Washington, D.C.

There’s a horrible, horrible, heart-breaking disease stalking us…

A disease without a cure.

It’s not heart disease, diabetes, Alzheimer’s, or cancer.

And, just so you know, cancer is not a single disease.

There are over 100 different types of cancer, each requiring a different costly treatment.

All these cancers have a combined market value of over $100 billion a year.

This disease, on the other hand, stands alone.

It has only one type, with a market value fast approaching $40 billion a year.

One disease with a price tag that’s nearly half that of all combined cancers.

That’s pretty remarkable — and alarming.

Right now, 1.5 million Americans are battling this disease.

Many are living in unrelieved agony, day after day after day.

This Disease Has Been a Money Printing Press for

Drug Companies for the Past 32 Years

The biggest money-making drugs on the market today, advertised every day on TV…

They ALL target this disease.

Not to cure it, because they can’t.

They merely attempt to make it bearable. Sometimes they can’t even do that.

This disease carries a potential death sentence.

And if it doesn’t kill you quickly, it’ll shorten your life by up to 15 years.

We know more about heart disease, diabetes, Alzheimer’s, and cancer than we know about this disease.

But, what we do know is that it can strike anyone at any time: the rich, the poor, the young, the old, the famous, and not famous.

And there’s nothing you can do to prevent it from striking you.

Actress Kathleen Turner, who starred in Romancing the Stone, Body Heat, The War of the Roses, and many others…

Was diagnosed with the disease and has undergone 12 surgeries.

Her doctors have told her she’ll eventually succumb to the disease.

Former Pittsburgh Steelers quarterback Terry Bradshaw was recently diagnosed with the disease.

“I try not to ever sit around and go ‘When is this coming to an end?’” he said.

LPGA golfer Kristy McPherson was diagnosed with the disease, but is mercifully no longer bedridden.

Actress Tatum O’Neal, the youngest actress to win an Oscar at age 10 for her role in Paper Moon, was recently diagnosed with the disease.

“I’ve got to get ahead of it,” she said. “I’ve got to! I have a young spirit… I want a long, healthy life.”

Two-time Olympic snowboarder Spencer O’Brien, just before the Sochi Olympics, suddenly found herself in chronic pain.

Diagnosed with the disease, she can barely walk… let alone snowboard competitively.

Actor James Coburn, now deceased, starred in The Magnificent Seven, Hell is for Heroes, and others.

“There was so much pain,” he once said, “Every time I stood up, I would break into a sweat.”

Tennis star Caroline Wozniacki was diagnosed with the disease in 2018 right after she won the Australian Open.

At first, she thought it was the flu, but then: “I wake up and I can’t lift my arms. I go to the doctor and they tell me everything is fine. But I’m not fine!”

Glenn Frey, now deceased, founding member of the legendary rock group the Eagles, suffered from the disease.

Sandy Koufax, the legendary pitcher for the Dodgers, is believed to have been forced into early retirement because of the disease.

What causes this disease is a total mystery.

Some scientists believe it’s genetic.

Others say it’s environmental, pollutants, the air in your house, even.

Others think it stems from a virus or bacterium.

In short, no one knows what causes it.

Yet, the company I’m recommending today knows how to kill it.

It’s a blockbuster breakthrough that could turn every drug prescribed within this $40 billion goldmine into useless garbage.

Own shares today in this company…

And tomorrow you might feel as if you bought the next winning Powerball Lottery ticket.

Because all the billions of dollars that people with this disease spend on drugs every single year…

That all have potential side effects worse than the disease…

All those billions of dollars could make a sharp right turn away from those companies named below that sell those drugs…

And into the hands of this one company and its shareholders.

Which is why YOU want to own shares in this company!

Because if this company is the only company that can kill this $40-billion-a-year disease…

You could earn enough money to last you a lifetime.

And think of all the people this company could save.

Saving one life is precious. Saving 1.5 million lives… is a blessing.

So what is this dreadful disease?

I’ll tell you, of course.

But first, I want to address “the wall of worry” you may be climbing right now.

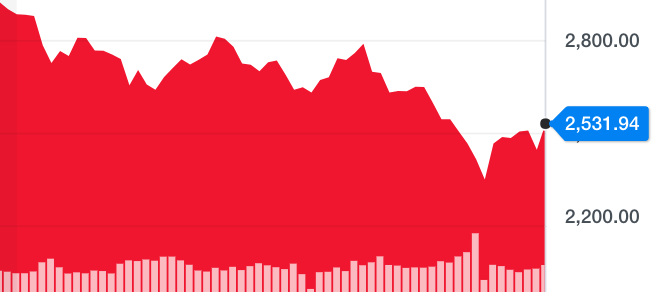

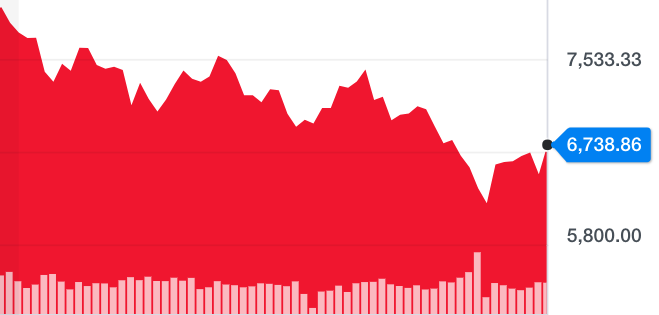

Recently, you’ve seen the value of your investments plummet, recover, plummet, recover, and fall again.

Many blame President Trump. Many blame the economy. Many blame the Federal reserve and their policy of raising interest rates higher and higher.

But it doesn’t matter who’s to blame — and there’s plenty of blame to go around.

It’s the end result — the dollar value of your investments — that concerns you.

Here’s what the markets have looked like over the past 3 months.

The Dow Industrial rollercoaster:

The S&P 500 rollercoaster:

The Nasdaq rollercoaster:

Unsettling, right?

Not a very pretty picture.

So I want you to know… your fears about the economy and the investment markets are totally justified.

The American economy is an untamable beast.

Recessions are devastating and inevitable.

