“Whenever the law has attempted to regulate the wages of workmen, it has always been rather to lower them than to raise them.” — Adam Smith, “The Wealth of Nations” (1776)

Last week in my economics class at Chapman University, I ended my lecture with this promise: “If you want to become wealthy, let me give you one piece of advice you will never forget.”

I will give the answer at the end of this edition of Skousen CAFÉ.

Here’s the background:

The American dream is full of contradictions — to live long, and to die young. We honor celebrities like Elvis Presley, Marilyn Monroe and Janis Joplin.

Another example: We vilify billionaires and demand they pay more in taxes, but we all want to become one.

It’s popular today for social democrats to demand that we soak the rich and subsidize the poor. They advocate progressive income taxes as high as 90%,and want to raise the minimum wage to $15 (now $20).

Is this good policy?

The best way to find out is with a good debate, so we can hear both sides of the issue and then decide. As Ben Franklin said, “By the collision of different sentiments, sparks of truth strike out, and political light is obtained.”

Last week, I invited Rick Wartzman, former business editor of the LA Times and director of the Drucker Institute at Claremont, to address my students at Chapman University on Walmart, the country’s largest retail store and largest employer (with 1.5 million “associates”).

Wartzman is the author of “Still Broke: Walmart’s Remarkable Transformation and the Limits of Socially Conscious Capitalism.” I read the book and listened to the audiobook before having him speak. He is a major critic of Walmart and capitalism, and I wanted my students to hear the other side of the argument and to engage in critical thinking.

Wartzman is a well-known expert on Walmart. He has shown how Walmart has made remarkable progress in many areas, but also complains that it still focuses more on helping customers (“always low prices”) and shareholders (its stock has outperformed due to the aid of rising dividends and stock buybacks), rather than paying its workers a “living wage.”

He noted that a large number of Walmart employees are paid so little that they have to depend on welfare (food stamps and Medicaid) to survive. He has a point. It’s a sad commentary when the country’s largest retailer is subsidized by taxpayers and pays less than a living wage to many of its workers.

$20 Minimum Wage?

At the end of his provocative and fascinating book, Wartzman is pessimistic. Despite all the advances by Walmart, it’s not enough. Therefore, he advocates forcing Walmart and other retailers to pay higher wages by having Congress impose a sharply higher federal minimum wage and allowing greater union collective bargaining power. He thinks a $15 an hour minimum wage is too little; he advocates $20 an hour.

We had a robust debate on these issues — I challenged him with 11 potential “unintended consequences” of a $20 minimum wage law, including layoffs and marginal businesses going under. He admitted that both are likely to happen, but felt that the benefits far outweigh the costs.

Walmart’s Biggest Challenge: How Can You Raise Wages When Its Profit Margins are Less than 2%?

I offered a different solution. As I see it, the biggest hurdle to higher wages at Walmart is its razor-thin profit margins (1.6% over the past few years). Retailers like Costco, Target, Amazon and grocery stores in general, all face the same problem — low profit margins. Amazon is actually losing money.

Meanwhile, mature technology companies like Microsoft, Apple and Facebook are much more profitable, with profit margins of 33%, 25% and 19% respectively. Financial institutions like Bank of America have profit margins of 30% or more. Not surprisingly, they pay their workers more and can afford higher minimum wages.

Increasing Profits Will Lead to Better Pay

My solution to helping the working poor is to make companies more profitable, and they will pay their workers more through wage increases and profit-sharing. How can they increase their profits? Through corporate tax cuts, getting rid of unnecessary regulations and encouraging capital investment and entrepreneurial productivity.

I love telling students the Ford $5 a day story, where Henry Ford more than doubled workers’ wages overnight in January 1914. Why? Because he made record profits the year before and could afford to pay his workers more.

Henry Ford’s decision to share the wealth was revolutionary. He countered the Marxist argument that capitalists never shared their profits; they only exploited their workers. Not anymore.

I call it “democratic capitalism.” It is practiced today for thousands of enlightened companies. Microsoft, Home Depot and other companies offer stock options and profit-sharing to their employees. In fact, Microsoft has made over 12,000 ordinary workers into multi-millionaires.

This is supply-side economics at its best.

Unfortunately, Walmart made the fateful decision to discontinue Sam Walton’s profit-sharing plan. What a pity.

Wartzman does favor profit-sharing, increased labor productivity and training, but he is also convinced that higher wages must come first, and that will make workers more productive and better employees — and eventually will increase company profits. He is aware that raising wages also means increasing the salaries of all employees, not just the lowest earners. He feels his $20 mandate will be a win-win for everyone, but it’s a risky strategy when profit margins are thin.

