Options were always popular amongst traders. But they were largely ignored by the broader public…

…that is until the COVID-19 market crash.

Stuck at home with nothing to do and having pockets flush with government cash, retail traders jumped into options, sending volume soaring.

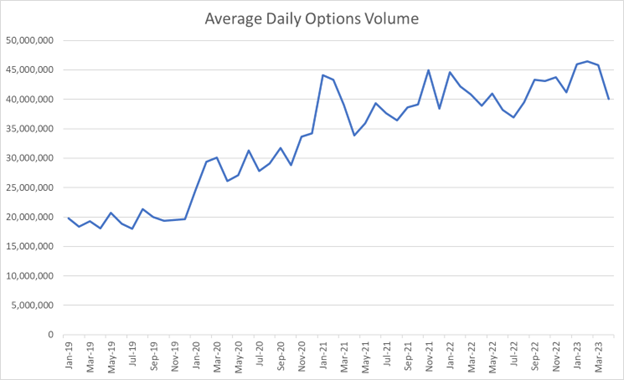

To give you an idea, we compiled the average daily options volume from the Options Clearing Corp. (OCC), the world’s largest equity derivatives clearing organization.

You can see the incredible explosion in early 2020.

This could have led to a renaissance in the stock market.

Instead, it built a bubble so dangerous we now face inflation, a banking crisis and a recession trifecta.

Worse, we saw predatory practices ooze out of one company in particular, Robinhood, the most ironically named business in the last decade.

A lot of folks lost a lot of money because THEY WEREN’T PREPARED.

Incredible gains are possible with options, but only if you know HOW to wield them.

That’s why we’re willing to put up Bryan Perry, our options expert, against any of the garbage pumped by “friendly” brokers.

Bryan’s wealth of experience is built from the knowledge he acquired as a financial advisor to Wall Street firms.

He knows EXACTLY the tricks and traps they lay for investors, and how not just to avoid them but EXPLOIT them.

That’s why we’re excited to share his latest project: The Eight-Month Millionaire.

This is more than just a plan to turn $5,000 into over $1 million…

It’s a chance to fill in the gaps companies like Robinhood so recklessly abandoned.

Because when used correctly, options have the potential to REDUCE YOUR RISK and enhance your overall return.

CLICK HERE, and you’ll understand why.

Where Robinhood Failed

Billed as the retail-friendly disrupter, the company obliterated trading commissions in favor of payment for order flow, a sleight-of-hand trick that barely benefited retail investors and left other brokers scrambling for a new source of income.

Robinhood proved itself to be the true shyster it was, pumping irresponsible levels of trading without concurrent education.

In one tragic instance, a young man took his own life after he saw a balance of -$730,000.

Worst of all, he may have misunderstood the readout.

So, it might sound a bit jarring to hear us say that EVERYONE should consider options trading.

Aren’t we being irresponsible?

Actually, no. There’s a big difference between us and Robinhood.

Robinhood pushed customers to take outsized bets with little or no understanding of how they worked.

Customers could sign up and start trading options products within minutes, whether they understood the dangers or not.

All Robinhood cared about was getting folks to trade more so they could collect more commissions on one end and payment for order flow on the other.

We want to make something abundantly clear.

Options are leveraged products with a specific expiration date.

When you buy an option, the maximum amount you could lose is the amount you pay for the option.

Selling options is a whole different ballgame.

Do you know why brokers require a margin account for options selling?

Because, in some cases, your theoretical losses could be infinite.

We’re not saying this to scare you, but we will not shield you from reality.

Robinhood pushed folks to get into trading with margins and leverage with little to no education whatsoever.

That’s why so many were caught flatfooted when the company changed the margin requirements for GameStop (GME) overnight, forcing many traders to exit at a loss before they even woke up the next day.

Rather than take responsibility, Robinhood executives pointed to regulatory requirements from the clearing firms.

It wasn’t much of a surprise that this triggered bipartisan anger from politicians such as Ted Cruz and Elizabeth Warren.

They may not agree on much, but when corporate greed steps on the little guy in such a blatant fashion, it’s hard to sweep it under the rug.

The irony is that the original intent for options was to provide a tool that hedges risk rather than expands it.

Most large institutions use options to offset holdings in their portfolios.

For example, a fund with a bunch of stock holdings may buy put options on the S&P 500 to reduce market risk, leaving the fund with a more pure performance from the managers’ stock selections.

Others use it for speculation but size their positions accordingly.

And then there are folks that combine instruments to create option spreads and other strategies that expand their profit potential.

The point is that options aren’t dangerous when you:

- Understand how they work.

- Appreciate the risks.

- Use them responsibly.

However, most retail traders fall for the tricks from Robinhood and other companies, pushing them into positions they don’t understand, all for the chance to hit the big score.

Following them is like listening to Jim Cramer — you’re more likely to lose your shirt than pick up even a single penny.

So we offer you two choices: Take your chances with these broker recommendations from kids barely out of their diapers…

… or CLICK HERE to listen to someone who’s got the experience and track record to help you generate some real wealth.

IMPORTANT ANNOUNCEMENT: We are having our Eagle Virtual Trading Event on Tuesday, May 16. If you haven’t signed up for this yet, there’s still time. Just click here now to sign up for free. You won’t want to miss this online event — as we bring together all of Eagle’s investment experts at the same time to reveal the Second Half Outlook: 7 Ways to Beat the Market. Reserve your seat now by clicking here.