ARK 3D Printing (PRNT) is a unique exchange-traded fund (ETF) that focuses on the advent of one of the biggest technological advancements of our time.

3D printing refers to the process of creating a three-dimensional objects. Theoretically, almost anything can be “printed,” ranging from a slice of pizza to electric cars.

PRNT is the first ETF to track an index composed of stocks that are directly involved in 3D printing and 3D-printing-related businesses. Those businesses include printing software, hardware, printing centers and scanners. The fund is roughly two-thirds invested in U.S. equities and one-third in overseas markets (mostly Europe), but could expand its holdings to several Taiwanese technology companies.

Drawing strength from the inherent push for technological advancement around the world, managers of PRNT are expecting 3D printing to revolutionize manufacturing. As the technologic basis for 3D printing gradually enters a more mature phase, some analysts estimate that 3D printing soon will appeal to a wider audience, which would be excellent news for PRNT.

In September 2016, General Electric (GE) spent $1.4 billion on two large acquisitions of 3D printing companies Arcam and SLM Solutions. GE also plans to bring 1,000 3D printing machines online over the next decade, which is huge.

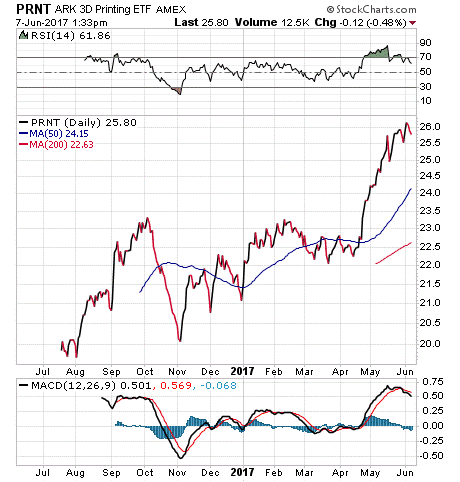

Year to date, PRNT has returned 13.80% to beat out the S&P 500’s return of 8.63%. From the chart below, you can see that the price of PRNT started off the year in an uncertain fashion but has sharply spiked in the last month by about 16% to trade in the $26 range. PRNT has an expense ratio of 0.66% and does not pay a dividend.

Top holdings for PRNT include 3D Systems Corp (DDD), 6.59%; ExOne Co (XONE), 6.48%; MGI Digital Technology (ALMDG), 6.43%; Stratasys Ltd. (SSYS), 5.57%; and SLM Solutions Group AG (AM3D), 5.38%.

If you believe in the strength of the growing 3D printing industry, I encourage you to look to ARK 3D Printing (PRNT) as a possible addition to your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)