My students now know both sides, and they can make up their own minds.

Hearing Both Sides

Rick has some nice things to say about my teaching approach. During class he said:

“I just want to begin by thanking Mark for having me. We didn’t know each other. He had seen my book, and he reached out to me. I live up in LA, and we had lunch. He challenged me on some of my positions in the book, and I think rightfully. He’s somebody who says that we gotta get away from political labels and he is totally right. We’re all here to find solutions. But it is fair to say, we don’t see eye-to-eye on everything. But I think what we have found is that we can have a really good conversation and push each other, and push each other’s thinking. I’ve learned a lot from listening to Mark, and I hope, vice versa, that we learn from each other. We can find common ground where we can. I think you all are really lucky honestly to have a professor who is not only willing, but interested in having people come into this classroom that aren’t in the same bubble. That’s a really cool thing. And so, I think we need a lot more of that generally. So it’s a real pleasure to be here.”

Unforgettable Advice to My Students

The next day, I gave my students this advice: “If you don’t remember anything else in this economics class, remember this: the key to getting a raise and becoming a millionaire is to work for a company with high profit margins who also offers stock options and profit-sharing. It works every time.”

New Speakers at FreedomFest

If you are as concerned as I am about the direction this country is headed, politically, economically and culturally, I urge you to join in at this year’s FreedomFest in Memphis, July 12-15. Below is our latest update on speakers.

It includes a full three-day investment conference, with such financial gurus as Alexander Green (Oxford Club), Louis Navellier and David Bahnsen. Plus, there will be a special interview with Jeremy Siegel, the “Wizard of Wharton,” and Burt Malkiel (Princeton). Our financial editors at Eagle Publishing will all be at FreedomFest — Jim Woods, Bryan Perry, George Gilder, Roger Michalski and Paul Dykewicz as part of our three-day investment conference. Stop by our booth!

Get $77 Off the Registration Fee

Special Discount Code for Subscribers: I’ve arranged a special code to get $77 off the registration fee at FreedomFest. Use the code EAGLE77 when you register at www.freedomfest.com. Or call Hayley at 1-855-850-3733, ext. 201.

Are you feeling the pinch of rising prices? Don’t let inflation eat away at your savings — join us in Memphis July 12-15 for a game-changing financial conference focused on inflation strategies!

The expert speakers at FreedomFest’s Global Financial Summit will share their insights and strategies to help you protect your wealth and stay ahead of inflation. From investing in alternative assets to hedging against currency fluctuations, you’ll learn everything you need to know to weather the storm of inflation.

Financial experts including Mark Moss, Preity Üpala, George Gilder, Bryan Caplan, Barbara Kolm, Art Carden and Ed Lyon will provide valuable insights into the latest trends and strategies, so you can stay ahead of the curve and achieve your financial goals.

You can’t afford to miss the sessions we have planned for you, including:

The Global Financial Summit will bring you amazing financial experts and gurus who will guide you onto the road to financial independence and strength, teaching you what to do now to protect yourself from inflation, economic crisis, stock market downturns and so much more.

Don’t let inflation erode your wealth — register now to secure your spot at this must-attend financial event. Save $100 on your ticket when you register in advance!

IMPORTANT ANNOUNCEMENT: We are having our Eagle Virtual Trading Event on Tuesday, May 16. If you haven’t signed up for this yet, there’s still time. Just click here now to sign up for free. Believe me, you won’t want to miss this online event — as we bring together all of Eagle’s investment experts at the same time to reveal the Second Half Outlook: 7 Ways to Beat the Market. Reserve your seat now by clicking here.

P.S. Come join me and my Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.

In liberty, AEIOU,

![]()

You Blew It!

