Nothing resolves market ills and pains more than corporate profits. The old saying of “sales fixes everything” applies to just about every kind of business, but for the stock market, a more fined-tuned saying of “earnings fixes everything” seems fitting, especially after the first-quarter rollercoaster ride of risk incurred by investors.

The bulls have made several attempts to build a sustainable uptrend, only to see them broken by a surprise hot inflation reading for January, a hawkish Fed bumping the Fed Funds rate by 75 basis points so far in 2023, a banking crisis that had the makings of being contagious and a surprise slashing of crude output by OPEC+. Last Friday’s robust employment was released with the markets closed, and it too raises the specter of more Fed tightening.

Following the release of the jobs data, MarketWatch reported that “traders of Fed funds futures priced in nearly a 70% chance of a 25-basis point rate hike by the Federal Reserve when the central bank meets in May. The probability of a hike rose to 67.4% after the data, up from 49.2% a day earlier, according to data from the CME’s FedWatch tool.

Analysts said the March jobs report would likely embolden the Fed to hike rates in May, as the labor market continued to see signs of strength last month. The U.S. economy created 236,000 jobs, just shy of the 238,000 median estimate from economists polled by the Wall Street Journal. Average hourly earnings for private-sector employees also slowed to 4.2% in the prior 12 months. Wage growth is seen by the Fed as an important inflation driver.”

Although the gains were the lowest since December 2020, it is not likely to sway the Fed from increasing rates once more. Another quarter-point hike will represent the 10th straight hike, taking Fed Funds up to 5-5.25%.

Friday’s jobs report comes after the Labor Department on last Thursday made revisions to its latest data on jobless claims, indicating Americans filed an additional 142,000 first-time unemployment claims over the past three weeks — up 24% from levels previously reported. The revisions fueled recession concerns that intensified during the week, with “every major data point” — including jobless claims, manufacturing activity and construction spending — signaling the economy is slowing down and pushing some experts to worry it may be slowing down too quickly, says Sevens Report founder Tom Essaye.

“A rising trend in claims has been a key missing part of the labor market story, but it is now clear layoffs are increasing,” Pantheon Macro chief economist Ian Shepherdson said in a Thursday note. “These data alone won’t stop the Fed from raising rates again in May, but they are a warning sign that should not be ignored.”

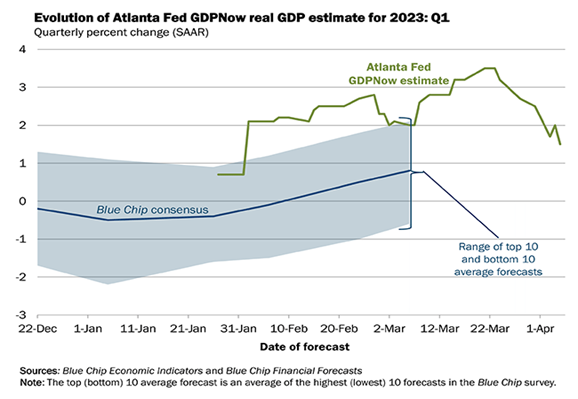

Adding to the rising noise level of recession talk is the sudden and disconcerting slide in first-quarter earnings estimates, as published by the Atlanta Fed showing a forecast of only 1.5% growth in gross domestic product (GDP) for the first quarter and down from 3.5% in only two weeks. By the time this column is distributed, the next GDPNow report from the Atlanta Fed will have been released on Monday of this week, where it too may show further weakness, especially with oil prices spiking on the recently announced production cuts by OPEC+ about to take place as of May 1.

Even with all this negatively that is broadly known, where the majority expect another rate hike and slower overall growth, the S&P 500 and the Nasdaq are trading very well considering the rapid sector rotation that has occurred these past two weeks, even in the face of plunging long-term bond yields that are typically a hard landing caution flag of sorts. The yield on the 10-yr Treasury is really coming down, looking like 3.0% is the next stop, and essentially daring the Fed to raise rates further. And yet, there isn’t one Fed official that I can find that thinks the Fed should pause until Fed Funds are at 5.00-5.25%.

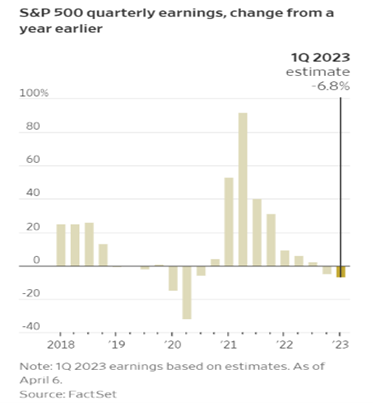

With that said, the market knows this and, in my view, is holding its ground because the tightening cycle is coming to an end, the Fed is pumping liquidity into the banking system to backstop deposits, most data points show inflation is trending lower and the job market is finally softening aside from a buoyant services sector. What the market doesn’t know is what earnings season will deliver in the way of profits and guidance. As of this week, FactSet is forecasting Q1 earnings to decline by 6.8%.

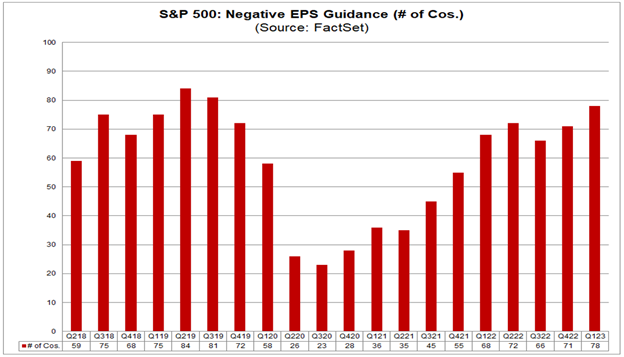

FactSet lays out the pre-announcement season, stating that as of March 24 — 106 S&P 500 companies have issued EPS guidance for the first quarter. Of these 106 companies, 78 have issued negative EPS guidance and 28 have issued positive EPS guidance. In fact, the first quarter has seen the highest number of S&P 500 companies issuing negative EPS guidance for a quarter since Q3 2019 (81). If 78 is the final number for the quarter, it will mark the fourth-highest number of companies in the S&P 500 issuing negative EPS guidance for a quarter since FactSet began tracking this metric in 2006.

So, here we are, the week of April 9, heading into the first full week of earnings season highlighted by the money center banks reporting this Friday, with the highest number of earnings warnings going back 17 years, and both the S&P and the Nasdaq are not caving in as predicted by some very smart people. Sure, some heavyweight tech stocks are holding their ground, but it stands to reason the market should be trading lower based on all the recent weaker data.

If all these bearish indicators can’t break the S&P, then maybe the hard-landing forecasters are wrong. Just maybe, the market is already in an earnings recession that will have run its course by the end of Q2 with a rebound in earnings beginning in Q3 and accelerating in Q4.

Assuming inflation is peaking and earnings are troughing, it makes for a interesting set up where the early gains of 7% for the S&P and 11% for the Nadaq not only hold, but potentially double or more from here. For whatever reason or reasons there are to talk the market lower, it sure seems from the price action of the stocks that matter most is that the least path of resistance for the market is higher.

P.S. My colleague, Jon Johnson, will be holding a free teleconference on “How We Closed 19 Winning Trades in a Row.” The event will take place on April 12 at 2 p.m. EST. The event is free to attend, but you have to register here to be able to attend. Don’t miss out!

P.P.S. Come join our Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)