Whoever tells you otherwise is a fool.

The stock and bond markets…

They’re completely irrational — always have been, always will be. And yet…

Today, I’ll tell you about a company whose catapulting fortunes are not tied to either the economy or the markets.

Both can go completely off the rails.

But this company — a biotech company in the mountains of Switzerland…

Is fully capable of making you rich, no matter which direction the economy or the investment markets are headed.

Provided, of course, you get in before the Wall Street lemmings.

The “mindless herd” that always wants to crash a party and drive share prices higher, which can be a blessing if you get in before they do.

However, the best news is for the 1.5 million Americans who today suffer from one of the most heartbreaking diseases ever to plague a human body.

Today, these poor souls, finally, have hope.

And a fighting chance to live a long, healthy and enjoyable life.

My name is Roger Michalski.

I’m publisher of Eagle Financial Publications here in Washington D.C.

We proudly publish Dr. Mark Skousen’s work.

If you’ve read one or two of the 25+ books he’s authored, to the benefit of many a successful investor, his name might ring a bell.

You may have attended one of his lectures at Columbia, Barnard or Mercy College, among others.

If you are or were a C-suite executive at IBM or other Fortune 500 companies he’s consulted for, you may have benefited from his advice and counsel.

If you’ve ever worked at the CIA, you may have actually rubbed shoulders with him during his time there as an analyst.

Yet, you may not recognize him if he passed you on the street…

Unless you were a regular viewer of Larry Kudlow & Company on CNBC, where he was a frequent guest.

That show is no more, of course.

Larry is now President Trump’s chief economic advisor, the director of his National Economic Council.

Nonetheless, here’s a recent picture of Dr. Mark Skousen…

He’s the jolly fellow on the far left. The woman on his left is his wife, Jo Ann, and on her left are Senator and Mrs. Orrin Hatch.

Dr. Skousen stopped by the Hatch’s Washington residence to congratulate the Senator, the Chairman of the Senate Finance Committee…

On the occasion of the historic passage of the 2017 tax cut, which he was instrumental in passing.

A tax cut which I’m sure you’re now benefiting from.

On the other hand, all of us may soon experience quite a bit of national angst and pain.

As Dr. Skousen recently wrote:

“President Trump and the Republican leaders on Capitol Hill have pushed through a gigantic $1.3 trillion federal omnibus budget…”

That Budget Could Easily Bankrupt America!

Because if economists are saying, and indeed they are, that the nation is enjoying full employment…

We should be running a surplus!

Instead, the deficit is expected to exceed $1 trillion this year, ballooning our national debt to $22 trillion or more.

And now we’re in the midst of a trade war with China (if not the rest of the world) which seems to be hurting us more than the Chinese.

Yet, as one of Dr. Skousen’s sources in the White House confided to him (and so he will remain unnamed)…

“The President is determined to double down on his fight with China, in an attempt to bring them to the bargaining table.”

In the meantime, interest rates are going up, up and up.

Put it all together and our national economy may soon be a dead man walking!

That’s why you need to do what any carpenter worthy of the name does:

Measure twice and cut once.

In other words, as an investor, be extremely careful and selective in the stocks you buy and hold.

Fortunately, the company Dr. Skousen’s recommending has been measured, measured, and measured again.

And I’m convinced it could be a monumental money-maker both for itself and for you.

If for no other reason than it’s about to take over a hugely profitable ($40 billion) healthcare market!

And that, needless to say, doesn’t happen every day.

This company could anchor your portfolio, act as a safe harbor against the approaching economic winter, and all that comes with it, namely:

A highly volatile and often ruinous stock market.

Doubt that prediction, if you choose.

Because Mark could be wrong; he’s not infallible.

But, and you can trust me on this, he’s really good at what he does.

He’s been predicting stock market turns before they happen, before markets go up or down…

And providing critical investment, financial and economic analysis for the benefit of investors…

For a long, long time.

When Ronald Reagan was President, and inherited an economy from Jimmy Carter that was totally on the skids…

Dr. Mark Skousen predicted “Reaganomics” would work.

This happened when almost every other analyst and economist said it wouldn’t!

Dr. Mark Skousen recommended investors sell their gold, silver and other inflation hedges to buy stocks and bonds instead.

Sure enough, a year later, a long-lived and historic bull market in both stocks and bonds began.

Investors who listened to Dr. Skousen, and acted on his recommendations when others didn’t, were well rewarded.

Then, six years later, he predicted the end of that bull run was coming fast — and it wasn’t going to be pretty.

Sure enough, just six weeks later, the devastating October 1987 stock market crash stunned the nation and the world.

It caught everyone who didn’t listen with their pants down.

A lot of people lost a lot of money.

Mark warned them, but it was their choice not to listen.

Two years later, at an investor conference in Orlando, Florida, he predicted that the Federal deficit would disappear…

And that we’d soon have a surplus!

That prediction stunned everyone in the audience. There was utter silence in the hall; you could’ve heard a pin drop.

And then everyone laughed… they thought Mark was trying to be funny.

But a surplus we absolutely had!

Clinton and Gingrich got the job done. (It’s amazing what real bi-partisanship can accomplish.)

At the start of the 1990s, Dr. Mark Skousen predicted it would be the best decade ever to own stocks. And, of course, it was.

In 1995, when the Nasdaq was at its all-time high of 750, Dr. Mark Skousen predicted it would double, and then double again.

This time he was wrong, but in a good way.

The Nasdaq doubled and doubled — and then doubled again — closing out the decade at almost 4,000!

In 2000, Dr. Mark Skousen predicted the markets were reaching a top. His view: internet stocks were in an unsustainable bubble.

And sure enough, that infamous tech bubble popped.

In 2009, during the darkest days of the Great Recession, Dr. Mark Skousen predicted the Dow would hit 10,000 by year end.

Few believed him. Most laughed (again).

But, on December 31, 2009, the Dow closed at 10,428.

And because many of his predictions over the years have come true, Grantham University renamed its business school, “The Mark Skousen School of Business.”

But I digress.

Right now, Dr. Mark Skousen is predicting that biotech stocks, which have been utterly pummeled over the past year…

Offer investors the biggest profit potential going forward.

