Real estate investment trust (REIT) CoreCivic (NYSE: CXW), of Nashville, Tennessee has taken a massive hit to its stock price in recent months.

This drop comes after the announcement that CoreCivic will suspend its quarterly dividend payouts as the company explores a restructuring and capital reallocation. This news came as a big surprise to many investors who were expecting payouts that would produce a dividend yield of 17.89% this year.

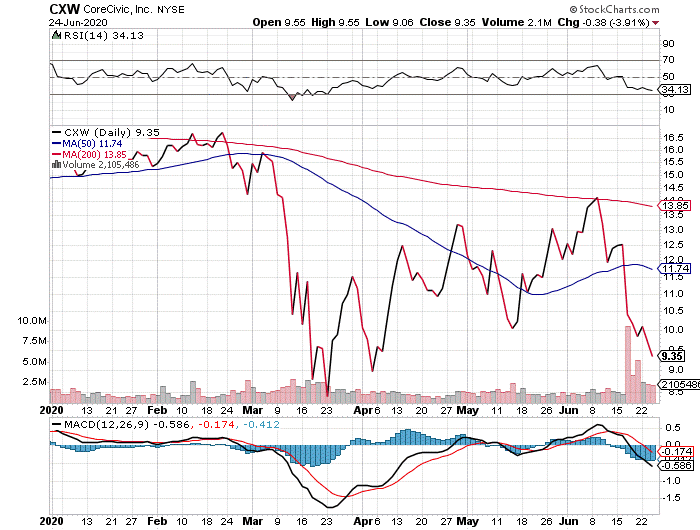

Performance of CoreCivic

CoreCivic owns and operates 65 state and federal prisons and detention centers across the nation. The company, formerly known as the Correction Corporation of America, endured a 19.20% drop in its share price this week following a 42.09% decrease during the last six months. REITs are typically seen as sound investments due to the constant demand and profitability of real estate. CoreCivic’s plummet is uncharacteristic of REITs, which usually perform well in slow economies.

Chart courtesy of www.StockCharts.com

A Series of Stable Financial Earnings

The initial suspicion regarding CoreCivic’s drop in stock price was poor financials earnings, however the company has actually performed well amid Covid-19. Revenues for first-quarter 2020 ended on March 31 came in at $491.1 million, marking a minimal 1.34% decrease from the company’s revenues for the fourth quarter of 2019.

Net income for first-quarter 2020 was $32.06 million, a 23.61% decrease from net income of $41.97 million in fourth-quarter 2019. This is quite a substantial decrease; however, this can be largely attributed to poor performance across the economy as a whole.

CoreCivic Announces It Will Suspend Quarterly Dividends

In a press release on Wednesday, June 17, 2020, CoreCivic’s President Damon T. Hininger made a statement regarding the state of the company. In the statement, Hininger said, “We are a financially strong company. Nevertheless, our debt and equity securities have been trading at significant discounts to their historic multiples in recent years and to multiples applied to other real estate asset classes for many years. We do not believe these trading prices properly reflect our stable cash flow generation or the value of our real estate.”

President Hininger then announced that CoreCivic would suspend quarterly dividends while reassessing capital allocation to move the company forward through difficult times. As a REIT, CoreCivic is required to pay at least 90% of its earnings in dividends. The temporary suspension of dividend payouts largely can be attributed to its sudden drop in stock price

Future Outlook for CoreCivic

The company currently is undergoing an examination of alternative corporate structures to increase flexibility in allocating free cash flow (FCF) to funding opportunistic growth opportunities and return of capital to shareholders. CoreCivic’s board of directors expressed that it is “confident” that the suspension of dividends and reallocation of capital will put the company back on track for future growth.

What This Means for Investors

While the news presented in the June 17 press release does not appear promising in the short term, it is not necessarily reason to panic. CoreCivic stated that the actions taken on dividends will not impact the company’s position as a REIT for the 2020 tax year and noted stable earnings are always a welcome sight amid the current state of the market.

This decision by CoreCivic should prove beneficial in the long run. However, do not expect to see a firm resolution on the matter for at least a few months. REITs also historically are held in high regard by investors for their competitive total returns and long-term capital appreciation.

Jaxon Kim is an editorial intern with www.Stockinvestor.com and www.DividendInvestor.com.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)