Last week’s stand by the stock market to close out the month of April breathed a temporary sigh of relief, but that pop in the major average applied primarily to investors who were long in so-called FAANG stocks, “Mr. Softie”, the S&P and Nasdaq, where these equities are heavyweight components.

Aside from mega-cap tech, consumer staples put in a strong performance, as did energy. Year-to-date of the 11 market sectors, those that rose, and their gains, were: consumer discretionary (XLY), 14.83%; industrials (XLI), 2.23%; consumer staples (XLP), 4.37%; materials (XLB), 4.14%; communication services, 25.16%, real estate (XLRE), 2.94%; and technology (XLK) 21.47%. The sectors that slid and their dips were: health care (XLV), -1.43%; energy (XLE), -1.64%, broad financials (XLF), -2.54%; and utilities, -1.44%.

As for areas of real trouble, the bank sector (KBE) is down by -18.27% and the regional bank sector has been crushed by -29.11% so far this year. For most of April, the Nasdaq has led the way on the back of a few high-tech draft horses and some other individual standouts within energy, communications and staples. However, there was a much-needed positive development when the market broadened out nicely late last week. On Friday, advancers led decliners by an 8-to-3 margin at the NYSE and a nearly 2-to-1 margin at the Nasdaq. The following indices and their performances are:

- Nasdaq Composite: +16.8% YTD

- S&P 500: +8.6% YTD

- Dow Jones Industrial Average: +2.9% YTD

- S&P Midcap 400: +2.5% YTD

- Russell 2000: +0.4% YTD

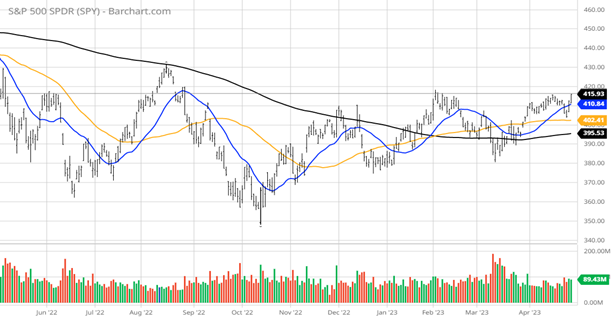

Chart Provided by Barchart.com.

Falling market rates were another supportive factor for equities last week, as the two-year note yield fell to 4.06% and the 10-yr note yield fell to 3.45%. If nascent market breadth can build on itself, then the S&P has a real shot at breaking above key overhead resistance at 4,200 that has proved to be a good place to fade rallies. The market has priced in another quarter-point hike to be announced this Wednesday, with the hope of a policy statement that hints of a pause of further rate hikes in June and July.

The data that the Fed takes into account in its monetary policy decisions definitely points to another rate hike. The March core Personal Consumption Expenditures Price Index rose 4.6% from last year, down from the revised 4.7% recorded in February, but came in higher than the analysts’ consensus forecast of 4.5%. The core index was up 0.3% on the month, the Bureau of Economic Analysis reported, matching both last month’s pace and the analysts’ forecast. A separate report from the Labor Department showed that its closely tracked employment cost index rose 1.2% over the first quarter, higher than analysts’ 1.1% forecast. Private-employer wages were up 5.1% in March, the data indicated.

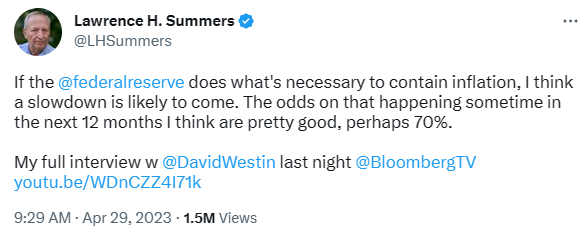

As to the topic of future rate hikes, on Sunday, Elon Musk jumped on a Twitter thread initiated by Harvard economist Larry Summers, predicting a “severe recession” if the Fed keeps raising rates. “Fed data has too much latency,” Musk commented on April 30. “Mild recession is already here.”

Musk claims to have as much real-time data on the present condition the economy as anyone with the various businesses he oversees.

Elon Musk answered questions during the Baron Funds Investment Conference last Nov. 4 in New York .

While this is one man’s opinion, Larry Summers is someone people listen to carefully, as well as Elon Musk. Both are superstars in their own spaces. Yet while Summers warns of the Fed doing more to contain inflation, Musk raises the caution flag to let the hikes in place have time to work through the economy. With that said, the economy is learning to live with 4-5% inflation. After all, the past decade was one of artificially low rates. With mortgages in the 5-7% range and lending rates above that level, the initial reaction has been negative, but the world of lending is just normalizing in my view.

The debate continues to elevate between critics of the Fed and those who believe that the current rise in prices for goods and services warrants further hikes.

The S&P Global U.S. Manufacturing PMI jumped to 50.4 in April 2023 from 49.2 in March 2023, beating forecasts of 49, and pointing to the first expansion in factory activity in six months, preliminary estimates showed. Production levels at manufacturers gained slightly in April, but at the fastest pace since May 2022 due to increased employment and a return to new order growth. New sales climbed for the first time in six months and the rate of job creation increased to its fastest pace since September 2022.

As far as prices, increases in operating expenses reached the quickest pace since last November, as selling prices rose at a sharp and historically elevated rate. Plus, optimism in the outlook for output over the coming year rose to a three-month high but was slightly below the long-run series average amid inflation worries and concerns about a shift away from goods towards services among customers, following the pandemic.

How the Fed threads its policy statement will weigh large on the near-term direction for the market as a whole. However, it is a market of stocks, and there are selective and stealth bull markets within dozens of individual stocks that are hitting new 52-week highs and all-time highs. It has been a stellar first four months for the tech sector. Now if the Fed can give its soon-to-be-11 rate hikes a chance to have their full impact on inflation, the S&P can finally break out of its range, because it certainly acts like it wants to do so.

P.S. Come join me and my Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.