And the stock he’s recommending to you in this letter could outperform the entire field!

It’s at the Very Top of

“Mark’s Biotech Winners List!”

Just one of the many lists he maintains — and has been carefully documenting for the past 30 years!

In every one of his lists, investors found ways to create wealth and increase it.

I won’t bore you with names of every company he’s recommended over the past 30 years.

Suffice it to say, I’ve had the good fortune to see hundreds of Mark’s wins.

Which is why we continually receive emails like these from those who acted upon those recommendations.

I Made Over 1 Million Dollars!

I Buy the Stocks Mark Recommends!

$25,000 in Dividends This Year Alone!

Making Money is Fun With Mark!

And Stephen Halprin, editor of Stock Advisors, (every year he runs an investing contest) said this…

Mark is Among the Best of the Best!

“For over 25 years, I have conducted an annual feature asking the nation’s leading newsletter advisors to select their favorite stock for the coming year.

Year after year, Mark has consistently been among the top performers in this contest.

Indeed, out of some 100 financial advisors, Mark has ranked in the top few spots more than any other.”

Let me also add this…

The company he’s recommending to you today, which is his first profit prediction for 2019, is not only “recession-resistant,” it has the potential to be…

Mark’s Most Profitable Recommendation EVER!

A company that could literally make you far richer than you ever hoped or thought you’d be.

A company that could offer you a supremely comfortable retirement, no matter the current direction of the economy or investment markets.

Ok, great! What is the company? What is the disease?

And why am I so confident this company could kill it and make you rich?

These are the facts:

Most people contract this disease when they’re older, and far more women contract it than men.

Women will typically contract it after the age of 30. Men, after the age of 40 or 50.

But, as you can tell from the celebrities above, it can strike anyone at any age.

I know of one little girl, and I’m sure there are others, who was diagnosed with the disease at 18 months.

The disease can affect your skin, eyes, lungs, kidneys, glands, nerves, bone marrow, blood vessels, and heart.

In fact, people with this disease are at increased risk of heart failure.

One year after you’re diagnosed with this disease, you’ll have a 60% chance of suffering a stroke.

But diagnosing the disease is not easy, at least not in the beginning, because its symptoms mimic so many other diseases.

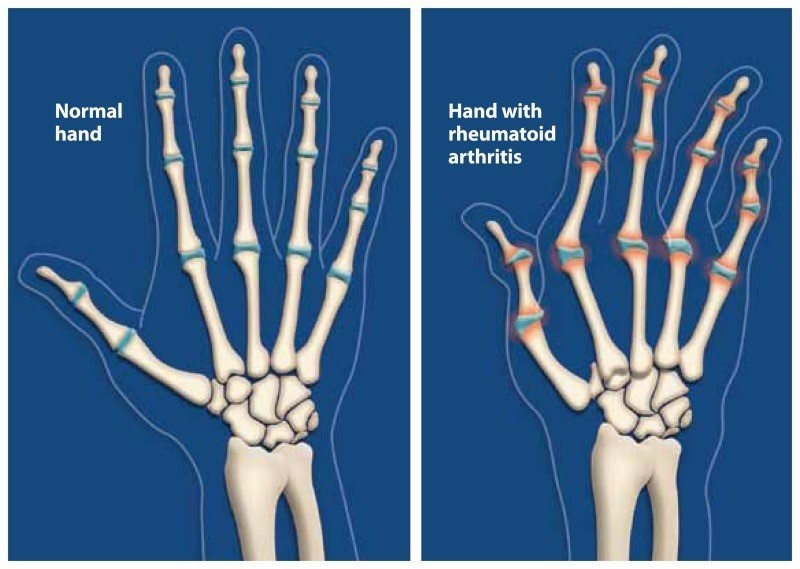

But, in its advanced stages, typically during the first two years after contracting the disease…

Your hands become misshapen and look like claws.

You’ve seen people with hands like that — people with this incurable disease…

People with rheumatoid arthritis (RA).

RA is an autoimmune disease.

In other words, instead of your immune system attacking and destroying infections, such as bacteria and viruses, as it’s designed to do…

It attacks you!

Your cells, your tissues, your organs.

In particular, it attacks the synovium, the lubricating tissue lining your joints.

The synovium becomes thicker and inflamed, resulting in intense pain and the eventual destruction of cartilage and bone.

Your tendons and ligaments also become weaker; they’ll stretch, causing your joints to become misaligned.

RA is most common in the hands, but it can occur in any joint…

Including your knees, wrists, neck, shoulders, elbows, feet, hips, and even your jaw.

For unknown reasons, RA patients may also develop cancer.

To manage RA, not cure it…

Doctors recommend everything from yoga to an aggressive regimen of powerful drugs to immobilize your immune system.

That’s Why This Company that Could Kill it May

Lock Up the Entire $40-Billion-a-Year RA Market!

The first drug to treat RA was methotrexate.

It was developed in 1947 as a chemotherapy drug to treat breast cancer. And it’s still used as such today.

It’s also used to treat lymphoma and leukemia, and even induce miscarriages in unwanted pregnancies.

The reason it has such broad usage is because methotrexate is an indiscriminate killer.

It kills any cell it comes into contact with — the good and the bad.

And that’s why the potential side effects include seizures, low white blood cell counts, severe toxicity of the liver, kidneys and bone marrow.

Which also explains why many RA patients stop taking it.

As for why methotrexate lessens the severity of RA in some patients and not others… there’s no clear answer.

Nevertheless, most physicians will prescribe methotrexate for RA, because it’s inexpensive — around $50 a month.

Which is also why many insurance companies insist it be tried first, before moving on to far more expensive drugs.

Of course, there are many different RA drugs currently on the market…

Because not every RA patient responds the same to any given one.

So, doctors and patients frequently try different drugs to find the one that seems to work best for them…

Which is why pharmaceutical companies and their shareholders have been getting rich off the $40 billion RA market.

But this scattershot approach — throwing mud on the wall to see what sticks, so to speak — is getting old. Bottom line:

This small company Mark’s recommending could put an end to RA…

And deprive the world’s biggest and wealthiest pharmaceutical companies of tens of billions of dollars.

Currently, the 600-pound gorilla of RA drugs, with over $18 billion in sales in 2017 is…

You’ve seen it on TV, day in and day out…

Humira, manufactured by AbbVie.

The average monthly price for Humira is over $5,000 per month.

Sales in 2020 are expected to approach $21 billion.

It’s by far the world’s best-selling RA drug.

Enbrel, manufactured by Amgen, is the second-best-selling RA drug.

2017 sales finished close to $9 billion.

Remicade, manufactured by Johnson and Johnson, is the third-best-selling RA drug.

2017 sales? Over $7 billion.

All told, there are 11 other companies manufacturing drugs for RA.

For these companies, RA is the gift that keeps on giving.

Sad, but true.

Nevertheless, all those billions of dollars may soon be funneled into the company Mark is recommending you buy shares in.

For every reason listed below.

But here’s what’s really interesting…

Most if not all the drugs, but definitely the top-selling three above, work pretty much the same way.

They’re called “TNF blockers.”

I won’t bore you with what that means or how exactly it works.

Suffice it to say, TNF blockers deactivate your immune system, which would appear to make sense…

Because if you have RA, it means your immune system is going crazy — literally trying to kill you!

However, suppressing your immune system is NOT a great idea.

Think about it. If your immune system is put to sleep, you’re shark bait.

Feast food for almost every disease, virus, bacteria that wants to kill you and eat you.

In which case, the cure might be worse than the disease.

To prove that point, the next time you sit in front of the TV and see a Humira commercial, pay attention to what they admit near the end.

(I copied the below from their website and edited it for brevity, but kept all the scary parts):

These serious infections include tuberculosis (TB) and infections caused by viruses, fungi, or bacteria that have spread throughout the body.

Some people have died from these infections.

Cancer. For children and adults taking TNF blockers, including HUMIRA, the chance of getting lymphoma or other cancers may increase.

There have been cases of unusual cancers in children, teenagers, and young adults using TNF blockers.

Some people have developed a rare type of cancer called hepatosplenic T-cell lymphoma.

This type of cancer often results in death.

If using TNF blockers including HUMIRA, your chance of getting two types of skin cancer (basal cell and squamous cell) may increase.

You may also experience:

- Allergic reactions. Symptoms of a serious allergic reaction include hives, trouble breathing, and swelling of your face, eyes, lips, or mouth.

- Nervous system problems. Signs and symptoms include numbness or tingling, problems with your vision, weakness in your arms or legs, and dizziness.

- Blood problems (decreased blood cells that help fight infections or stop bleeding). Symptoms include a fever that does not go away, bruising or bleeding very easily, or looking very pale.

- Heart failure (new or worsening). Symptoms include shortness of breath, swelling of your ankles or feet, and sudden weight gain.

- Immune reactions including a lupus-like syndrome. Symptoms include chest discomfort or pain that does not go away, shortness of breath, joint pain, or rash on your cheeks or arms that gets worse in the sun.

- Liver problems. Symptoms include feeling very tired, skin or eyes that look yellow, poor appetite or vomiting, and pain on the right side of your stomach (abdomen). These problems can lead to liver failure and death.

- Psoriasis (new or worsening). Symptoms include red scaly patches or raised bumps that are filled with pus.

Enbrel, Remicade, and every other TNF Blocker pretty much carries the same “black box” warnings.

Yet, for people with RA, TNF blockers right now are the best they’ve got. State of the art drugs.

Helping some… killing others.

And still bringing in tens of billions of dollars every year.

A Blue Cross/Blue Shield report stated that in 2017 more money was spent on Humira, Enbrel and Remicade than all other drugs.

But get this…

The Institute for Clinical and Economic Review, a drug cost watchdog, reported that TNF blockers are — to put it in simple English — a rip off. Not worth the money.

So I ask you what would happen to the stock of a company 99.9% of people never heard of…

That developed a RA “biologic” (a drug containing proteins or other molecules derived from human cells) in advanced clinical trials…

That’s not a useless TNF blocker…

That can stop RA dead in its tracks…

End it, kill it…

What would happen to that stock?

Well, I think you know the answer.

Quite a few investors in this company could soon be buying new homes, new cars, and taking long and lavish vacations.

Of course, some might just opt to cash in their shares and put the money in the bank.

But we’re getting ahead of ourselves.

First, we have to know…

What makes this company’s RA biologic so different — and so much better — than all the RA drugs currently on the market?

And what’s the mechanism of action this RA killer uses…

That could finally make all TNF blockers — which have ruled the RA market — obsolete and worthless?

The answer:

Devastating Pinpoint Accuracy

While TNF blockers hobble your immune system in an effort (not always successful) to ease the debilitating symptoms of RA…

Where walking or holding a glass of water is near impossible for those with advanced RA…

What this company has developed is a biologic that directly attacks the inflammation within your joints.

This leaves your immune system untouched and unharmed, allowing it to continue fending off diseases and infections.

How does it do that?

The $40 Billion Question… Answered!

Within pharmacology, it’s a fact that most drugs do not selectively accumulate at the site of a disease.

For example, most chemotherapy drugs for cancer, like methotrexate, tend to attack healthy and cancerous tissue.

Hence, all the notorious side-effects associated with chemotherapy: ranging from hair loss and nausea to developing other cancers down the road.

So what’s clearly needed are “smart drugs.”

Drugs or biologics that can zero-in on a targeted disease and avoid all collateral damage to nearby healthy tissue.

Easier said than done, of course.

Nevertheless, what this small company in the mountains of Switzerland discovered is fascinating.

Namely this: The growth of new blood vessels (called angiogenesis) is rare in healthy human tissue.

But very common in inflammatory disorders like RA.

The company also discovered that, on a molecular level, newly formed blood vessels are quite different from mature blood vessels.

That means, if we’re able to identify and target only tissues where new blood vessels are forming — tissues surrounding inflamed joints…

Half the battle against RA is won!

The other half of the battle is figuring out how to deliver a knockout punch to those inflamed tissues.

Well, this small Swiss company figured that out, too.

First, they created a monoclonal antibody.

Don’t worry, I won’t nerd out on you. I’m going to keep this very short and simple.

A monoclonal antibody is a clone of a human cell, specifically…

An immune system cell that can be programmed to bind or cling to a selected target.

In the case of RA, inflamed tissues containing new blood vessels.

Next, they attached the monoclonal antibody to a detonator.

The $40 Billion RA Killer!

There’s a human protein molecule called Interleukin 10 (IL-10).

IL-10 is widely considered the most potent anti-inflammatory produced by the human body.

But it’s always been notoriously difficult to harness, tame and train.

Yet this company solved that puzzle, too — succeeding where others have failed.

In short, the anti-RA biologic this company created is potent and effective!

Code named “Raptor,” it’s been extensively tested in Phase 1 and Phase 2 clinical trials…

Successfully killing RA-induced inflammation, and halting its progression with no serious side-effects.

So, now you’re ready, as any reasonable thinking person would be…

To log into your brokerage account and buy shares in this Swiss company as soon as I name it…

But you can’t!

This Swiss company is not a publicly-traded company… it’s privately owned.

You can, however, buy all the shares you want in the American biotech company that owns exclusive rights to Raptor.

Much as if they were the company that invented it!

And that’s why…

Even Bigger Profits Could Be Yours!

I’ll explain…

This Swiss company absolutely pioneered the research into angiogenesis-related disorders…

Which includes cancer, by the way (a $100+ billion-dollar market)!

The Swiss company is also a world-leader in developing different kinds of monoclonal antibodies.

It literally owns “libraries” containing billions of them.

Any one of which can be programed to target and deliver payloads of immune system cells, or drugs, to diseased tissues where angiogenesis is occurring.

It’s precision medicine by any other name: targeted, effective and safe.

No damage is done to healthy tissue surrounding the disease site.

However, what this company is not a leader in… is immunology.

In other words, this company is able to create guided biological missiles.

But it needed another company to help it create the biological TNT those missiles are built to deliver.

In short, it needed a partner.

A partner with deep, deep pockets to fund Raptor’s continuing research and development.

And to ultimately market it worldwide.

After a long search, the Swiss company partnered with the publicly-traded American company that I call “American X.”

In the words of the Swiss company’s CEO, it’s a perfect pairing.

“We believe that combining our extensive experience with targeted therapies with American X’s world‐leading immunology expertise and clinical capabilities will optimize Raptor’s development pathway and progress.”

Neither the Swiss company or American X have revealed the financial details of their partnership.

But they have stated that American X will receive exclusive commercial rights to Raptor.

In other words, all money brought in from sales of Raptor goes to American X.

American X will also receive exclusive commercial rights to every other product developed in partnership with the Swiss company that targets angiogenesis-related diseases.

In return, the Swiss company will receive milestone and royalty payments from American X on all sales of Raptor and related therapies and cures.

No sooner was the ink dry on their agreement…

American X Began Raiding the

Swiss Company’s Knowledge Banks

So now, alongside the development of Raptor to conquer RA…

American X is fast at work in using the science behind Raptor to conquer other diseases where angiogenesis also occurs…

Namely cancers and IBD (Inflammatory Bowel Disease).

When you combine the revenue stemming from those diseases with RA…

You’re looking at over $140 billion in annual sales.

And there are many other diseases in which angiogenesis occurs.

For example:

| Disease | Market Size |

|---|---|

| Alzheimer’s | $14.8 Billion by 2026 |

| Cardiovascular Disease | $91.0 Billion by 2025 |

| HIV/AIDS | $27.1 Billion by 2023 |

| Diabetes | $35.5 Billion by 2024 |

| Psoriasis | $21.1 Billion by 2022 |

| Asthma/COPD | $34.3 Billion by 2020 |

| Crohn’s Disease | $4.7 Billion by 2025 |

| Total Combined Annual Sales: | $213.71 Billion! |

And there are still even more diseases where angiogenesis occurs:

Restenosis, transplant arteriopathy, scar keloids, synovitis, osteomyelitis, choroideal and intraocular disorders, endometriosis, uterine bleeding — to name a few.

In other words, you’re looking at a combined market that could well be over $350 billion in annual sales for American X!

And unlike the Swiss company…

You Can Start Buying Shares in American X Today!

But let’s be realistic…

American X and this Swiss company will not “own” all the markets mentioned above by tomorrow.

It’ll take time, though the end result is all but inevitable…

Because when a better, safer, more effective technology revolutionizes the way any disease is treated or cured — in this case, angiogenesis-related diseases…

That revolutionary technology will become the new and accepted standard of care.

Precisely because it’s more effective, superior to everything else out there, and safer!

Still, let’s say American X captures 15% of the market for all angiogenesis-related diseases (in the short-term).

15% of those markets amounts to roughly $52 billion in annual sales!

That extra $52 billion a year will no doubt do wonders for American X’s bottom line, not to mention its shares…

Even though American X is not a small company.

It’s not a thinly-financed biotech, a day away from shutting down if its “one and only” product fails.

Nor is it likely its shares will suffer a catastrophic meltdown if the stock market corrects or completely tanks.

Or if we have another recession, which will undoubtedly happen sooner or later.

American X is Practically Bullet-Proof!

It currently has over 40 FDA-approved products on the market, and over 90 in development!

Annual sales in 2017 was roughly $52 billion.

Which, coincidentally, equals what it could initially earn from sales of Raptor and related therapies.

In other words, in one fell swoop, American X’s annual sales could double!

And that doesn’t normally happen to large, established companies.

So what could a doubling of its revenue do for American X’s shares?

