Last Friday’s negative trading session for stocks, which all but erased any gains for the week, left a burn mark on the ever-resilient bullish sentiment that has characterized the primary trend.

Global trade matters greatly, and the prospect of a real and escalating trade war with China has made its way into the fabric of current market psychology. Let me note up front that all four major averages have held their Feb. 9 lows.

The Dow, S&P, Nasdaq and Russell 2000 remain in a primary uptrend. The extreme volatility lately has shaken out a lot of nervous money, but trading volume started to lighten up last week, signaling that seller exhaustion is setting in. China’s President Xi Jinping will give a wide-ranging speech Tuesday at the Boao Forum, where there are high hopes that he will outline market access reforms amid the trade tension.

Markets caught a huge bid last Wednesday from newly appointed National Economic Council Director Larry Kudlow’s remarks that any tariffs would take several months to implement and that there is time to find common ground to avert tariffs altogether.

What followed caught Mr. Kudlow and the market flat-footed, as President Trump threatened to impose an additional $100 billion in tariffs on Chinese imports. This was followed by Treasury Secretary Steven Mnuchin implying that “there is potential of a trade war” in his interview with CNBC on the situation. Mnuchin stressed that the objective was to rein in the trade deficit and pressure China on the decades-long practice of stealing American intellectual property.

The upheaval in investor sentiment is not simply because President Trump is trying to create a more level trading relationship with China. This is a bold attempt to right the wrongs of preceding presidents, who chose not to hold China responsible for IP abuses and for requiring companies to reveal trade secrets for access to the Chinese market. However, when American companies ship raw materials to China and have them assembled there for a fraction of the labor cost that it would be here, those same assembled and packaged goods that are exported back to U.S. markets are factored into the U.S. trade deficit.

So, it’s not just products from China-owned companies that are 100% of the problem. American products, such as Apple’s iPhones, are considered imports from China, and it will take a lot of creative bargaining to figure out what is really a fair set of trade terms.

You’d think that the folks that own and operate Silicon Valley would be cheering loudly from the sidelines that Trump is fighting to protect their trademarks, innovations, secret sauces and global distribution franchises, but not so. The ultra-hyper-liberal groupthink that permeates Silicon Valley just can’t bring itself to do so. The political media has clouded the thinking of those making billions of dollars from cloud computing. For all his foibles, the reality is that Trump is trying to protect the future of American innovation.

The main problem I see in this geopolitical quagmire is that China operates by a different moral code. More accurately, it does not have one. Let’s never forget that we’re dealing with a Communist Party-led government that will say anything and do anything to gain its long-term aims of global economic and military leverage in all its dealings. Seizing and stealing intellectual property and fomenting cyber warfare against U.S. companies and government agencies is the modus operandi at all levels of the Chinese government. Allowing this behavior to flourish unchecked for all these years makes the challenge of reining in these abuses that much more difficult. The idea of “we’re not going to take it anymore” doesn’t resonate with China’s leaders.

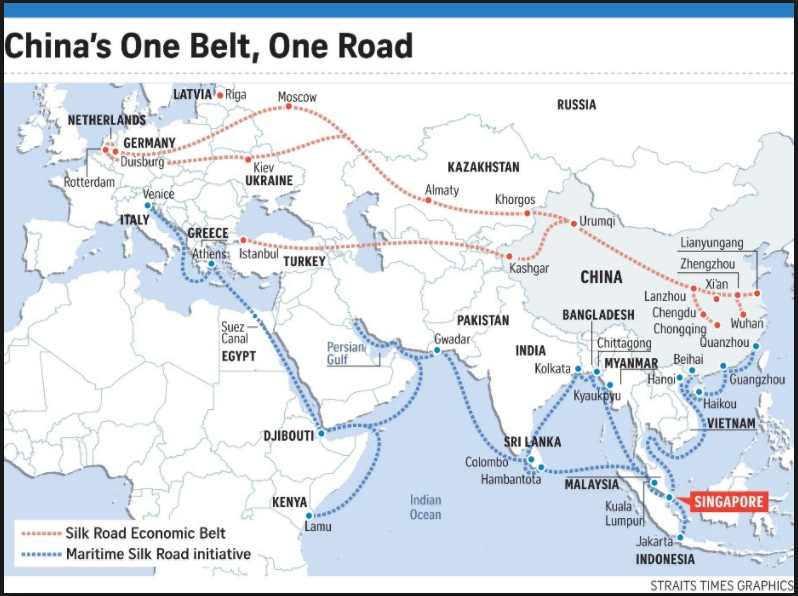

China has an $8 trillion plan in place to dominate global trade. The country already has partnered with 60 countries, many of which are authoritarian and corrupt military regimes. The result is large Chinese infrastructure investments to expand both land and sea trading routes throughout that part of the world, in which 60% of the world’s population resides. This is called the Belt and Road Initiative (BRI) and it spans three continents, and it is also how China plans to become the world’s next superpower — by controlling trade on its terms.

China is financing all these projects by issuing loans to those nations that sign up for various infrastructure, pushing them as “shared” efforts where there is a “win-win” outcome for all. Terms of the deals include the use of Chinese laborers to feed China’s massive construction industry. Financing from the West typically involves meeting high ethical standards and lengthy public disclosures, which China bypasses for its long-range goals. So, it’s no surprise that the BRI has been a big hit with less democratic countries.

The BRI essentially has two parts. The first, the economic belt, is made up of six corridors that direct trade to and from China. These corridors include railways, bridges, power plants — basically anything that makes it easier for Europe, Asia and Africa to trade goods with China. The second part, the maritime silk road, is a chain of seaports from the South China Sea to the Indian Ocean to direct maritime trade to China.

Here is the rub. As part of the terms of the partnerships crafted by China’s government, if the nations that borrow the money can’t pay back those loans, China assumes control of those projects. You see, there is more to the BRI than just economics. A case in point is that China loaned $1.5 billion to Sri Lanka for the construction of a deep-water port. It was a key stop in the maritime Silk Road. Sri Lanka defaulted on the loan in 2017. As a result, Sri Lanka gave China control of that port as part of a 99-year lease.

China now also controls the strategic port in Pakistan, where it has a 40-year lease. It is pushing for a similar agreement in Myanmar and just opened an actual Chinese naval base in Djibouti. It is part of what is called the String of Pearls, a plan for eight naval bases to control trade throughout that part of the world and coerce western nations into favorable terms to access those markets.

While this ambitious global pursuit by China is being closely monitored, the first thing we need to see is some real progress in market reforms that conform to World Trade Organization (WTO) ethics. As a member of the WTO, China has to start acting more like a first-world player instead of its former third-world status. To that end, the world watches and waits to see how all this unfolds in the weeks and months ahead.

The best way to cash in on market volatility is to sell option premium back to the market. When the market endures extreme volatility, option premiums expand to make them more attractive to sell for bigger profits. My Quick Income Trader advisory service takes an underlying stock, such as Intel (INTC), and recommends a covered-call trade on the stock itself, while also recommending a naked put option trade.

A stock as stable as Intel provides peace of mind because of its blue-chip status in the market, but it also offers a way to carve out excellent short-term cash generation by selling puts and calls every month or two for double-digit-percentage returns. That’s extraordinary in a super choppy market, but it is exactly the kind of strategy that thrives during periods of high volatility. Take a tour of Quick Income Trader by clicking here to see how equity capital can work overtime in the best stocks where volatility makes for a robust tailwind for profit growth.