**************************** Personal Invitation ******************

Each year, at this time, I invite a handful of investors to join my exclusive Income Alliance 100. This includes all my services for a lifetime with just a one-time fee (which, for the first time ever, we are discounting by $1,000) and small annual maintenance fee afterward. This is your invitation to join us now to become a member of all six of my services. But hurry, this offer ends on May 31, and we only opened up 100 slots. To learn more and secure your spot, call Grant Linhares at 202-677-4492 for your personalized quote — every one of my current subscribers will get a prorated refund for any product they currently have (in addition to the $1,000 discount) when they join (meaning you pay less than others!).

******************************

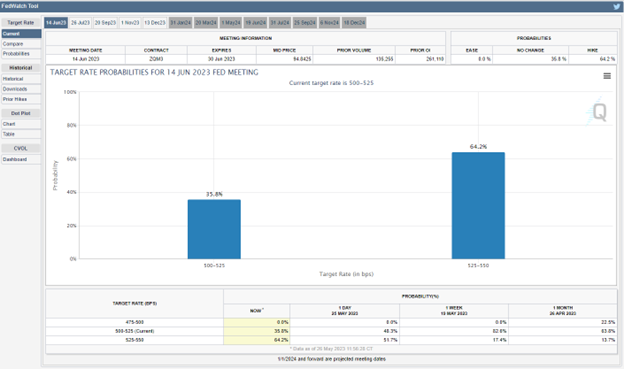

This past week’s consumer and inflation data came in a bit hotter than forecast, pushing up interest rates further and increasing the odds the Fed will again raise the Fed Funds Rate by another quarter point to 64.2%, and up from 17.1% just a week ago. This will take the rate up to 5.25-5.50% and account for the 11th consecutive rate increase.

The up-rate market has been a stiff headwind against the overall REIT sector, as the cost to develop and maintain properties has outpaced lease increases for many REIT operators stuck with long-term leases. But not all REITs are created equal, and those than can adjust terms for tenants on a more frequent basis stand to best weather the inflationary pressures.

They will also have the best chance of rebounding when money starts flowing back into the sector in general. This is where I want to have a short list of those REITs in the multi-family residential REIT space, where higher home prices, higher mortgage rates and rising uncertainty about job security are keeping millions of potential home buyers on the sidelines, seeking full-featured Class-A apartments in which to reside.

As REITs are capital intensive by nature, any rate relief later this year could have a meaningful impact on the heavy debt loads that REITs typically have. When the Federal Reserve does pivot on rates, it could potentially help restore investor confidence, and mark “a cyclical low,” as Brent Dilts, a real estate analyst at Columbia Threadneedle Investments, recently told Barron’s.

Further, Dilts points out that “REITs tend to outperform the broader stock market 18 months after the Fed ceases hiking interest rates.” In that same article, Michael Knott, head of U.S. REIT research at Green Street, told Barron’s that “publicly traded real estate is less expensive than property in the private market… and can offer ‘a cheaper way to buy real estate’ today.” I agree, and I’ve always been a fan of being a passive investor where the only work required is clicking your mouse to buy and sell real estate.

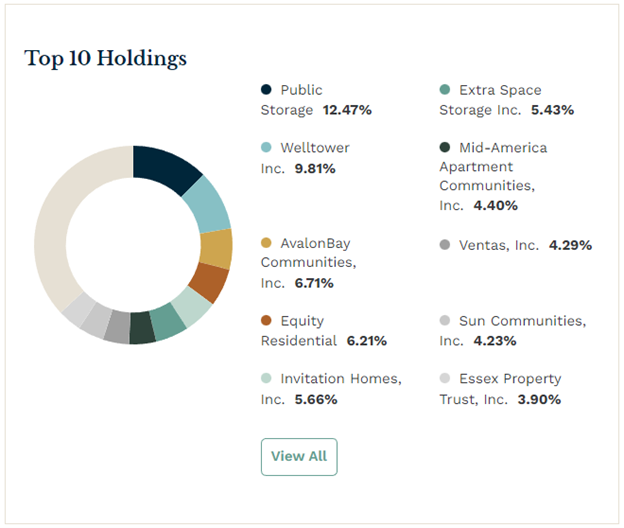

One REIT in particular to pay attention to is the iShares Residential and Multisector Real Estate Fund ETF (REZ). It has strong exposure to the self-storage sector and some healthcare facilities, both of which are highly defensive in a slowing economy where the narrative of a recession is still an ongoing topic of concern for investors.

Source: www.etf.com

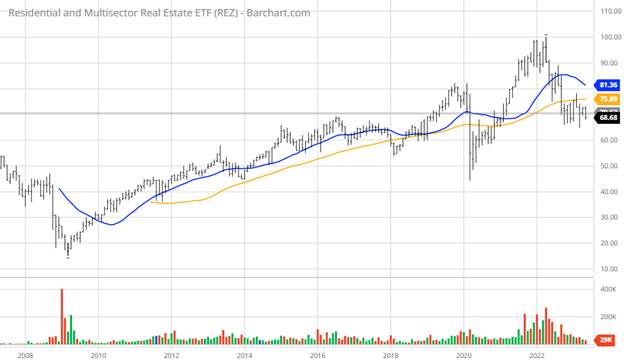

Looking at the long-term chart of REZ, the stock took a big hit during the Great Recession of 2008-2009, followed by another big sell off in 2020 during the pandemic and once more this past year in the wake of 11 Fed rate hikes. Shares of REZ are down just over 31% since hitting its high of $100 in April 2022. The fund pays a dividend yield of 3.45%, which isn’t nearly as attractive as other REITs, but the quality of the holdings is very good and should respond in a bullish manner when the market gets a whiff of a Fed pause on monetary policy.

The Fed may have one or even two more rate increases in its plan, but its important to do some early due diligence in the real estate market where excellent assets are on sale and trading at steep discounts to their previous highs. When the market does rotate back into REITs, it should prove to be a very lucrative investment class to own.

P.S. Come join our Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)