Today is a historic one across the pond, as Britain has made “Brexit” official by invoking a provision in European law known as Article 50.

Britain’s European Union (EU) ambassador formally triggered what is likely to be a two-year process of the United Kingdom extricating itself from membership in the European Union. And the Brits did it in characteristically subtle fashion by simply handing a letter to EU Council President Donald Tusk.

In comments following the official Article 50 trigger, Prime Minister Theresa May said that this was “an historic moment from which there can be no turning back.”

For investors here at home, the official Brexit trigger does have implications for specific exchange-traded funds (ETFs) pegged to Europe.

Over the past several weeks, our ETF Talk segment has featured several European ETFs. One reason why is because I am bullish on this market segment. However, the Brexit situation does pose a few things to think about when assessing which European ETFs might be best.

To get a better sense of the pros and cons of European ETFs, I turned to my friend and colleague Tom Essaye of The Sevens Report. Tom is pretty much an expert at all things involving the markets, but he has a particularly interesting read on Europe. Like me, he’s bullish on the segment and for the same basic reasons.

First, there is compelling relative valuation in European equities vs. U.S. stocks. Second, there continues to be central bank support from the European Central Bank, which has pursued “easy” money polices compared to the Fed. Finally, the political risks of investing in Europe, in my view, have been far too overstated.

Valuation wise, Tom explained to me that the S&P 500 now trades at the top end of historical valuations at 18.25 times 2017 earnings per share (EPS), and 17.75 times 2018 EPS. Conversely, the MSCI Europe Index is trading at 15.1 times 2017 earnings, and 13.8 times 2018 earnings. That’s a 17% and 22% discount to the U.S. index valuations, respectively.

As for central bank support, the European Central Bank still is using quantitative easing (QE), and it still plans to buy some 60 billion euros worth of bonds through December of this year. That will continue to support the EU economy, and help earnings and inflation move higher, which is European-equity positive.

On the political risk front, people have overreacted to Brexit and the potential pitfalls that could befall European equities due to political instability. I am not saying there isn’t reason for caution. However, there seems to be too much trepidation on the part of some investors when it comes to putting money to work in Europe.

So, what is the best way for investors to get long in European equities?

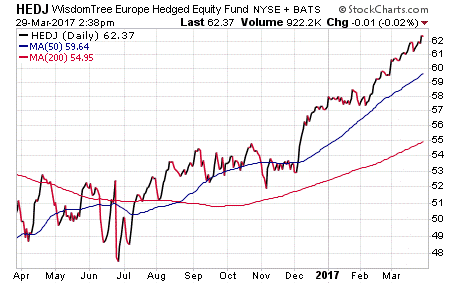

Although there are many great funds to choose from, Tom and I are partial to the ETF that we featured in last week’s ETF Talk, and that is the Wisdom Tree Europe Hedged Equity Fund (HEDJ).

There are a couple of primary reasons for the HEDJ preference. First, if you believe, as I do, that the U.S. dollar is going to appreciate over time vs. the euro, then you want the currency hedge that HEDJ offers.

Second, HEDJ is by far the most-liquid European currency hedged ETF out there. And, for those who are concerned about the any possible Brexit exposure and its negative influence on British stocks, you’re in luck, as HEDJ has virtually no British exposure (just 0.37% of holdings).

Apparently, the smart money agrees with Tom and I, as HEDJ is up 8.65% in just the first three months of the year.

If you’d like to find out more about how to profit not only in Europe, but in U.S. stocks, bonds, commodities and countries around the world with a proven plan that’s been working for investors for 40 years, then I invite you to check out my Successful ETF Investing advisory service, today!

*************************************************************

ETF Talk: Fund Focuses on Countries that Use the Euro

By Eagle Staff

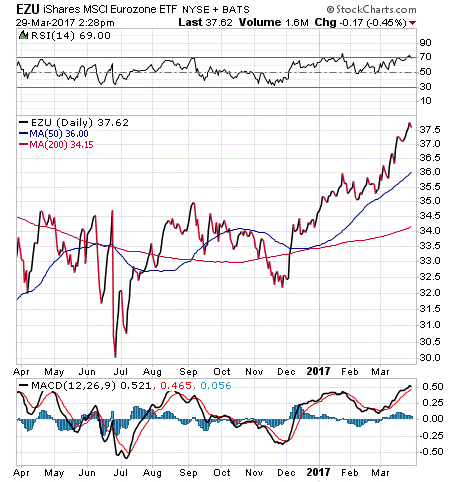

With $8.8 billion in total assets, the iShares MSCI EMU Index ETF (EZU) is the third-largest fund in the European equity markets, behind only WisdomTree Europe Hedged Equity (HEDJ) and Vanguard FTSE Europe (VGK), both of which were covered earlier in our ongoing series about European ETFs.

