The devastating wealth destruction that has been caused by the coronavirus is unprecedented. And as bad as it’s been for the equity markets, we do know that when the virus is defeated, the buying will begin again. When that happens, there will likely be a “V-shaped recovery” that will send some of the highest-quality sectors higher. The V-shaped rebound also will likely send some of the most beaten-down market sectors higher as well.

Over the next several weeks, the ETF Talk will feature several funds that are likely to do well when the market rebounds. Leading things off is a fund that’s pegged to the technology sector and one that offers direct exposure to semiconductor chipmakers. These are the hardware stocks that develop, manufacture and power the brains behind all our technological devices.

The VanEck Vectors Semiconductor ETF (NASDAQ:SMH) tracks a market-cap-weighted index of 25 of the largest U.S.-listed semiconductor companies.

Since it only holds companies that are listed in the United States, it is easier to trade, but has a somewhat limited scope. SMH allocates about one-third of its portfolio to Intel NASDAQ:INTC) and Taiwan Semiconductor (NYSE:TSM). Still, with only 25 holdings, the fund is a highly concentrated play on the market.

As one of the most liquid semiconductor exchange-traded funds (ETFs) on the market, SMH trades in large volumes with penny-wide spreads to match, and its underlying liquidity is ideal for block traders. It’s also an efficient fund with a modest expense ratio and reliable tracking. It appears to be a strong play in the semiconductor space for those who are willing to accept the extra exposure to the United States.

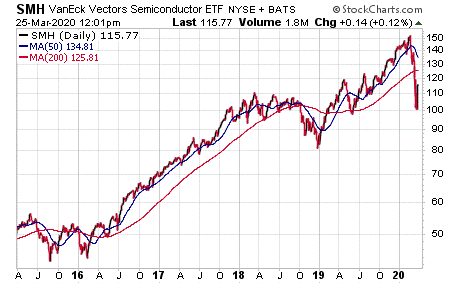

With the recent state of the market, SMH is available at a discounted price. As you can see in the chart below, SMH has been trending upwards for a long time and has shown its ability to weather market corrections.

Chart courtesy of StockCharts.com

The fund has $1.84 billion in assets under management, a 0.2% spread and a 0.35% expense ratio, meaning that it is less expensive to hold relative to other exchange-traded funds. SMH shares are trading around $115, down from a 52-week high of $152.62. The fund has a distribution yield of 1.61%. Its next distribution date is on Dec. 21.

In short, SMH is a concentrated, predominantly U.S.-based ETF consisting of mega-cap semiconductor companies. Due to being heavily weighted in the United States, the fund has a somewhat narrow scope. However, investors who are looking to gain exposure to the semiconductor space should consider this fund.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)