(Note: First in a series of environmental, social and governance (ESG) ETFs)

The iShares ESG MSCI U.S.A. ETF (ESGU) tracks an index composed of U.S. companies that have been selected and weighted for positive environmental, social and governance (ESG) characteristics.

ESGU invests in companies with strong ESG traits, while maintaining an overall market-like portfolio. Companies in the broad MSCI USA Index are rated on risk factors related to environmental (carbon emissions, water use and toxic waste), social (health and safety, labor management and sourcing) and governance issues (corruption, fraud and anti-competitive practices).

Portfolio optimization software is used to maximize the fund’s stake in highly rated companies, while also staying true to market-like exposure. In addition, the fund completely excludes tobacco companies, producers of certain weapons (landmines and bioweapons) and companies embroiled in “severe business controversies.”

The fund is competitively priced for its exposure. However, a distinct lack of interest from investors can make the fund difficult to trade at the retail level and significantly raises the risk of closure. Prior to June 1, 2018, the fund tracked the MSCI USA ESG Focus Index.

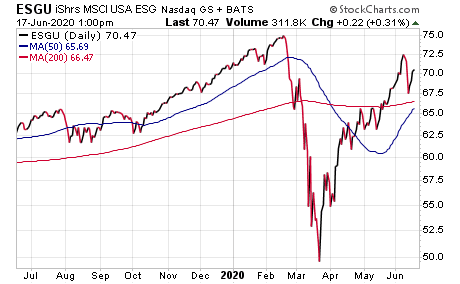

Although the risk involved with ESGU might deter some investors, you can see its general positive uptrend, aside from late 2019 and March 2020, in the chart below.

The fund’s top five holdings are in Apple (NASDAQ:APPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Facebook (NASDAQ:FB) and Alphabet (NASDAQ:GOOGL). Each of those holdings accounts for less than 6% in the portfolio. Its top sectors are technology (32.51%), health care (14.97%), consumer cyclicals (12.69%), financials (12%) and industrials (8.58%).

Investors who want exposure to higher-rated environmental, social and governance companies, while accessing large- and mid-cap U.S. stocks, may want to consider this fund. ESGU seeks similar risk and return to the MSCI USA Index, while achieving a more sustainable outcome.

It can be used as a sustainable building block for the core of your portfolio at a low cost. However, I urge all potential investors to conduct their own due diligence in deciding whether or not this fund fits their own individual portfolio goals.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)