Sometimes, especially during times of economic uncertainty, bank failures and high interest rates, it is best to play it safe and stay within the comfortable domain of well-known and safe sectors of the market.

Returns from these stocks may not be extremely high, but they are safe, regular and somewhat predictable. At other times, the momentum in the market, or a certain sector of the market, is such that you cannot ignore it.

One such sector involves the growth and expansion of artificial intelligence (AI), especially in the wake of AI-trailblazer NVDIA’s (NASDAQ: NVDA) recent blowout earnings report. Now, I have talked about artificial intelligence and its effects on your job, your life and your money in both The Deep Woods and my Way of the Renaissance Man podcast, but here, I want to discuss a specific exchange-traded fund (ETF) that is closely correlated with the recent AI boom.

The iShares MSCI USA Momentum Factor ETF (BATS: MTUM) is a popular exchange-traded fund (ETF) that is comprised of a basket of stocks that have recently, but steadily, increased in price. In order to do this, the fund’s managers look at each stock’s returns for both six- and 12-month periods, and then scale them based on the volatility of returns during the past three years. This produces a small portfolio in comparison with its competition (the fund only has between 100 and 350 different stocks) and contains the possibility of both high risks and high rewards.

At the same time, while momentum investing (especially with regards to AI-related companies) may seem like a path to alpha, it is important to note that past performance is not always indicative of future success. All stocks, after all, are prone to sharp reversals at any time — as we have seen in the technology sector. In addition, this fund’s portfolio is heavily centered around large-cap stocks, leaving out large segments of the market that may provide similar (or better) returns.

Top holdings in the portfolio include NVDIA (NASDAQ: NVDA), Meta Platforms Inc., Class A (NASDAQ: META), Microsoft Corp. (NASDAQ: MSFT), Exxon Mobil (NYSE: XOM), Broadcom Inc. (NASDAQ: AVGO), Eli Lilly and Company (NYSE: LLY) and Merck & Co. (NYSE: MRK).

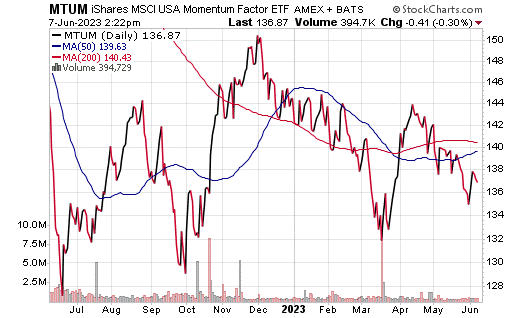

As of June 6, 2023, this fund has been down 1.93% over the past month, down 2.49% over the past three months and down 4.99% year to date. This ETF has total net assets of $9 billion and an expense ratio of 0.15%.

Chart courtesy of StockCharts.com.

While MTUM is a way to ride the momentum of the market, investors should be aware of the risks associated with investing in such a fund and always do their due diligence before adding any stock or fund to one’s portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.