Options Trading

Options Industry Council (OIC) – What is It?

The Options Industry Council is a resource used to educate investors about the benefits and risks associated with...

Put-Call Parity – Defined and Simplified

The put-call parity is the relationship that exists between put and call prices of the same underlying security,...

What Does Open Interest Mean? – Options Trading

In terms of option trading, open interest means the total number of option contracts that are currently active,...

What Does Volume Mean in Terms of Trading Options?

In terms of option trading, volume is the number of option contracts traded in a given period of...

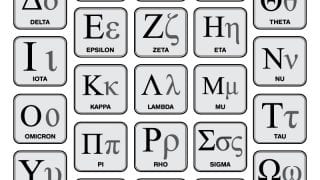

The Basics of Option Greeks

The option Greeks provide a way to measure the change in the price of an option when affected...

Three Paths to Profit from SPY

Three paths to profit from SPY reward investors from the movement of the S&P 500. Two of the...

Married Put – Option Trading Strategy

The married put is an option strategy where an investor buys an “at-the-money” put option while simultaneously buying...

Strangle – Everything to Know About This Options Strategy

A strangle is an options strategy where an investor simultaneously buys a call and put that have different...

Credit Spread – Option Trading Strategy

A credit spread is an option spread strategy where an investor sells options that have higher premiums than...

Vertical Spread – Option Trading Strategy

A vertical spread is an option strategy where an investor buys an option while simultaneously selling an option...