EZU is 83% allocated to large-cap companies, with 14% in mid caps and 2% in small caps. All of these companies are from countries that use the euro, with EZU thereby designed to exclude stocks from non-euro countries such as the United Kingdom, Switzerland and Sweden.

Since these three countries combined account for approximately half of the entire European market’s capitalization, EZU’s focus is not on the broad market, but rather concentrated on a few countries, such as France (32% of EZU’s portfolio) and Germany (29%).

Some risks to keep in mind that could affect EZU are euro-currency fluctuations and uncertainty due to national elections in Germany and France that are scheduled for later this year.

EZU has experienced ups and downs over the course of 2016, as evident in the chart below. However, it has performed well since December 2016 and its share price has climbed to new heights. As of March 2017, EZU had been trading at its highest levels since fall of 2015 and is up 9.31% year to date, versus a year-to-date 4.89% increase in the S&P 500. EZU has an expense ratio of 0.50% and a distribution yield of 2.84%.

EZU has more than 250 holdings in its portfolio, without investing more than 3% of the fund’s total assets in any single position. From a sector point of view, EZU is well diversified, with 20% invested in financials, 14.92% in industrials, 13.86% in consumer discretionary and 10.67% in consumer staples.

EZU’s top five holdings are Total SA, 2.77%; Sanofi SA, 2.53%; Siemens AG, 2.50%; SAP SE, 2.35%; and Bayer AG, 2.33%.

If you are seeking exposure to developed market countries that use the euro, I encourage you to look at the iShares MSCI EMU Index ETF (EZU) as a possible addition to your portfolio.

As always, we are happy to answer any of your questions about ETFs, so do not hesitate to send us an email. You just may see your question answered in a future ETF Talk.

****************************************************************

A Dangerous Glitch in the ETF Matrix

Last week’s market sell-off largely overshadowed an important news item that largely went unnoticed. That news was a glitch at the New York Stock Exchange’s Arca platform, where most exchange-traded funds (ETFs) are traded, that resulted in 341 securities not completing their closing auction successfully.

According to media reports, it was a botched software update that caused many popular ETFs, including the SPDR Gold Trust (GLD), to fail to settle at the closing auction.

The closing auction is held in the final minutes before the market’s 4 p.m. close. This final flurry of trading is critical, as it determines the daily settlement price for each stock or ETF. It’s also important because big investment houses and big traders frequently pile into the closing auction with big orders as the trading day nears.

This “glitch in the Matrix” (a 1999 sci-fi film classic reference) is by no means the first such glitch that’s negatively affected ETFs. On August 24, 2015, a massive glitch in the NYSE trading matrix caused many ETFs to open 30%, 40%, even 50% lower than their previous close.

I recall that moment of high anxiety quite vividly, as Doug Fabian and I scrambled to make sense of what was happening, and to protect any positions we had. Fortunately, Successful ETF Investing subscribers had a Fabian Plan Sell signal on at the time, so we had little exposure to the glitch.

Still, the idea that something like a software update can cause real-money losses to investors is something that we always must be on guard against. It’s also something that only gets corrected if people are aware of it, and only if we demand corrective action be taken.

That’s what I’m doing today in writing about this issue, and that’s why I want you to know about it as well.

****************************************************************

The Paine of a Real Man

“The real man smiles in trouble, gathers strength from distress, and grows brave by reflection.”

— Thomas Paine

Perhaps my favorite Founding Father, Thomas Paine was a man of towering intellect. In this week’s quote, he offers up a few keys to being a “real man,” as in the type of man I certainly strive to be. So, smile during times of trouble, gain strength from pain and be heroic in thought. In short, be a real man.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)