toronto-based Barrick Gold (NYSE: GOLD) is recommended as a BofA buy and received a price objective of $25.00 per share. That valuation is based on the stock trading at 1.50 times the investment firm’s estimated net asset value (NAV).

Historically, North American precious metal stocks have traded between 1 and 3 times net asset value (NAV), with unhedged, growth-oriented producers that have their assets in relatively geopolitically stable regions reaching the upper end of the range. BofA need to refrain from giving GOLD a higher valuation than it did partly due to Barrick’s stable gold output.

Risks to Barrick Gold attaining BofA’s price objective include potential commodity price weakness, any inability to secure financing for expansion or development projects, possible unforeseen operating problems and political or legal challenges in the regions in which the company operates. Further risks feature rising capital and operating costs amid increased interest rates, as well as delays in the development of the company’s growth projects.

Chart courtesy of www.stockcharts.com

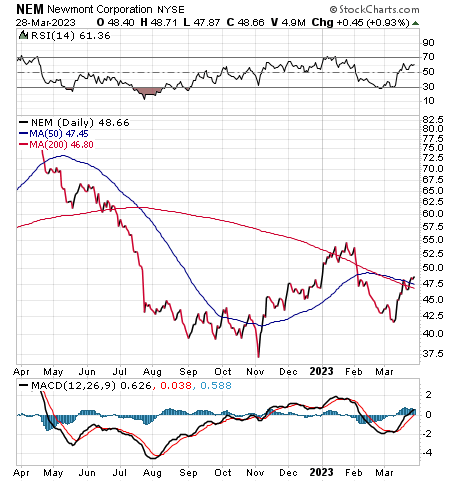

Newmont Mining Joins Five Gold Stocks to Purchase for Profits and Protection

Newmont Mining (NYSE: NEM), a profitable recommendation of the Home Run Trader advisory service led by Skousen, also is rated as a BofA “buy.” The company is a recent recommendation but already is on the rise. Skousen has recommended Newmont successfully in the past and produced a double-digit-percentage profit in its call options.

With a market cap of $38 billion, Newmont has mining operations in the United States, Australia, Peru, Indonesia, Canada, New Zealand, Ghana and Mexico. Approximately 70% of its mines are in North America and Australia, giving the company less political risk than most gold miners face.

In 2019, Newmont Mining, of Greenwood Village, Colorado, acquired Goldcorp, gaining new mines and additional assets. The company is the world’s largest gold mining operation and has more than 100 million ounces of proven and probable gold reserves. It also produces silver, copper and zinc, while running a merchant banking operation.

The stock is inexpensive by trading at just 15 times prospective earnings for the next 12 months. Skousen forecast that earnings per share will rise from $2.85 in 2022 to more than $5 in 2023. And that’s if there is no uptick in the price of gold, Skousen predicted.

With all-in costs of $1,150 per ounce, profits will grow dramatically if gold prices move higher, Skousen concluded. Investors also will be paid for their patience in holding the stock with a 3.5% dividend yield.

Chart courtesy of www.stockcharts.com

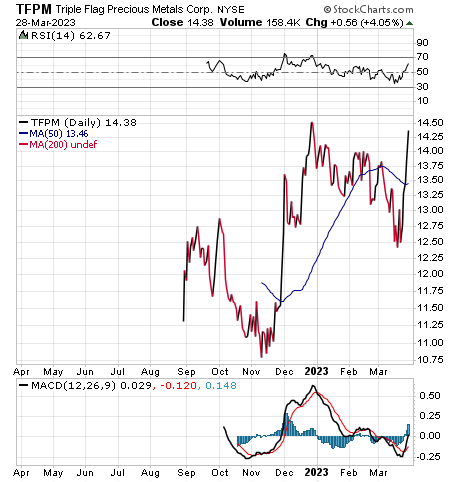

Five Gold Stocks to Purchase for Profits and Protection from Threats: Triple Flag

Triple Flag Precious Metals Corp. (NYSE: TFPM; TSX: TFPM) provides structured financing solutions that are customized to meet the needs of its mining partners. Similar to Franco-Nevada, the Toronto-based company’s role is to serve as a finance partner, facilitating development and expansion of mining projects.

