If you’ve been investing only in U.S. stock markets this year, you probably haven’t noticed that 2013 has been a rough year for global stocks.

For all of the current hand wringing about the impact of the Fed’s imminent tapering on global financial markets, with its 17.7% return year-to-date, the U.S. stock market ranks #2 among the 39 global stock markets that I follow on a daily basis at my firm Global Guru Capital.

In fact, only a handful of global stock markets are showing positive returns in 2013.

That said, there is one region of the world that has shown surprising momentum during the past two months. Ironically, it is the region that has attracted the most negative headlines over the past few years. And it’s also the region that you are least likely to be invested in.

Global Stock Markets: The Year’s Top Three Performers

Ireland, a market that I’ve discussed and recommended many times in my Alpha Investor Letter investment newsletter and trading services, Bull Market Alert and Triple Digit Trader, is by far the top-performing market in the world, with the iShares MSCI Ireland Capped (EIRL) up 28.14% year-to-date.

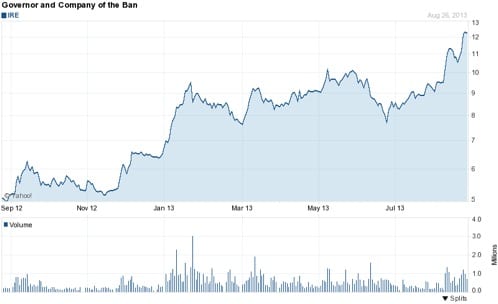

And if you invested in Bank of Ireland (IRE) — a longtime recommendation in my trading service Bull Market Alert — on Jan. 1 of this year you’d be sitting on gains of 88.92%.

With the S&P 500 returning 17.7%, the U.S. market ranks a distant second behind Ireland.

The United States has had some pockets of strength. Small caps have been big outperformers with the Vanguard Small Cap ETF (VB) chalking up a 23.02% gain. Other specialized sectors like biotechnology also have been solid outperformers with the iShares Nasdaq Biotechnology ETF (IBB) soaring 43.64% year-to-date. And as I pointed out in a recent issue of The Global Guru, there are a handful of “Buffett Beating” strategies that have strongly outperformed the S&P 500, with gains of between 27.44% and 30.87%.

Next is the Japanese stock market. After a strong start to 2013, Japan — boosted by the promise of its own version of quantitative easing and “Abenomics” — has lost its mojo. But the iShares MSCI Japan Index (EWJ) is still up 14.77% this year — enough to put it in third place among global stock markets. The yen-hedged version of Japan — the WisdomTree Japan Hedged Equity (DXJ) — has performed even better, and is up 24.16%.

Europe’s Stealth Bull Markets

Europe is the market that U.S. investors love to hate. And you’d have to be a serious, serious contrarian to have put your money to work there over the past few months.

As I noted, the Irish stock market has been in a league of its own in 2013, as investors have shown appreciation for Ireland’s commitment to difficult but effective austerity policies that have helped it regain its financial footing.

Despite the relentless headlines trumpeting the euro zone’s imminent implosion, Europe’s economies seem to have turned the corner and are emerging from recession. With its 14.53% performance in 2013, the iShares MSCI Netherlands ETF (EWN) is now nipping at the heels of Japan. Germany, the euro zone’s economic engine, also has performed well this year, with the iShares MSCI Germany ETF (EWG) gaining 13.76%.

But with Europe’s markets exploding to the upside over the past two months, focusing on 2013 year-to-date returns masks as much as it reveals.

Let’s start with Europe’s “other” PIIGS — besides, of course, top-performing Ireland.

Portugal (for which there is no exchange-traded fund), iShares MSCI Italy Capped ETF (EWI), Global X FTSE Greece 20 ETF (GREK) and iShares MSCI Spain Capped ETF (EWP) have been on fire over the past two months, soaring between 10% to 14%, even as the U.S. market has pulled back.

Look at some other markets in Europe — iShares MSCI Austria Capped ETF (EWO), iShares MSCI Belgium Capped ETF (EWK), iShares MSCI France Index (EWQ), Market Vectors Poland ETF (PLND) and iShares MSCI Sweden ETF (EWD) — and you’ll see equally impressive returns.

At this rate, it would only take a couple of more months of gains for European markets to leap to the top of the global stock market performance tables.

The Current Wasteland of Global Stock Market Returns

Look outside Europe, and performance of global stock markets rapidly deteriorates.

Not a single market is in the plus column for 2013 in the emerging markets of Asia or Latin America.

The threat of the Fed tapering its monetary policy is signaling the end of easy money in emerging markets, and investors are abandoning these former red hot markets in droves. Former investor favorites like China are down 11.84% as India has tumbled a whopping 26.54%.

Over the past six months, the MSCI Emerging Market Index has underperformed the S&P 500 by a whopping 20% — one of the biggest underperformances relative to U.S. markets I’ve ever seen.

One day, investors will make big gains in these underperforming global markets, as their performance reverts to the mean.

But until then, the most profitable — and surprising — markets to put your money to work for the rest of 2013 may be in Old World Europe.

To read my e-letter from last week, please click here. I also invite you to comment about my column in the space provided below.