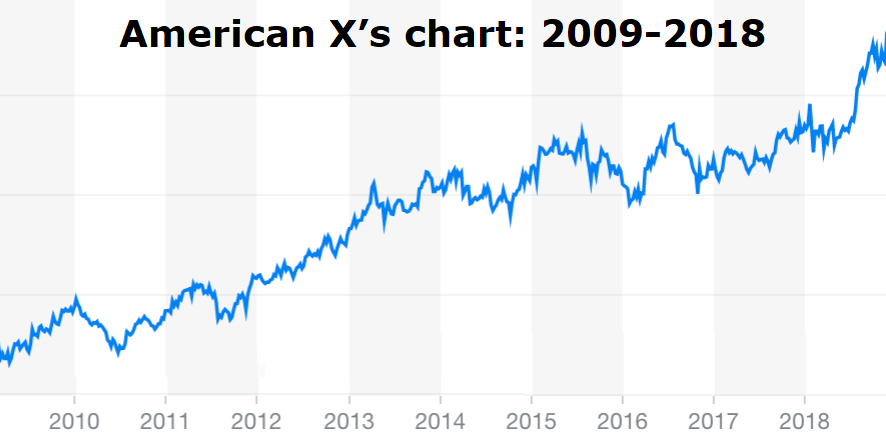

Well, consider this…

Over the past 10 years, through all the market’s ups and downs, including the Great Recession…

American X’s shares have almost tripled!

Gaining 283% to be exact.

That, too, doesn’t normally happen to large, established companies in the pharmaceutical niche.

In fact, in 2017, the third-biggest earner in this niche was Sanofi with $37 billion in sales.

Yet, over the last 10 years, its shares gained just 88%.

The second-biggest earner was Roche with $44 billion in sales.

Over the last 10 years, its shares gained 146%.

And the biggest earner, with $52 billion in sales and a 10-year gain of 283% — nearly double that of Roche — was, of course, American X.

So it wouldn’t be unreasonable to assume that if American X doubles its revenue…

Its share price could just as easily double as well!

Or triple, or quadruple!

Imagine that — growth, value and impressive safety — all in one company!

And the icing on the cake: American X pays an annual dividend of nearly 4%!

So, do you think American X deserves a place in your portfolio?

If so, I’ll be happy to send you a detailed investment brief on American X, which will include the company’s ticker symbol and name, along with Mark’s research on it. The brief is called:

American X Unmasked: The biotech behemoth with $52 billion in annual sales

In this special investment brief, you’ll also find Mark’s research on the Swiss company that started this medical revolution.

This must-have investment brief is yours absolutely FREE when you accept a 30-day, no-money-risk, trial subscription to the award-winning newsletter written by Dr. Mark Skousen called, Forecasts & Strategies.

Your trial subscription will grant you all the privileges and benefits enjoyed by full-time subscribers.

For example, you’ll have full access to the Forecasts & Strategies model portfolio.

In it, you’ll see ALL of Mark’s current buy recommendations.

Which includes both growth and income stocks, gold and natural resource stocks, energy stocks, even mutual funds and ETFs!

You’ll also have complete access to Mark’s just-released predictions on the economy, interest rates, inflation, the dollar… and his latest recommendations on the market sectors you should be in right now.

Because, as Mark always says:

“There’s always a bull market somewhere!”

It’s true!

And biotech and health are just two of the sectors you want to be in going forward.

After all, none of us are getting younger; with age comes disease and disability.

Which is why American X, backed by the research and innovation of this leading Swiss medical company…

Offers you an outstanding, unparalleled opportunity to seize massive profits and secure an abundant and wealthy future.

That’s why I want you to read my brand new investment brief!

And here’s something else I want you to read…

I debated long and hard with myself about whether or not I should offer it to you today.

But I’m so impressed and excited by its potential to change society and the way we live…

It would be a disservice not to tell you about it right now.

Another Blockbuster Company

You Must Consider Owning!

This is a company that’s capable, more than any other, of influencing and plotting the future direction of civilization.

Yes, you read that right.

What this company invented, and is selling in ever larger numbers, is already creating massive changes around the world.

Quite a few investors now see this company as their ticket to becoming multi-millionaires.

Indeed, billionaire Mark Cuban believes the change this company is bringing…

Will give birth to not just millionaires, but trillionaires!

And there’s no reason on God’s green earth why you can’t be one of them.

Around the world, almost every company in every industry is trying to figure out how to employ what this company invented to increase their profits.

And what it invented is the secret sauce that makes artificial intelligence (AI) possible.

Read my investment brief about this company: the leading provider of AI hardware and software.

Consider that, in 2015, just three years ago, the global AI market was valued at $126 billion.

It’s not a small sum (it’s roughly what Amazon’s Jeff Bezos is worth today).

However, by 2024, six years from now…

AI is expected to be worth over $3 trillion!

A 2,300% increase in both value and opportunity.

Other analysts believe that, by 2030, it will contribute $15.7 trillion to the global economy.

That would be an increase of 12,664%!

Forbes magazine recently wrote:

“AI’s exponential growth is increasing at scale in every industry, sector and marketplace — every second.”

Kiplinger magazine wrote:

“There’s little on the horizon that looks like it’s going to slow this stock down, let alone stop it in its tracks.”

And, because the Wall Street “herd” is still ignorant to the potential of AI and of this company…

Ignorant to the mountain of money this company could earn them…

YOU can dive in now, before its shares move higher!

The Motley Fool wrote:

“This company could make you rich!”

All told, over 1,200 companies rely on this company’s hardware and software.

Whether you’re a conservative investor, looking to lower your risk…

Or an aggressive investor, looking to capture triple- or quadruple-digit gains…

This company is a no-brainer.

That’s why, when you accept a zero-risk, 30-day trial subscription to Forecasts & Strategies…

I’ll send you a FREE copy of Dr. Skousen’s investment brief on this amazing company.

The Age of Artificial Intelligence and the Multi-Millionaires it Will Create

Plus, when you subscribe, you’ll be able to read every other investment brief Dr. Skousen has written.

In fact, after you subscribe, I’m going to send the following three investment briefs straight to your email inbox:

Special Investment Brief #1: Dr. Skousen’s Practical Guide to Making Money with Marijuana

In it, you’ll discover his top three recommendations in the exploding cannabis sector.

Each stock is a potential cash cow, offering you a unique way to profit from the ongoing pot boom:

Cannabis Cash Cow #1:

A conservative buy-and-hold stock that’s already a giant in the cannabis sector.

This $5 billion monster is the #1 distributor of equipment and supplies to marijuana growers.