The company is another BofA recommendation that focuses on cash-generating mines and construction-ready, fully permitted projects that are two years or less to producing cash flow. That aim is balanced by the company’s search for “prudent investments” across earlier stages of the mine life cycle to maintain exposure to a robust collection of development-stage assets to grow free cash flow per share over the long term, according to its management.

A high proportion of its financing deals originate from referrals by existing counterparties, as well as by the company’s network of contacts. Those leads then produce bilateral discussions with potential partners, rather than auction processes.

Risks to the price objective include a lack of input the operation of portfolio assets, competition from a growing royalty and streaming sector, precious metal price volatility, asset investments in non-investment grade emerging markets, concentrated ownership structure and possible ramp-up issues at the Gunnison and Pumpkin Hollow mines. Positive catalysts could include higher than expected gold and silver prices, future exploration discoveries and unexpected expansions at mines in the portfolio and a potential acquisition.

Chart courtesy of www.stockcharts.com

Russia Fires Cruise Missile into the Sea of Japan as a Military Test

Russia’s hawkish former President Dmitry Medvedev said on Friday, March 24, that his country’s military may send troops back to Kyiv, despite current struggles in eastern Ukraine. Medvedev, now the deputy chairman of Russia’s Security Council, has repeatedly talked about potential new offensives since the war in Ukraine started on Feb. 24, 2022. “Nothing can be ruled out” about Russia’s war effort, news reports quoted Medvedev saying.

The ominous warning was followed on Tuesday, March 28, with Russia’s Pacific Fleet firing supersonic anti-ship cruise missiles at a mock target in the Sea of Japan. The Russian Defense Ministry issued a statement that the combat exercise involved Russia firing supersonic, Moskit anti-ship cruise missiles at a “mock enemy,” and hitting the target.

News reports quoted Japan’s foreign minister saying his country would remain vigilant against Russia’s military operations. Russia’s firing of cruise missiles in the Sea of Japan came just one week after Japan’s Prime Minister Fumio Kishida visited Ukraine’s President Zelensky in Kyiv on Tuesday, March 21.

Also on March 21, China’s President Xi Jinping met with Russian President Vladimir Putin in Moscow for talks. Xi called Putin a “dear friend,” even though the International Criminal Court issued an arrest warrant for Russia’s president on Friday, March 17. The warrant accused Putin of having responsibility for war crimes in Ukraine that followed the invasion he ordered more than a year ago.

Putin committed the “war crime” of overseeing the unlawful abduction and deportation of children from Ukraine to Russia, among other offenses, the court stated in a press release. The visit by President Xi appears aimed at seeking to blame for the war in Ukraine on the United States and its allies, analysts said. Putin called the attack on Ukraine a “special military operation,” but it has grown into an extended war of 399 days as of March 29, even though Russia’s leaders reportedly predicted a quick victory.

CDC Shows Vaccinations Against New Bivalent Variant of COVID-19 Keep Rising

The U.S. Centers for Disease Control and Prevention (CDC) reported rising vaccination rates against COVID-19 and its bivalent variant. The CDC reports that 269,835,963 people, or 81.3% of the U.S. population, have received at least one dose of a COVID-19 vaccine, as of March 22. People who have completed the primary COVID-19 doses totaled 230,283,056 of the U.S. population, or 69.4%, according to the CDC. Also on March 22, the United States had given a bivalent COVID-19 booster to 51,335,207 people who are age 18 and up, equaling 19.9%. Vaccinations should help consumers shop, travel and spend money to support the economy.

The five gold stocks to purchase feature companies that can be viewed as hedges against economic weakness. All five could entice investors seeking refuge from further threats such as big bank failures, Russia’s continuing onslaught against Ukraine and potential military actions by China or North Korea in Asia.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. He is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases.