(Note: first in a series on hedged-equity, low-volatility ETFs)

Volatility is a familiar and unavoidable reality in today’s market.

As any seasoned investor understands, market volatility can send a portfolio into a tailspin, as breaking even requires a market surge and restoring a portfolio’s original value takes an even bigger market boost. To combat volatility attacks, a handful of low-volatility portfolios have been popping up in the exchange-traded fund (ETF) space.

Their appeal has continued to grow as market fear has increased. However, while there is proof that a low-volatility portfolio can and will outperform conventional index products through keeping fund declines in check, that strategy requires patience and well-timed investments.

So, the problem becomes how can an investor capitalize on reward produced by a low-volatility ETF, while avoiding potentially major risks of such a fund strategy?

Transamerica Asset Management, along with Milliman Financial Risk Management, have partnered up to sub-advise the DeltaShares S&P 500 Managed Risk ETF (NYSEARCA:DMRL). The ETF is made up of a fleet of portfolios that adjusts equity exposure based on realized market volatility, as opposed to future or potential market volatility.

DMRL uses a rules-based index methodology, created by Milliman, to lower each of its fund’s exposure to the relevant S&P 500 index portfolio, whenever annualized volatility spikes above 22%. The index portfolio is made up of three subcomponents: equity, fixed income and cash.

The targeted equity component tracks the S&P 500 index, the fixed income component is comprised of the most recent five-year Treasury note and short-term Treasury bills and the cash component follows the zero-to-three-month Treasury bill index. In short, when the 22% spike is hit, it triggers a reallocation of funds from stocks, into the reserve assets made up of the three subcomponents above.

The ETF has an expense ratio of 0.35% and $369.41 million in assets under management. The open-ended fund has a distribution yield of 1.25%, and its next distribution date is Sept. 23. The fairly new fund, created in 2017, has a 6.66% three-year daily total return, a 3.78% one-year daily total return and a lagging year-to-date loss of 4.08%, which is not a complete surprise as the market has been fraught with volatility lately.

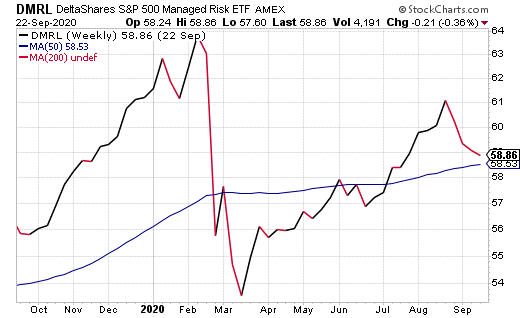

As can be seen from the chart below, DMRL has a relatively steady 50-day moving average (MA). Similar to many other funds, DMRL felt the March lows but has recovered substantially. As of Sept. 22, its weekly moving average has surpassed its 50-day MA.

Courtesy of Stockcharts.com

While the majority of the fund’s composition of is made up of bonds, at 71.14%, the remaining 26.96% of its weight is in stocks primarily in the technology sector. Aside from United States Treasury Notes 0.25%, which makes up 71.15% of the ETF’s top 10 holdings, its top five holdings include Microsoft Corp. (MSFT), 1.47%; Apple Inc. (AAPL), 1.39%; Amazon Inc. (AMZN), 1.07%; Facebook Inc. A (FB), 0.57% and Alphabet Inc. A (GOOGL), 0.45%.

Ultimately, DeltaShares S&P 500 Managed Risk ETF (NYSEArca:DMRL) is an ingenious model, which is designed to simulate the dynamic allocations made in a volatility-managed portfolio. The goal of this particular ETF is to balance the risk and reward that investors face when investing in low-volatility portfolios.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)