Five software as a service stocks to buy offer investors a chance to ride a rebound in technology amid market volatility.

The five software as a service (SaaS) stocks to buy feature companies engaged in automated accounting and investment analytics, a manufacturer of security products, a provider of payroll and human capital management (HCM) software solutions, a developer of plug-in processes, reporting and job-specific workflows for enterprise customers and an artificial intelligence (AI) marketing cloud. The five software as a service stocks to buy generally have been rising so far this year.

Investors who are reluctant to take the plunge by purchasing individual stocks may prefer a fund, said Bob Carlson, a pension fund chairman who heads the Retirement Watch investment newsletter. One such fund to consider would be Invesco Dynamic Software (PSJ), intended to track the Dynamic Software Intellidex Index that consists of approximately 30 companies that are mainly engaged in businesses related to software applications, systems and information-based services.

Bob Carlson, head of Retirement Watch, meets with Paul Dykewicz.

The index is updated quarterly using factors such as price momentum, earnings momentum, quality, management action and value. The fund’s turnover ratio is more than 200%.

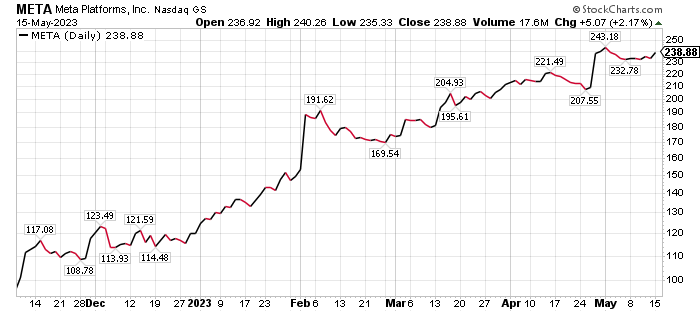

Meta Platforms Inc. (NASDAQ: META), formerly named Facebook, Inc., is a multinational technology conglomerate based in Menlo Park, California. As the owner of Facebook, Instagram and WhatsApp, Meta is one of the biggest information technology companies in the United States.

Seasoned stock picker Jim Woods, who heads the Bullseye Stock Trader advisory service that recommends both stocks and options, recommended META to his clients on March 16, then advised taking profits on April 27. The stock soared 19.77%, while the call options he recommended zoomed 112.42%.

In a volatile market, the profit-taking proved prescient as the stock slid after Woods advised his Bullseye Stock Trader clientele to cash out.

Jim Woods heads Bullseye Stock Trader.

Clearwater Analytics Ranks as One of the Five Software as a Service Stocks to Buy

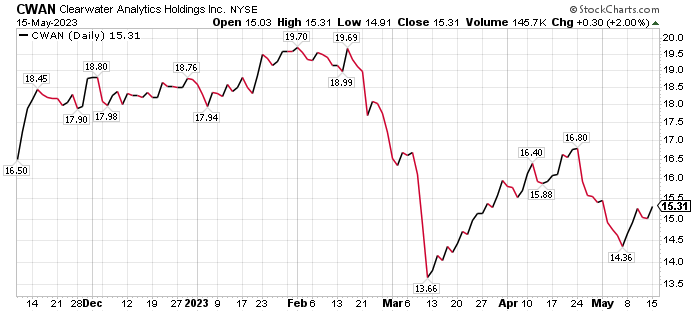

Chicago-based investment firm William Blair resumed coverage of Boise, Idaho-based Clearwater Analytics Holdings, Inc. (NYSE: CWAN), with an “Outperform” rating early this month following the SaaS company’s first-quarter results that beat consensus expectations and led its management to raise full-year guidance slightly at the midpoint. The brightening outlook reflects broadened resiliency and the high value nature of supporting enhanced investment compliance and risk management visibility and analysis, William Blair equity research analyst Dylan Becker wrote. Plus, Clearwater Analytics features a balanced mix of growth and profitability, while offering a “durable runway” for continued growth and margin expansion, Becker continued.

