The Health Care Select Sector SPDR Fund (NYSEARCA: XLV) is an exchange-traded fund that can give a prospective investor access to the segment of the global economy that is involved with health care.

XLV specifically tracks the Health Care Select Sector Index, which, in turn, attempts to provide an effective representation of the health care sector of the S&P 500 Index. Currently, the fund’s assets are divided among companies that are involved in pharmaceuticals; 43.42%, health care equipment and supplies; 31.17%, health care providers and services; 17.44%, biotechnology and medical research; 5.75%, food & drug retailing; 1.50%, machinery, equipment and components; 0.55% and collective investments; 0.16%.

Almost all the companies that make up the fund’s portfolio are based in the United States. One of the things that adds to XLV’s allure is the fact that this ETF is the oldest and largest fund in the U.S. health care segment. Furthermore, the fact that the daily dollar value of its traded shares averaged over the past 45 days is $954.38 million means that this fund’s level of liquidity is quite high. This, in turn, lets XLV provide investors with highly liquid exposure to high-end health care names.

This fund’s top holdings includes Johnson & Johnson (NYSE: JNJ), United Health Group Inc. (NYSE: UNH), Pfizer Inc. (NYSE:PFE), Merck & Co. (NYSE: MRK), Abbott Laboratories (NYSE: ABT), Medtronic Plc. (NYSE: MDT), Thermo Fisher Scientific (NYSE: TMO), Amgen Inc. (NASDAQ: AMGN) and AbbVie Inc. (NYSE: ABBV).

Readers who subscribe to my Successful Investing, Intelligence Report, Fast Money Alert or Bullseye Trader trading alerts might recognize some of those companies!

The fund currently has more than $17.74 billion in assets under management and an average spread of 0.01%. It also has an expense ratio of 0.13%, meaning that it is less expensive to hold than some other ETFs.

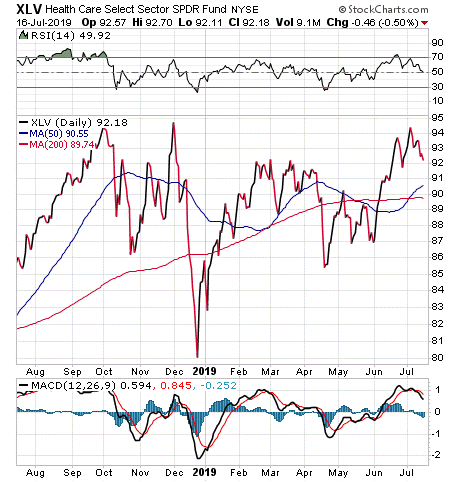

This fund’s performance has been solid in both the short and long terms. As of July 16, XLV is up 0.95% over the past month, up 2.93% over the past three months and 7.25% year to date.

Chart Courtesy of stockcharts.com

In short, while XLV does provide an investor with the ability to profit from the world of health care, the sector may not be appropriate for all portfolios, especially given the current dispute about health care funding in the United States in the run-up to the 2020 Presidential Election. Thus, interested investors always should do their due diligence and decide whether the fund is suitable for their investing goals.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)