Earning above-market returns without taking on more risk than the market is nearly impossible, according to the Efficient Market Hypothesis (EMH).

Therefore, buying and holding low-cost index market funds appears to be the only winning investment strategy. However, some investors outperform the market consistently enough to explore whether any EMH anomalies can be exploited to beat the market.

While data from mutual-fund returns seems to support a weak form of the EMH, several well-known anomalies, or deviations from the expected behavior, complicate the picture.

Three generally accepted “anomalies” of EMH are (1) the size effect, (2) the valuation effect and (3) the momentum effect.

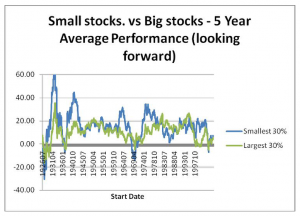

- Research on the size effect shows that companies with smaller market capitalizations have historically outperformed those with large market capitalizations, even after controlling for their higher risk. Research conducted by Eugene Fama and Kenneth French shows that stocks with market capitalizations in the smallest 30% of companies in the data set outperformed those with market caps in the largest 30% by an average of 4.5% a year since 1926, when the data set begins. Small stocks had an average annualized return of 15.4% vs. 10.8% for large stocks during that time. While quite impressive, this outperformance was volatile, as the chart below shows that there were many five-year periods when large stocks actually outperformed small stocks. In fact, while small stocks outperformed impressively overall, they did so in only 49% of all individual months.

- Research on the valuation effect shows that companies with low price/book (P/B) multiples have historically outperformed those with higher P/B multiples. Again using research from Kenneth French’s Dartmouth website, a portfolio that bought the lowest 30% of stocks by the P/B ratio every year and held them for a year would have returned an average of nearly 18% a year, versus only 12% for an equally weighted portfolio of stocks with an average multiple. This is quite significant outperformance. Again, this outperformance did not persist over every time period.

- Research on the momentum effect shows that companies that have performed the best over the past six months to one year tend to perform better than the set of companies that have performed the worst over a similar period.

Of course, the EMH implies that as soon as an anomaly becomes popularized, it will likely cease to exist. Imagine that stocks always went up on Fridays and down on Mondays. If this anomaly became widely known, many would try to buy stocks on Thursday afternoon right before the close and sell them at a similar time on Friday afternoon to capture this Friday bounce. But if everyone tried to buy shares on Thursday afternoon and sell on Friday afternoon, by simple supply and demand, prices would have to go up on Thursday and down on Friday. The Friday boom would turn into a Friday bust.

Investors who try to take advantage of any proclaimed anomaly must be very aware of the potential for this dynamic to show up again and again. As soon as it appears that “easy money” is on the table, thousands of aggressive, return-seeking fund managers will immediately try to grab it.

Implications for Individual Investors

While the degree to which stock prices are efficient remains a subject of debate, the evidence from investor returns shows that for the majority of individual investors, they might as well be. Market efficiency has some sobering lessons for aspiring stock-pickers who remain unconvinced of its full validity:

- If something seems like “easy money,” pause. Remember that thousands of other professional investors have observed the same facts as you and decided to pass. Ask yourself what you could be missing.

- Always approach an investment by first understanding why the stock is trading like it is. Only then consider whether you think the market is right or wrong. For instance, do not buy a stock that is selling at a discount to its industry on a number of metrics just because it looks cheap. First, understand why that stock may be cheap, then develop your own view on whether the valuation is justified or not.

- Remember that there is always someone else “on the other side of the trade.” Could this person be more informed than you or know something you do not? What do you know or realize that the person selling the stock to you is missing?

Therefore, the three main EMH “anomalies” — the size effect, the valuation effect and the momentum effect — must be used in conjunction other market analysis concepts and tools to determine whether a particular stock is a “buy”. A factor to consider is –the time value of money, which will be covered in a separate article.

Billy Williams is a 25-year veteran trader and author. For a free strategy guide, “Fundamentals for the Aspiring Trader,” and to learn more about profitable trading, go to www.stockoptionsystem.com.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)