Clearwater Analytics’ SaaS platform for automated accounting and investment analytics provides comprehensive compliance, reporting, reconciliation and analytics capabilities across equities, fixed income and other asset classes, according to William Blair. The company currently supports 1,000-plus customers collectively managing more than $6.4 trillion of assets across its platform, providing a unified data set of verified and reconciled reporting data, standardized reporting and analysis framework for asset managers.

In the next several years, demand should grow as asset managers look to modernize their front- and back-end infrastructure and reporting capabilities. Clearwater Analytics has also recently transitioned its pricing to a base-plus revenue model to mitigate potential assets under management (AUM) volatility across its customer base, Becker noted. It should help provide greater durability and visibility in light of recent market volatility across nearly every asset class, while providing incremental pricing leverage as AUM’s stabilize and recover over time, he added.

“We believe the company maintains a widening competitive advantage in a large and growing market opportunity that collectively accounts for more than $10 billion, as a leading back-office accounting tool across asset managers, insurance carriers, and corporations, while leveraging the company’s historical depth and expertise to deliver incremental platform expansion and product innovation,” Becker wrote. “This is most evident in the company’s recent acquisition of JUMP technologies, a France-based front-to-back investment management offering to highlight the company’s efforts to drive greater penetration across asset management teams, while unlocking greater operational efficiency and revenue-generating capabilities for end-customers.”

NAPCO Security Picked as One of the Five Software as a Service Stocks to Buy

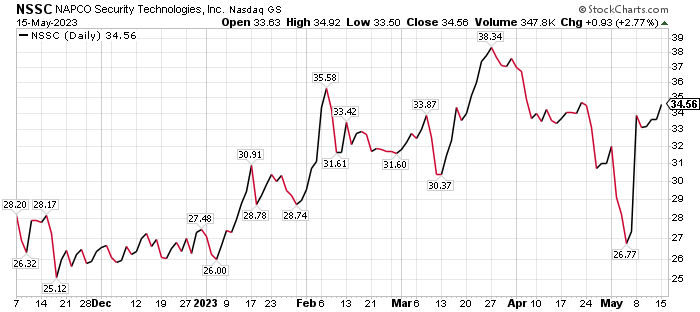

Napco Security Technologies (NASDAQ: NSSC) is an Amityville, New York-based manufacturer of security products, featuring advanced technologies for intrusion, fire, video, wireless, access control and door-locking systems. Its products are sold and installed by tens of thousands of security professionals worldwide to serve commercial, industrial, institutional, residential and government applications.

The company has a heritage of developing innovative technology and reliable security solutions for the professional security community, including StarLink Universal Wireless Intrusion & Commercial Fire Communicators and new StarLink Connect Radios with Universal Full Up/Download for major brands. Napco Security also offers Gemini Security & Fire Systems and the NAPCO Commercial Platform of 24V Addressable/Conventional/Wireless Systems and Firewolf Fire Panels & Devices.

“When the Federal Reserve stops ratcheting up interest rates, I would expect strong growth stories to continue to profit,” said Michell Connell, who heads the Dallas-based Portia Capital Management. The company’s five-year revenue growth has been 10.45% per year and its five-year earnings growth rate has averaged 28% or more every year, Connell continued.

“EPS growth rate is expected to increase exponentially more than 100% this year,” Connell commented. “That’s well ahead of the industry average expected growth rate of 22%.”

The company is a “strong cash generator,” Connell concluded.

Michelle Connell heads Portia Capital Management.

During the past three to five years, Napco Security’s annualized growth rate has topped 20%. The industry average has only been about 5 to 6%, Connell told me.

The Company initiated a dividend when it reported on May 8. While the dividend yield is less than 1%, it’s a start, Connell counseled.

The company’s outlook appears “strong,” Connell opined. Since the beginning of 2023, earnings expectations for the company have climbed.

“While the stock is up over 20% YTD, it could return another 20-25% over the next 12-18 months, Connell conveyed. “However, given its high-octane performance, it can also provide swift downdrafts. The stock has declined more than 60% at certain points. In addition, there is a high short interest of 14%. Makes me cautious in the near-term.”

To avoid overpaying before a potential short-term dip, consider dollar-cost averaging by purchasing shares amid pullbacks, Connell counseled.

