Nothing is more American than dumping money into a government retirement fund you’ll never see.

Our country has 10 years left until Social Security becomes insolvent.

This isn’t a shock to anyone, including the politicians charged with fixing the problem.

Yet, they’d rather hand out billions to pet projects instead of shoring up our fiscal affairs.

Social security suffers from three problems:

- Fewer contributors

- Smaller real-money contributions

- People living longer

Interestingly, the more we spend on Medicare, the more we spend on Social Security.

This isn’t meant to be some morbid revelation. Instead, it’s a simple fact.

- You spend money to keep folks healthy.

- They live longer.

- They draw more from Social Security.

That’s why more than a dozen studies have looked at whether COVID pushed back the Social Security insolvency date.

Initially, the results suggested we will lose more in economic productivity. But after the rebound in 2021-2022, those dynamics shifted.

No one is advocating for a Jonathan Swift Modest Proposal style solution (except maybe for lockdown advocates).

But many wrongly ridiculed Paul Ryan for suggesting we raise the Social Security age limits, privatize the funds or both.

So, what does this have to do with us as investors?

It’s simple. With Social Security firmly in the spotlight, our retirement strategies need to be re-examined and updated. We have to make sure we are prepared for the future of Social Security.

Your investment choices today could be the difference between retiring at 65 or 75.

Does that mean we need to get overly aggressive?

Not at all.

In fact, we’ll introduce you to what we like to call a Second Social Security Check.

To do that, we need to understand what insolvency looks like and the most likely solutions.

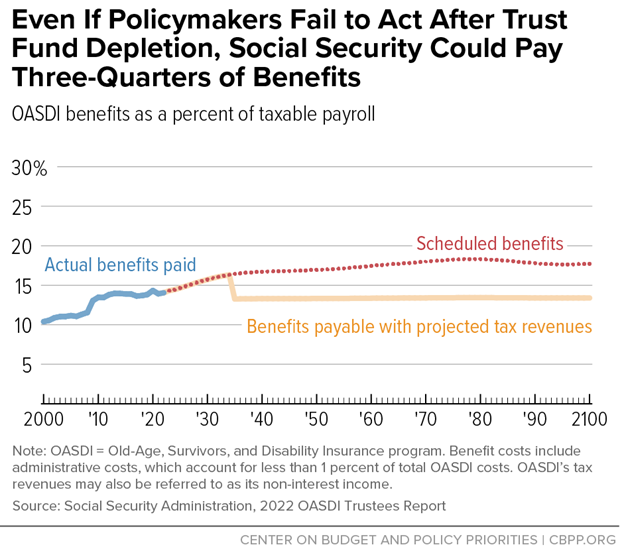

Social Security insolvency does not mean that the program will stop paying benefits. Instead, you will receive a portion of the benefits. Current estimates put the number at 80%.

Source: CBPP.org

That might not sound that bad until you consider inflation. We’ve seen the price for goods and services jump more in the last few years than they rose in the prior decade.

And one of the worst offenders is health care — a huge chunk of a retiree’s budget.

This also assumes payroll taxes come in as scheduled, which relies on economic growth and many other moving parts.

Some of the solutions being proposed include:

- Raising the payroll tax cap: The payroll tax is a tax that is paid by workers and their employers. The payroll tax cap is the maximum amount of income that is subject to the payroll tax. Raising the payroll tax cap would increase the amount of money that is collected in payroll taxes, which would help to shore up the Social Security trust fund.

- Reducing benefits for high earners: Currently, Social Security benefits are not reduced for high earners. This means that wealthy retirees receive the same benefits as low-income retirees.

- Gradually raising the retirement age: The full retirement age for Social Security benefits is 66 years old. Raising the retirement age would mean that retirees would have to wait longer to receive full benefits.

- Increasing the payroll tax: Today’s payroll tax runs about 6.2% of wages.

- Changing cost of living adjustment calculations: Social Security is adjusted based on the Consumer Price Index (CPI) every year. Different calculation methods could slow the increases over time.

- Privatizing a portion: Privatizing Social Security would mean that individuals would be able to invest a portion of their Social Security taxes in private accounts. This could help to increase the amount of money that is available for retirement, which could help to reduce the need for Social Security benefits.

Option six could be the one option that wouldn’t involve higher taxes or curtailing benefits. It’s also the least likely option, given its complexity.

The most likely fix will be something that pulls in aspects of solutions one, two and three. All the others are simply unlikely due to the fractured political nature, or the complexity involved.

Currently, the average payment for Social Security is around $1,700 or $20,400 annually. By 2034, that should increase to around $1,970 or $23,640 annually. If that number drops to 80%, it becomes $18,912 annually — a decrease of $4,728.

Essentially, you would need around $100,000 and a 5% interest rate just to make up for the money that you’re owed.

It seems rather unfair, but that’s the situation.

Fortunately, you don’t have to let it become YOUR reality.

Remember that second Social Security check we talked about earlier?

In order to make that happen, you’re going to need an investment that provides a near-constant stream of income.

401(k) plans and IRAs rise and fall with the stock market. While they’re great over the long run, it’s tough to plan year-to-year in retirement.

That’s why Bob Carlson decided to lay out how the average investor can create his or her own Second Social Security Check.

If you’re worried about your retirement and want to protect your golden years, then this is a MUST READ.

CLICK HERE to learn more about Bob Carlson’s Second Social Security Check.