The iShares Core MSCI Emerging Market ETF (IEMG) is an exchange-traded fund (ETF) that offers investors a chance to invest broadly in emerging markets as a whole rather than take the heightened risk of buying into a specific sector or country.

This broad-market approach involves IEMG tracking the investment results of an index that consists of all types of emerging market equities — large-, mid- and small-cap companies from around the globe that are all included in this fund. Founded in 2012, IEMG originally was viewed as a cost-effective alternative to the main emerging market benchmark ETF, the iShares MSCI Emerging Markets (EEM).

IEMG is only half the size of EEM, which has a giant market cap of $30 billion. Even so, IEMG has attracted a lot of attention in the four years since its inception and currently boasts year-to-date fund flows of almost $5 billion. One possible explanation for IEMG’s quick growth in funds under management could be its lower annual fees compared to its bigger rival. EEM charges an annual fee of 0.71%, whereas IEMG charges investors just 0.16% annually.

In terms of asset allocation, IEMG is invested almost entirely outside of the United States, with 72% of its portfolio in Asian stocks. Europe and South America account for a combined 27% of the remaining portfolio.

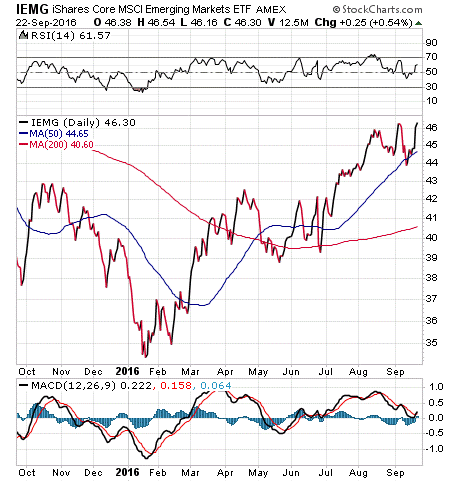

Despite the turbulence of global markets this year, IEMG has a respectable year-to-date return of 16.9%. This isn’t the strongest return among emerging markets thus far this year, but it still is impressive since emerging markets as a whole are more resistant to extreme price swings than individual sectors or countries. Investors in this fund can expect an expense ratio of 0.16% and a 2.1% dividend yield.

View the current price, volume, performance and top 10 holdings of IEMG at ETFU.com.

IEMG is fairly well diversified among different sectors, but its biggest investments are in technology, 23.18%) financial services, 21.56%, and consumer cyclical, 12.34%. The fund’s top holdings and their percentage of the portfolio’s assets include Tencent Holdings Ltd., 3.72%; Taiwan Semiconductor Manufacturing, 3.52%; Samsung Electronics, 3.46%; Alibaba Group Holding, 2.79%; and China Mobile, 1.85%.

So far, 2016 has been a year of ups and downs for many investors, but the emerging markets have been a bright spot in the financial landscape this year. If you like the idea of investing in emerging markets but aren’t thrilled to be putting your hard-earned capital at risk, consider a broad emerging market fund such as the iShares Core MSCI Emerging Market ETF (IEMG) as a possibility.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)