Chart courtesy of www.stockcharts.com

Paylocity Holding Earns Place Among Five Software as a Service Stocks to Buy

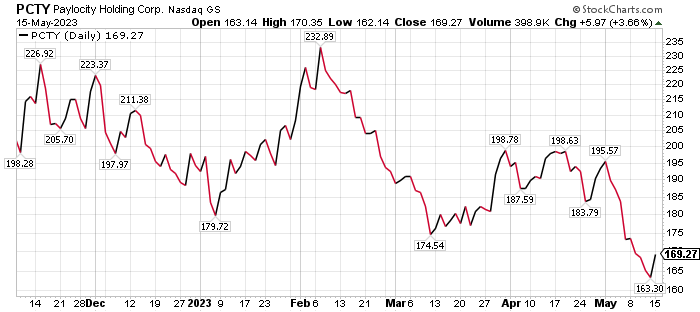

Paylocity (NASDAQ: PCTY) is a provider of payroll and human capital management (HCM) software solutions. The company’s comprehensive product suite is aimed at delivering a unified platform for professionals to make strategic decisions in the areas of benefits, core HR, payroll, talent and workforce management, while cultivating a modern workplace and improving employee engagement.

Paylocity’s fiscal third-quarter results came in ahead of expectations, with revenue increasing 38%, 2% ahead of consensus, and adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) increasing 52% — 6% ahead of consensus, wrote William Blair equity research analyst Matthew Pfau. The outperformance was driven by strong operational results, float income and efficiencies from scale on the profitability side, Pfau continued.

“The demand environment remains strong, and the employment base remains stable, according to management,” Pfau wrote. “The company increased its fiscal 2023 guidance, and now expects revenue growth of 37% at midpoint, versus prior guidance of 36% at midpoint, and adjusted EBITDA growth of 55% at midpoint, versus prior guidance of 52% at midpoint. Unless we see a significant macro shift, we believe that there is room for Paylocity to come in ahead of its fiscal 2023 guidance on both revenue and adjusted EBITDA.”

Founded in 1997 and headquartered in Schaumburg, Illinois, Paylocity has consistently been recognized nationally for its innovation, culture, and growth. Most recently, Paylocity was recognized as a top HR performer on the Workforce 100 and ranked #27 on Crain’s Fast 50 list of rapidly-growing Chicago-area companies.

Chart courtesy of www.stockcharts.com

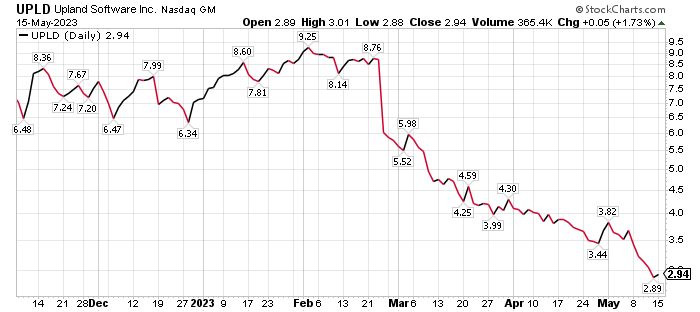

Five Software as a Service Stocks to Buy Include Upland Software

Upland Software, Inc. (Nasdaq: UPLD), an Austin, Texas-based provider of cloud-based tools for digital transformation, delivers the “last mile” plug-in processes, reporting and job specific workflows that some major cloud platforms and homegrown systems do not provide. The company focuses on addressing specific business challenges to support its roughly 1,800 enterprise customers.

Upland reported first-quarter results that were in line with consensus estimates on most key metrics. Highlights from the first quarter of 2023 consisted of free cash flow of $16 million, which beat consensus estimates for $9 million, and customer expansions to reflect 19% growth, wrote William Blair equity research analyst Jake Roberge. Revenue was flat on a year-over-year basis when adjusting for FX headwinds, beating Street estimates for a decline of 2%. While it is still early days for the transition, the company is beginning to execute on its new growth strategy.

