Out-of-favor stock-picking themes can return to favor at any time.

Some might argue that there are greater potential profits to be had in choosing the right moment, when stocks fitting certain themes might have been beaten down for a long time, to jump into a turnaround play. One exchange-traded fund (ETF) that mixes several out-of-favor themes that have been underperforming for years but have real potential is WisdomTree Europe SmallCap Dividend Fund (DFE).

Dividend-paying stocks are rarely a poor choice, although their returns can sometimes not live up to more exciting and dangerous growth plays. But the confluence of European and small-cap stocks is what really makes this fund a bit of a contrarian play in the current market landscape.

It also is an interesting take on that market segment, because small-cap stocks aren’t necessarily known for their dividend payments. The fund weights its holdings, not by market cap, but by dividend payment.

This fund has underperformed in the last 12 months — up just 3%. Its returns are similar to those of iShares Europe ETF (IEV), a fund that just tracks a European theme. DFE’s yield is 2.42%, which may help investors balance out its somewhat high expense ratio of 0.58%. The fund holds $289 million in assets and is open-ended. The current price-to-earnings (P/E) ratio of its holdings is 16.3, which may make it more appealing from a valuation perspective than American blue-chip stocks.

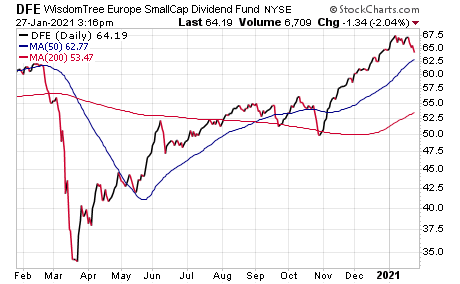

Chart courtesy of StockCharts.com

The fund’s holdings hail from all over Europe, but the largest portions are allocated to the United Kingdom, Norway and Sweden. Financials and industrials lead its sector holdings. The top holdings include Jupiter Fund Management plc, 2.60%; Ferrexpo plc, 2.26%; TGS-NOPEC Geophysical Company ASA, 2.22%; Kardex Holding AG, 2.04%; and ANIMA Holding S.p.A., 1.96%. Just under 20% of the fund’s assets are allocated to its 10 largest holdings.

For investors looking for a thematic paradigm shift in the market to happen in the immediate future, WisdomTree Europe SmallCap Dividend Fund (DFE) provides access to investment themes that are off the beaten path right now.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)