A stock market crash is no laughing matter. So, what’s with today’s seemingly irreverent headline? Well, because a stock market crash is eminently survivable if you are following the proper investment plan.

As you likely know, Q4 2018 was a horrible one for stocks. On a total return basis, the S&P 500 plunged 13.52% in the quarter. That was the worst quarterly decline since Q3 2011. We also saw the broad-based measure of domestic equities dip into official bear market territory in Q4. A bear market is defined as 20% off the most-recent highs.

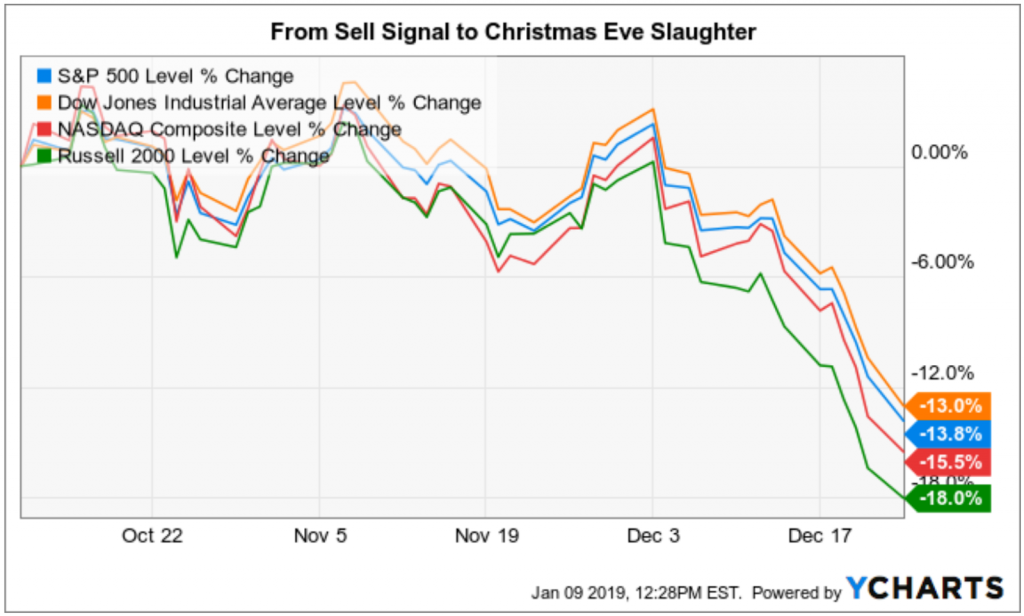

The worst of the damage in stocks occurred from early October through late December, and specifically that Christmas Eve slaughter in stocks that took the major average down nearly 3% across the board.

Take a look at the chart here of the Dow Industrials, S&P 500, NASDAQ Composite and Russell 2000 from Oct. 11 to Dec. 24.

As you can see, markets took a huge dive over this condensed, roughly 10-week time frame. So, if you were in stocks during this most bearish of periods, you’ve likely felt the pain and sorrow that comes with loss (at least, paper losses).

Yet what’s so special about Oct. 11? Why did I choose to highlight this particular day to make my point?

The reason why is because that was a pivotal day for subscribers to my Successful Investing advisory service.

You see, that was the day that our investment plan that tracks domestic equities flashed a “sell” signal. So, the following day, Friday, Oct. 12, I issued a sell signal to subscribers instructing them to exit their broad-based equity allocations and move to the safe harbor that is cash.

How did I know that, beginning Oct. 12, the market would continue its double-digit-percentage slide through Dec. 24? I didn’t.

Yet what I did know is that by adhering to an investment plan that serves as a de facto “safety switch” on the next stock market crash, I was able to help my subscribers move out of harm’s way and, thereby, avoid taking a big portfolio hit.

Now, in the final week of 2018, as well as in the first week or so of 2019, stocks have come roaring back. The S&P 500 now is up some 10% from that Christmas Eve low. That’s good news for investors, but it’s by no means enough to signal an “all clear” in markets.

Sure, Federal Reserve Chairman Jerome Powell appears to have softened his stand on interest rate hikes and balance sheet unwinding. And, the December jobs report helped buttress one of the two pillars holding the bull market up in 2018, i.e. strong economic growth. These two developments helped the bull case for equities.

Yet for us to be able to declare an all clear, we need to see Q4 earnings come in strong. Fortunately, we won’t have to wait much longer to find out, as the first round of significant earnings results will begin next week.

If things come in strong, we could see the early 2019 gains continue. If, however, the data is worse than anticipated and/or if companies significantly lower their respective 2019 forecasts, then this year’s nascent rally may fall to earth before it achieves escape velocity.

If that happens, there will be a segment of investors out there staying calm and steady in the face of adversity, and those will be the investors following the right investment plan that allows them to laugh at a stock market crash.

Another name for those investors is subscribers to Successful Investing.

**************************************************************

A Deeper Burn

“If you be pungent, be brief; for it is with words as with sunbeams – the more they are condensed the deeper they burn.”

— John Dryden

The poet reminds us that the power of words, and indeed ideas, often is in the way they pierce and burn into the mind. Remember that the next time you hear a politician or pundit saying a lot of words that amount to virtually nothing.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)