Three best sports stocks to buy let investors pursue profits from the increased popularity of sporting events in the post-COVID lockdown era.

Sporting events were some of the first activities to be sacrificed during the COVID-19 pandemic. Sports stadiums remained completely empty and tumbleweeds blew through some neighborhood basketball courts and soccer fields.

The sports industry experienced a $61.6 billion drop in revenue in the United States alone during 2020. Now that social events are reopening at a quick pace, it is critical to look at the best stocks benefiting from the rapidly growing industry.

Three Best Sports Stocks to Buy

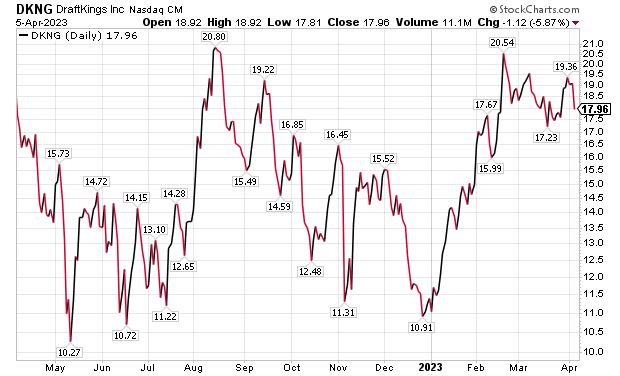

DraftKings (DKNG: NASDAQ)

DraftKings, of Boston, Massachusetts, is a digital entertainment and sports-betting company that has been the source of much excitement recently. In 2021-2022, DraftKings’ revenue increased by 98% and its stock rose 16% from March 2021 to March 2022.

DraftKings’ success can be attributed to its user retention rate and its consistent revenue gains in the betting industry. The company also has recently expanded into the online casino industry, bringing a safer and more inclusive way for people to enjoy betting without having to go to a casino or sports-betting establishment. DraftKings’ success is directly linked to the demand for sporting events and is well positioned to profit in the coming years.

Chart courtesy www.stockcharts.com

Three Best Sports Stocks to Buy

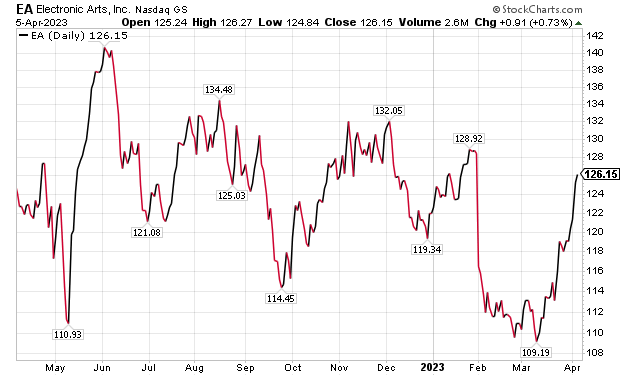

Electronic Arts (EA: NASDAQ)

Electronic Arts (EA), of Redwood City, California, is a large video game company that has produced big name sports games such as FIFA, Madden and NHL Live. EA’s key to success is the loyalty of its fanbase. Every new season of a sport like football in the NFL, or soccer in the Euroleague, EA releases a new version of its beloved game. This year-after-year consistent revenue growth has kept the company near the top of its industry for the past decade.

EA’s sports games are popular because of the lack of substitutes, putting the company in a strong position to profit from the increase in sporting events. In terms of financials, EA is also a relatively safe investment. The company has one of the most stable cash flows in the industry, with a strong current ratio of 1.23 (Current Assets/Current Liabilities).

EA’s gross revenue has increased 19% from 2021 to 2022, and has attained growing net income from operations since 2020. EA cut 6% of its workforce in late March 2023, reasoning that with the integration of better coding technology, the company could cut costs on those jobs. EA has stayed relevant in the industry and could be a strong investment for consistent returns.

Chart courtesy www.stockcharts.com

Three Best Sports Stocks to Buy

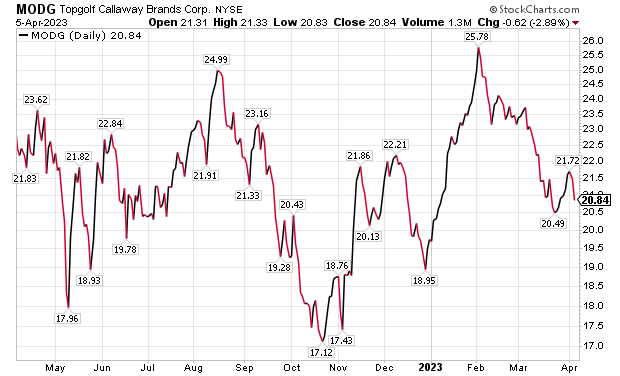

Topgolf-Callaway (MODG : NYSE)

Topgolf-Callaway, of Carlsbad, California, is a joint venture between Topgolf and Callaway Golf. Topgolf-Callaway is one of the first joint entertainment-performance golf companies in the United States. This product mix helps give amateur golfers a chance to explore the depths of the sport and allows experienced golfers to find a chance to entertain their friends with Topgolf. In addition, Topgolf-Callaway is poised to benefit from the increase in outdoor-based social events in the post-COVID era.

Topgolf-Callaway reported 2021 revenue of $148 million, an 81% increase from the previous year. Formed in a 2021 merger, Topgolf-Callaway is a new and popular name in the golf industry. If investors are looking for heightened profit potential, Topgolf-Callaway could be an answer.

Chart courtesy www.stockcharts.com

Three Best Sports Stocks to Buy

Investing in sporting companies like DraftKings, Electronic Arts and Topgolf-Callaway can be financially rewarding for investors looking to pursue profits from the growing industry in the post-COVID lockdown era.

Jordan Ellis writes for www.stockinvestor.com.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)