With the Fed widely expected to raise interest rates several times in 2018, we turn our attention to an exchange-traded fund (ETFs) that could benefit from the rate hikes.

The ProShares UltraShort 20+ Year Treasury (TBT) stands out as a strong contender. As bond prices and interest rates are inversely related, this means that an increase in interest rates leads to a decrease in bond prices and vice versa. Because of its bond bear nature, some investors consider TBT a good hedge against inflation.

As its name implies, TBT shorts, or bets against, U.S. Treasury bonds with maturities greater than 20 years. TBT uses leverage to provide investors with twice the inverse of the daily performance of the Barclays Capital 20+ Year U.S. Treasury Index. Note that TBT resets its holdings daily, meaning that its holdings are actively evaluated on a day-to-day basis and changed by management as deemed necessary.

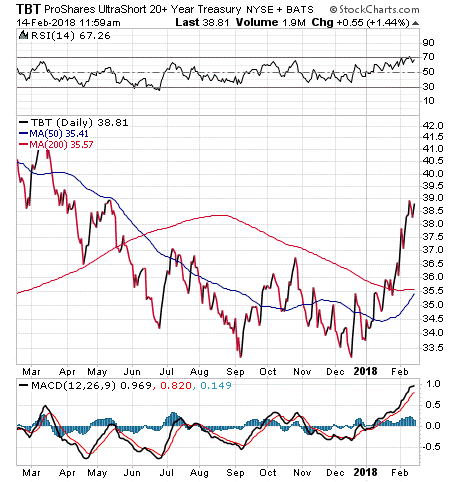

In the chart below, you can see that TBT has been on a downward trend since the beginning of 2017. However, that trend has reversed in 2018, thanks to the Fed’s plan to gradually raise rates. TBT’s one-year return is -1.96%, but its year-to-date return is 14.24%. TBT has an expense ratio of 0.90%.

As an inverse ETF, TBT’s portfolio makeup is very different from regular ETFs. Because it shorts Treasuries rather than holds them, the fund has “negative” holdings in its portfolio. As of Feb. 12, TBT holds -28.57% in Swap Goldman Sachs International bonds, -24.60% in Swap Societe Generale bonds and -22.82% in Citibank bonds.

For investors who are seeking a way to benefit from the upcoming Fed interest rate hikes, I encourage you to look into ProShares UltaShort 20+ Year Treasury (TBT).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)