The Fed Disaster Plan: Too Tight, Too Fast, Too Much

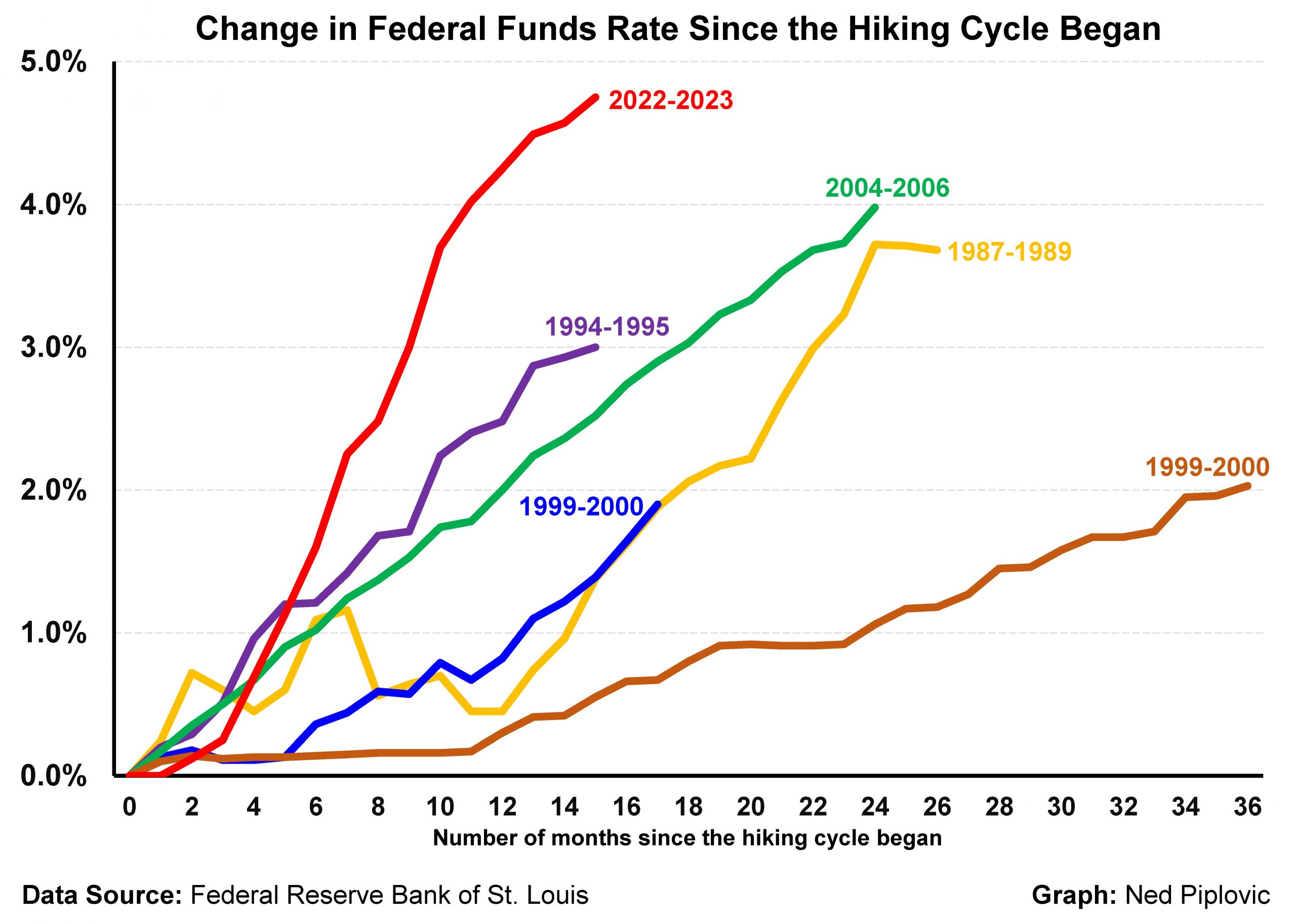

The Federal Reserve is famous for overdoing it on both sides. It engages in “easy money” policies for far too long and then pushes interest rates too high when it decides to “fight inflation.”

This cycle is no different. From 2009 until 2022, the Fed kept interest rates near zero, creating an artificial boom in stocks, real estate and the economy.

Then, when inflation raised its ugly head after the 2020-21 COVID-19 panic, Chairman Jay Powell and the Fed governors reversed course, imposing a tight money policy that has gone too far too fast.

In the past year, the Fed has raised its fed funds rates 10 times, faster than any other period since 1980. The quantity of money is also declining for the first time in decades. As a result, we are witnessing a bear market on Wall Street, a potential recession and a banking crisis that won’t go away.

But Jay Powell’s attitude is, “What, me worry?”

What’s scary is that Chairman Powell suggested during his press conference that the increases may not be over. He said that support for another increase was “very strong across the board.”

The Fed has definitely not pivoted, even in the face of a growing banking crisis. The Fed fears that reversing its tight money policy may be a sign that the monetary crisis is worse than expected.

Gold has held up well during this series of rate increases. I’m also recommending money market funds for the first time in ages. The interest yield on the Schwab money market fund is now 5%.

As Robert Prechter says, “There’s nothing wrong with cash. It gives you time to think.” (See “Maxims of Wall Street,” p. 71. Available at www.skousenbooks.com).