Chart courtesy of www.stockcharts.com

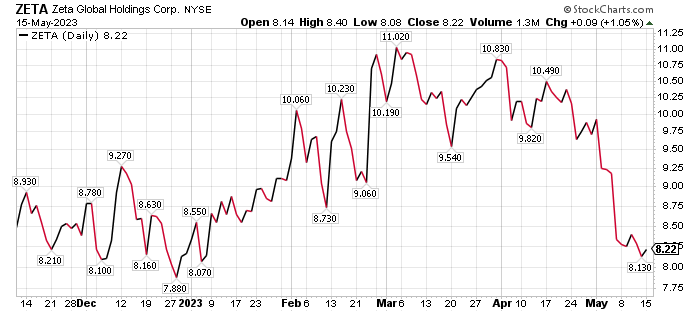

Five Software as a Service Stocks to Buy Feature Zeta Global

New York-based Zeta Global (NYSE: ZETA) uses advanced AI and trillions of consumer signals to help marketers to acquire, grow and retain customers more efficiently. The Zeta Marketing Platform (ZMP) is intended to unify identity, intelligence and omnichannel activation powered by one of the industry’s largest proprietary databases. Founded in 2007 by David A. Steinberg and John Sculley, Zeta Global serves enterprise customers to personalize experiences at an individual level to produce better results for marketing programs.

Zeta Global’s first-quarter 2023 highlights featured a 25% jump in total revenue to reach $158 million compared to the same quarter a year ago. Its “Scaled Customer count” rose to 411 in 1Q 2023 from 403 in 4Q 2022 and 359 in 1Q 2022. The company’s “Super-Scaled Customer” count increased to 110 in Q1 2023, rising from 103 in 4Q 2022 and 99 in 1Q 2022.

The average revenue per user (ARPU) in the Scaled Customer category during Q1 2023 climbed 10% to $374,000 compared to the same quarter a year ago. ARPU in the Super-Scaled Customer category leaped 18% in Q1 2023 to $1.16 million compared to Q1 2022.

A Generally Accepted Accounting Principle (GAAP) net loss of $57 million, or 36% of revenue, stemmed mainly from $64 million of stock-based compensation, improving for a net loss in 1Q’22 of $72 million, or 57% of revenue. Progress also occurred in Q1 2023 GAAP loss per share of $0.38, compared to a loss per share of $0.54 in 1Q 2022.

Cash flow from operating activities of $20.1 million in Q1 2023 slipped compared to $21.2 million in 1Q 2022. Free cash flow of $10 million in Q1 2023 grew from $9.7 million in 1Q 2022. Meanwhile, the company repurchased $6.5 million worth of shares.

William Blair Investment Firm Retains ‘Outperform’ Rating on Zeta

William Blair equity research analyst Arjun Bhatia wrote a recent research note that indicated Zeta’s first-quarter results “outperformed Street expectations” for both growth and profitability.

The company raised its guidance for the second quarter to 18% revenue growth, while the Street was looking for 17%, with a 15.1% earnings before interest, taxes, depreciation and amortization (EBITDA) margin. Management boosted its full-year revenue guidance to $701 million, projecting 19% growth, up $10 million from previous estimates.

EBITDA guidance for the year came in about $2 million ahead of consensus, or 10 basis points of margin, indicating about 150 basis points of margin expansion, Bhatia wrote. The company highlighted that its all-in-one, AI-native marketing platform is resonating especially well with large enterprise leaders who are looking to increase efficiency in a difficult macro environment, he added.

“Zeta continues to be one of the few software companies delivering consistent outperformance in spite of a challenging macro backdrop,” Bhatia wrote. “Overall, this was a solid quarter of execution for Zeta as the company continues to make steady progress toward its 2025 targets of $1 billion in revenue with 20% EBITDA margin. We are maintaining our Outperform rating.”

Chart courtesy of www.stockcharts.com

Analysis of Debt Ceiling Problem

The US failing to raise the debt ceiling and defaulting on its financial obligations would be the “ultimate gift” for China, affirms the CEO and founder of deVere Group, one of the world’s largest independent financial advisory, asset management and fintech organizations.

Nigel Green’s comments come as President Joe Biden, House Speaker Kevin McCarthy and other congressional leaders are planning to meet Tuesday to discuss budget negotiations to avoid what could be an unprecedented default that would rock the global financial system.

