Wall Street should be filled with the brightest minds. After all, they get paid top dollar for their work.

Yet, with all their proprietary technology, access to information and other assumed edges, more than 80% of hedge funds underperform the market, on average, each year.

We’re talking about an industry built with the aid of PhDs, JDs and fluff acronyms incubated at Ivy League schools. Mix that with trillions of dollars, and you still can’t defeat buy-and-hold.

Can you imagine overpaying your surgeon to underperform what a guy in his underpants could do in 20 minutes?

We think not.

And it’s why we never got behind the old axiom: Big Money = Smart Money

In fact, well-placed contrarian bets often pay substantially more in the long run.

One of those times could be RIGHT NOW.

You see, there’s one time-tested indicator that often tells us when markets are too complacent.

Funny enough, most folks know about this index. Yet, they only ever pay attention when it’s too late.

That’s EXCELLENT news for those of us savvy enough to get ahead of this trend.

You see, this simple indicator tells us how much protection large institutions carry against their portfolios.

And right now, it’s at its lowest level in nearly two years.

The last time it flashed this warning was in the late summer of 2021. Folks who spotted this signal were able to cash in on the coming crash.

So, what’s this magic eight ball that forecasts market gyrations so well…

… And more importantly, how do we take FULL ADVANTAGE of this opportunity?

The answers are close at hand and much simpler than you might think.

Here’s a thought experiment to help set the stage.

Imagine there were two portfolio managers: Careful Carl and Reckless Randy.

Careful Carl always ensures that he hedges his portfolio in case the market drops. Sure, it means that he misses out on some profits when the market rises. But it lets him sleep better at night. Carl owns 95% stocks and 5% hedges against those stocks.

Reckless Randy is all about money here and now. He wants to make as much money as possible, as quickly as possible, never worrying about a market crash. Randy owns 95% stocks and 5% cash, so he can buy more stocks.

One week from now, the market crashes. How do you think each one reacts?

Carl wouldn’t be all that worried. He has planned for this.

Randy would scramble to buy protection, along with every other greedy nut, driving up the prices for that protection.

Wouldn’t it be helpful to know when dummies like Randy don’t own enough protection?

Enter The Chicago Board Options Exchange Volatility Index, lovingly referred to as The VIX.

The VIX measures options demand on the S&P 500 index.

Portfolio managers often own lots of different stocks. Rather than bet against any individual stock, they buy put options — leveraged bearish bets — against the broader index.

This is what’s known as reducing “market risk.”

That way, when the market drops, the put options increase in value, offsetting declines in the stock holdings.

So, when the VIX is very low, it means investors, typically big money managers, don’t own a lot of protection, nor are they asking for it.

When the VIX is high, those same folks are clamoring to get their hands on protection.

This creates one of the tightest inverse correlations between any two assets. Essentially, the VIX and the S&P 500 move in opposite directions almost 100% of the time.

And when one bottoms out, the other often climbs, and vice versa.

Check it out.

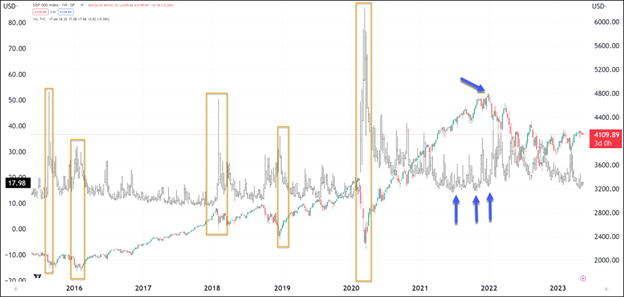

This chart plots the S&P 500 as red and green candlesticks and the VIX as black bars.

The orange squares encompass areas where the VIX reached extreme highs while the market hit extreme lows.

Further to the right, you’ll see the blue arrows. The lower ones point to the bottom of the VIX several months before the S&P 500 topped out.

That’s the secret most people don’t realize.

While the VIX and S&P 500 often snap back hard during a market crash, we typically see the VIX bottom out several months before a potential market crash.

By no means is it a guarantee of things to come.

It’s more like warm ocean water that creates hurricanes. By itself, it’s not much. But under the right conditions and at certain times of the year, it increases the odds of a severe event exponentially.

So, we know that the conditions are perfect for a potential market collapse. And pretty soon, big money will want to buy protection.

How can we turn this into cash?

That’s where Bryan Perry’s money machine comes into play.

As our options expert, Bryan helps folks place strategic bets that limit risk and maximize reward.

And right now, time is of the essence.

You see, demand for options across the board tends to rise and fall with the VIX.

So, with the VIX at such low levels, options are CHEAPER than they have been in YEARS!

The odds they get even cheaper are quite low… but… the odds they get MORE expensive are now even HIGHER.

That means we can buy options right now when demand is low, knowing they aren’t likely to get much cheaper, and then sell them when demand goes up.

It’s literally the best of both worlds.

Now, we know a lot of folks are skeptical about trading options, especially if they’re new to the strategy or have been burned in the past.

That’s why Bryan Perry’s Eight-Month Millionaire Program is perfect, no matter your skill level or experience.

His assisted learning experience equips you with the knowledge, skills and strategies to fully exploit these time-sensitive opportunities.

Act now before the next market turn leaves you behind.

Click here to learn more about Bryan Perry’s Eight-Month Millionaire Program.