By virtue of its size alone it provides you with an enormous advantage over the endless penny stocks crowding the sector.

Cannabis Cash Cow #2:

This company has a stranglehold on the Canadian pot market.

And now that Canada has legalized recreational marijuana use nationwide…

This company’s shares are expected to continue to explode.

In fact, its shares rose 13% in a single week after a recent earnings report.

That’s what typically happens when a company’s earnings grow 962% year-over-year.

Cannabis Cash Cow #3:

This company has a long story, but I’ll make it short.

This company was wrongly persecuted.

But now that it’s been completely vindicated, it’s ready to regain its former glory.

And yet, the “pros” on Wall Street are still stuck in the past, overlooking this “homerun play” that’s poised for massive long-term gains.

Right now, the company is busy buying up other cannabis companies and diversifying its product line to include medical marijuana, topicals, creams and lotions.

NOTE: Also included in this report are five marijuana companies that are absolutely toxic to your portfolios.

Special Investment Brief #2: Dr. Skousen’s 5 Favorite High-Income Growth Stocks

High-Income Growth Stock #1:

A real estate investment trust (REIT) that’s gobbling up health-related properties left and right.

It’s a brilliant way to take advantage of the “greying of America.”

So far, this REIT manages approximately 1,000 properties in 42 states, as well as 81 in the United Kingdom.

And it pays a dividend yielding over 7%. How sweet is that!

High-Income Growth Stock #2:

With a $60 billion market cap, it’s America’s largest oil and natural gas pipeline operator.

But what impresses Dr. Skousen the most about this company is the massive number of pipelines it’s built over the past 40 years.

And, with the U.S. about to become a net exporter of natural gas, this company could be sitting pretty for decades to come.

Best of all, the stock has increased its dividend every year for more than 10 straight years.

Its dividend yield is also over 7%.

High-Income Growth Stock #3:

A leading technology company that develops and licenses consumer and enterprise level software products worldwide.

It’s also a big player in cloud computing.

And its blockchain software, the technology that makes cryptocurrencies such as Bitcoin possible and so attractive to investors…

Is continuing to grow the company’s already impressive bottom line.

Although the stock is more of a growth play than an income play, the company nevertheless pays a quarterly dividend of $0.42 a share.

This is another company that belongs in every investor’s portfolio.

High-Income Growth Stock #4:

This company is one of the world’s largest metal and mineral miners.

It employs more than 50,000 people in more than 30 countries.

It mines iron ore, aluminum, copper, diamonds, gold, silver, uranium, titanium, and even salt.

And it owns and operates much of the infrastructure — railways, ships and ports — that transports these products to its global customers.

Plus, it pays a rock solid 5% dividend. Hard to go wrong with this stock.

High-Income Growth Stock #5:

Mark’s been recommending this fifth company for six straight years.

A business development company (BDC) that’s produced a total return of over 125%, including rising dividends and special payouts.

The company has already invested in nearly 200 companies, and expects 9 out of every 10 deals it signs to be highly successful.

So far, it’s been spot on!

Allowing it to increase its monthly dividend nine times since Mark began recommending it in 2012.

And note this: Among the 6,000 stocks that trade on U.S. exchanges, it’s the only one that pays a monthly dividend, and two special dividends a year. Money in the bank!

Special Investment Brief #3: The Next Healthcare Powerhouse: A 12-bagger in the Making

Odds are you’ve run across someone who suffers from a neurodegenerative disease.

Alzheimer’s, Parkinson’s, multiple sclerosis, epilepsy, meningitis, or any other debilitating disease of the spinal cord and brain.

Well, this company creates drugs that treat and combat the most debilitating of these diseases affecting the central nervous system.

Established a little over 10 years ago, it already has two approved drugs generating $250 million in annual revenues.

Three more drugs are in clinical trials.

Each one of these drugs is attacking a disease with a market value of more than $3 billion a year.

If only one of its drugs is approved, it could increase the company’s revenue 12-fold.

And if the company’s share price matches that revenue increase, you’re looking at earning 12 times your money.

A 12-bagger by any other name.

If two drugs are approved, there’s just no telling how much money you could earn.

It’s a highly speculative play to be sure, but one well worth considering.

Ok, you’ve seen with your own eyes…

Why any one of the above investment recommendations has the potential to make you legacy rich…

But especially American X — the 14th most profitable company in the world… the 8th most profitable company in the U.S…

And the company that could finally put an end to RA and all other inflammatory diseases, from cancer and cardiovascular disease to Alzheimer’s and diabetes.

A combined $350-billion-a-year market!

And now, of course, you’re wondering…

“How can I possibly afford a subscription to Forecasts & Strategies?”

Given Dr. Skousen’s award-winning ability to find uncommon and exceptional investment opportunities, like the one’s you’ve just read about…

It must be prohibitively expensive, right?

And even though I could help you become uncommonly rich, you’re also wondering…

“Do I have to be rich already to afford its $3,000 or $5,000 subscription price?”

Well, I’m not going to play games with you.

I’m not going to tease you with a price and then offer you a 50% discount.

Here’s what a 1-year subscription to Forecasts & Strategies will run you…

If you can afford it, great! You’ll be thrilled.

Because you could soon be years — and dollars — ahead of most investors.

And if you can’t afford it… well, you can’t.

A 1-year subscription to Forecasts & Strategies goes for…

Are you ready? Are you sitting down?

$49.95

Not $49.95 a day, week, or month.

$49.95 for your first year.

Why so cheap?

Baby steps.

Mark writes a number of other investment newsletters, all priced much higher and well worth every penny.

But that could be a tough sell, if you have not yet experienced firsthand how much money Dr. Mark Skousen could help you earn.

So, I decided that the wiser course of action is to introduce you first to Forecasts & Strategies.

And later, if you want to step up to his more advanced services… wonderful.

You may even want to do that in just a few months, after you see what Forecasts & Strategies has done for your portfolio.

In the meantime, I am giving you a 30-day, risk-free, all-your-money-back, if you’re not satisfied, guarantee.

Allowing you to explore everything Forecasts & Strategies has to offer, with zero risk.

Test Forecasts & Strategies. Kick the tires.