Biden has been reluctant to give details about terms of the negotiation but said at the weekend that he believed a deal could be reached.

The standoff is down to Democrats demanding a “clean” increase without conditions to pay debts resulting from spending and tax cuts approved by Congress. Meanwhile, Republicans are saying they will not authorize any additional borrowing without an agreement to cut spending.

According to the Treasury, the U.S. may default as soon as June 1, causing a global economic catastrophe, if the limit is not raised by Congress before then.

The deVere Group CEO says: “A default would upend the global financial system and would likely be worse than the 2008 crash.

“It would cause upheaval on an unprecedented level. However, there would be a major beneficiary of the economic and financial fallout: China.”

He continues: “The US failing to raise the debt ceiling and defaulting on its financial obligations would be the ultimate gift for China as it seeks global economic and financial dominance.

“A default would lead to a decline in the value of the US dollar and a loss of confidence in the US financial system. As such, investors would seek alternative destinations for their capital.

“China would move to position itself as a more stable and attractive investment option, attracting more international investment and capital inflows. In turn, this would boost the Chinese economy and financial markets.”

CDC Reports Rising Vaccinations Against New Bivalent Variant of COVID-19

The COVID-19 pandemic’s public health emergency status in the U.S. expired on May 11, 2023, and the World Health Organization earlier this month declared an end to what it began on January 30, 2020, to call the COVID-19 public health emergency of international concern. But the virus is still killing Americas each week and remains a public health threat. Even though death rates are dropping, Dr. Robert Anderson, the chief of the mortality statistics branch at the National Center for Health Statistics, said that COVID-19 deaths could top 100,000 in 2023.

The U.S. Centers for Disease Control and Prevention (CDC) reported at least one vaccination against COVID-19 and its bivalent variant has been given to 270,227,181 people, or 81.4%, of the U.S. population, as of May 10. Those who have completed the primary COVID-19 doses totaled 230,637,348 of the U.S. population, or 69.5%, according to the agency.

Also as of May 10, the United States had given a bivalent COVID-19 booster to 52,996,306 people who are age 18 and up, equaling 20.5% of America’s population. Medical studies have shown COVID-19 vaccinations help keep people healthy and reduce the morbidity from contracting the virus, potentially lifting confidence of consumers to encourage them to shop at stores, travel and otherwise spend money.

Russia’s War in Ukraine Remains a Fierce Firefight

Still posing a huge threat is Russia’s ongoing war in Ukraine. The latest news from the war zone indicates Russian soldiers and its Wagner mercenary group are continuing to battle in and around the Ukrainian city of Bakhmut as part of President Vladimir Putin’s reported plan to gain control and then advance to other cities in Ukraine’s industrial eastern region. However, some Russian soldiers reportedly fled their positions and lost valuable ground to Ukrainian forces, said Yevgeny Prigozhin, the private militia’s leader.

Despite Ukrainian President Volodymyr Zelensky talking publicly of delaying Ukraine’s expected spring counteroffensive, Prigozhin said it has begun and is proving to be “partially successful.” Nonetheless, Russia fired cruise missiles at the Ukrainian capital of Kyiv on Tuesday, May 9, as some of its troops participated in a parade across Moscow’s Red Square for the country’s annual celebration of victory in World War II.

The software as a service stocks to buy seem poised to climb, despite economic uncertainty and ongoing political risk due amid Russia’s continuing invasion in Ukraine.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal omf Commerce, Crain Communications, Seeking Alpha, Guru Focus and other publications and websites. Paul can be followed on Twitter @PaulDykewicz, and is the editor and a columnist at StockInvestor.com and DividendInvestor.com. He also serves as editorial director of Eagle Financial Publications in Washington, D.C. In that role, he edits monthly investment newsletters, time-sensitive trading alerts, free weekly e-letters and other reports. Previously, Paul served as business editor and a columnist at Baltimore’s Daily Record newspaper and as a reporter at the Baltimore Business Journal. Plus, Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many other sports figures. To buy signed and specially dedicated copies, call 202-677-4457.