A niche exchange-traded fund (ETF), the Guggenheim China Real Estate ETF(TAO), tracks a cap-weighted index of investable Chinese and Hong Kong real estate companies and real estate investment trusts (REITs).

This is a pure-play fund which has its entire investment portfolio in the Chinese real estate equities market. However, TAO is not exactly a mainland China play, as 80% of TAO’s 50 holdings are Hong Kong companies.

TAO offers liquid access to the Chinese real estate sector and provides growth opportunities based on major urbanization trends that are propelling the demand for real estate in China. Factors to watch for are the increasing strength in the big banks of China and China’s monetary policy of relaxing mortgage rates and down payment requirements, which are crucial for house buyers.

TAO has a relatively high expense ratio of 0.70%, possibly due to its risky nature, and can have high transaction costs as it is thinly traded. The fund has $55.96 million assets under management and a dividend yield of 1.99%. This figure puts it below my recommended threshold for investment, but its strategy is one that is worth bringing to your attention.

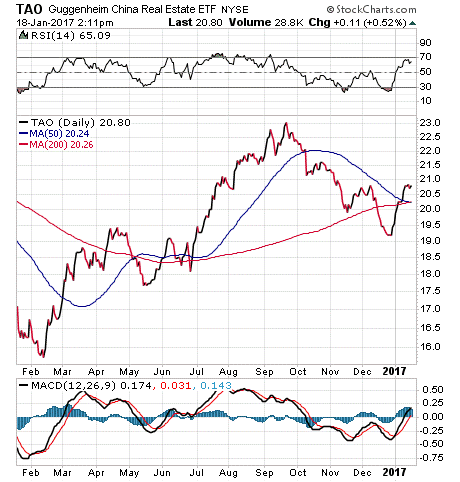

In the graph below, you can see that TAO pounced higher after a slow start at the beginning of 2016. The price of the fund surged from a low of around $16 to a high of $23 before settling at a price of around $21 recently. The fund’s one-year return was 15.30%, versus the S&P 500’s one-year return of 11.96%.

TAO’s top five holdings are Hongkong Land Holdings Ltd., 5.21%; The Wharf Holdings Ltd., 5.19%; Sun Hung Kai Properties Ltd., 5.05%; China Overseas Land & Investment Ltd., 5.02%; and Link Real Estate Investment Trust, 4.93%. The top 10 stocks have historically represented a significant percentage of this ETF. As of now, they make for roughly 50% of the fund’s total assets.

This fund is best considered as a high-risk, high-reward play for investors seeking further exposure to the Hong Kong region but wanting to stay away from the large, multinational holdings. A potential investor would need a strong belief in the further urbanization in China and Hong Kong, as well as the continuing appreciation of current real estate properties.

If this sounds like you, I encourage you to look to Guggenheim China Real EstateETF (TAO) as a starting point for your research.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)