If you’re not 100% satisfied during your first 30 days, just ask and I’ll return your $49.95.

And, just so you know, with this already-discounted offer, you’re also able to subscribe to Forecasts & Strategies for two full years at a deeper discounted rate, saving you even more money.

In essence, you’ll be paying less than $4 for each issue.

You can’t even see a first-run movie for $4, and a small bag of popcorn costs more than $4 nowadays.

By contrast, each issue of Forecasts & Strategies could help you earn enough money to buy a string of movie theaters (not that I’d recommend that.)

And my all-your-money-back guarantee will still apply.

So you’re not risking a penny.

It really doesn’t make sense to not subscribe for two years and save yourself money.

But note that this entire offer is only available today through this letter.

And if you subscribe today, I’ll send you two more investment briefs as a fast subscribing bonus.

Bonus Investment Brief #1: Get a Year’s Worth of Profits in Just 5 Minutes!

Mark calls this his “SWAN” (Sleep Well At Night) Strategy.

Five stocks that have, on average, beaten the Dow Industrials and the S&P 500 for the past 18 years.

This strategy only takes five minutes to “set it up and forget it.”

Then, just come back to it later, and count your money!

These are five high-dividend-paying blue chip stocks anyone will want to own.

Bonus Investment Brief #2: Live Long & Prosper with Dr. Skousen’s #1 Biotech Pick

This company has found a way to prevent heart attacks and strokes.

It’s developed a cardiac-imaging technology that allows your doctor to see the smallest and earliest possible warning signs that something is not right with your heart.

Which helps explain why the company’s revenue has increased 1,341%.

Mark believes this company’s shares could eventually rise just as much!

But this company is not a one-trick-pony.

In fact, it has three distinct revenue streams, which is like buying three companies for the price of one!

That’s why you owe it to yourself to read this investment brief as soon as you get it.

And just remember, when you subscribe to Forecasts & Strategies…

Whether you choose the 1-year or the money-saving 2-year subscription option…

You’ll still have a full 30 days to test Forecasts & Strategies.

And if you’re not completely satisfied…

If you’re not making more money than you could on your own…

If Mark’s not teaching you how to better analyze and understand the investment markets, and what to look for in investments you’re considering on your own…

Just ask for your money back before the end of that 30th day, and we’ll quickly give you a refund, no questions asked.

Best of all, you’ll get to keep all the investment briefs I’m sending you.

So what are you waiting for? Subscribe right now!

Oh Wait, I Nearly Forgot!

In addition to receiving your monthly issues of Forecasts & Strategies…

I’ll send you a constant stream of high-value special reports.

I’ll also alert you about important investment-related events.

Every quarter, you can participate in our “for subscribers only” conference calls, containing comprehensive updates on all Forecasts & Strategies’ portfolio holdings.

In this conference call, Mark will detail how all his recommendations are performing, and what to expect from them going forward.

He will also analyze the economy, the markets and what’s moving them.

Plus, we always take live calls from subscribers like you as Mark answers your questions.

And if you can’t make the live event, we record it, so you have access to it online at any time.

In short, as a Forecasts & Strategies subscriber, you’ll have everything you need to be fully informed and on the road to making serious money!

And speaking of money…

Start making money NOW and stop reading this letter!

If you want to capture all the massive gains I’ve been telling you about, this is what you need to do – quickly!

Click the button below right now.

It’ll take you to a secure page where you can choose your subscription option…

And it’ll explain everything you’re about to receive, which includes these 7 investment briefs:

So don’t wait another second.

Subscribe and claim your 7 free investment briefs today.

I’m looking forward to seeing you on the next page!

To your unending profits,

Roger Michalski

Publisher, Forecasts & Strategies

Biography

About Dr. Mark Skousen

Mark Skousen, Ph. D., is a professional economist, investment expert, university professor, and author of more than 25 books. He earned his Ph. D. in monetary economics at George Washington University in 1977. He has taught economics and finance at Columbia Business School, Columbia University, Grantham University, Barnard College, Mercy College, Rollins College, and is a Presidential Fellow at Chapman University. He also has been a consultant to IBM, Hutchinson Technology, and other Fortune 500 companies.

Since 1980, Skousen has been editor in chief of Forecasts & Strategies, a popular award-winning investment newsletter. He also is editor of four trading services, Skousen TNT Trader, Skousen Five Star Trader, Skousen High-Income Alert, and Skousen Fast Money Alert.

He is a former analyst for the Central Intelligence Agency, a columnist to Forbes magazine (1997-2001), and past president of the Foundation for Economic Education (FEE) in New York. He has written articles for The Wall Street Journal, Liberty, Reason, Human Events, the Daily Caller, Christian Science Monitor, and The Journal of Economic Perspectives. He has appeared on ABC News, CNBC Power Lunch, CNN, Fox News, and C-SPAN Book TV. In 2008-09, he was a regular contributor to Larry Kudlow & Co. on CNBC.

His economic bestsellers include “Economics on Trial” (Irwin, 1991), “Puzzles and Paradoxes on Economics” (Edward Elgar, 1997), “The Making of Modern Economics” (M. E. Sharpe, 2001, 2009), “The Big Three in Economics” (M. E. Sharpe, 2007), “EconoPower” (Wiley, 2008), and “Economic Logic” (2000, 2010). In 2009, “The Making of Modern Economics” won the Choice Book Award for Outstanding Academic Title.

His financial bestsellers include “The Complete Guide to Financial Privacy” (Simon & Schuster, 1983), “High Finance on a Low Budget” (Bantam, 1981), co-authored with his wife Jo Ann, “Scrooge Investing” (Little Brown, 1995; McGraw Hill, 1999), and “Investing in One Lesson” (Regnery, 2007).

In honor of his work in economics, finance, and management, Grantham University renamed its business school “The Mark Skousen School of Business.”

Dr. Skousen has lived in eight nations, and has traveled and lectured throughout the United States and 70 countries. He grew up in Portland, Ore. He and his wife, Jo Ann, and five children have lived in Washington, D.C.; Nassau, the Bahamas; London, England; Orlando, Fla.; and New York.