The Vanguard Dividend Appreciation ETF (VIG) seeks to hold shares in companies that feature rising dividend yields.

Specifically, VIG is designed to track the performance of companies that have increased their annual dividends for 10 or more consecutive years. This fact distinguishes VIG from many other dividend funds, such as the Vanguard High Dividend Yield ETF (VYM), which typically focuses on stocks that have the highest current yield.

In fact, VIG will exclude companies from its portfolio if it seems there is little potential for increasing dividends, even if the current yield is high. As a rule, VIG avoids real estate investment trusts (REITs), which do not benefit from favorable tax rates on qualified dividends.

A steady stream of income in the form of dividends has helped VIG avoid some market weakness from time to time. For example, during the 2008 financial crisis, the fund decreased by around 30%, while the S&P 500 fell 37%.

VIG is one of the most popular exchange-traded funds (ETFs) in the U.S. market, with $34 billion in net assets and an average daily trading volume of $63.91 million. VIG is fully invested and employs a passively managed, full-replication strategy that focuses on large equities, with the philosophy that income-producing equities will outperform other types of equities over the long term.

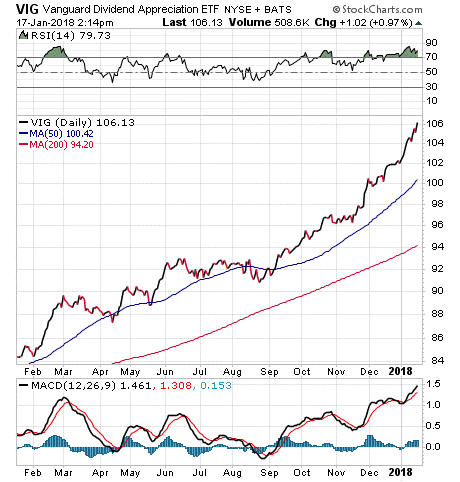

VIG has a dividend yield of 1.83% and a low expense ratio of 0.08%, making the fund a cheap one to hold. Year to date, the fund has risen 3.02%. Over the past 12 months, VIG jumped an impressive 24.77%.

The fund’s top five holdings are Microsoft Corp. (MSFT), 4.73%; Johnson & Johnson (JNJ), 4.05%; PepsiCo Inc. (PEP), 3.84%; 3M Co (MMM), 3.57%; and Medtronic PLC (MDT), 2.82%.

The fund is 30.07% invested in industrials and 15.68% in health care. Other areas of focus are consumer defensive, technology and financial services.

For investors who are in search of long-term income with potential dividend appreciation, the Vanguard Dividend Appreciation ETF (VIG) may be worth a look.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.