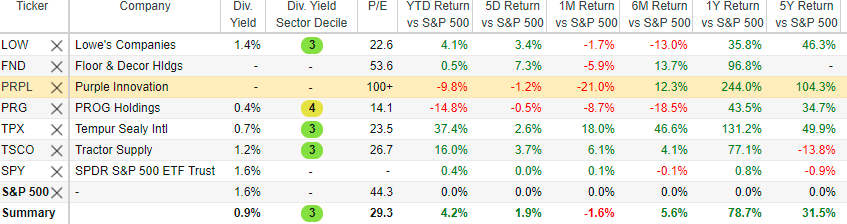

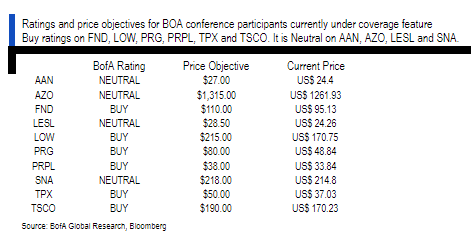

Six retail technology stocks to buy feature the best investment opportunities that emerged after BoA Global Research recently hosted virtual meetings and fireside chats with the leaders of 18 companies in the sector.

The six retail technology stocks to buy stood out from the pack at a BoA Global Research Consumer & Retail Technology Conference on March 9-11 as companies leaving the pandemic in a stronger position than they entered it with plan to keep growing market share. Rivals that were more challenged in 2020 by macro trends were optimistic about the economic recovery boosting their prospects, according to BoA.

Among the points of discussion at the event were the implications of reopening, the risk of inflation and a potential new investment cycle to spur transformation. Companies engaged in home-related categories seemed destined to become COVID-19 beneficiaries that likely would gain from increased consumer demand in early 2021.

COVID-19 Continues to Affect Six Retail Technology Stocks to Buy

Favorable tailwinds that could lift retail technology stocks include the $1.9 trillion federal stimulus recently passed by Congress, economic improvement and positive housing trends that could sustain spending for home upgrades at higher-than-average levels in the medium term, according to BoA. The companies tend to have strong cash positions after “unprecedented sales growth” and are investing in areas to boost market share.

Company leaders in categories such as auto parts retailers that incurred weakened 2020 demand voiced optimism about economic growth due to the improving pace of COVID-19 vaccine rollout, according to BoA. The investment firm forecast that some consumer spending would shift from goods to services in the second half of 2021.

Retail technology executives at the conference addressed the prospect of inflation, with those from larger, well-capitalized companies emphasizing that pricing power comes with purchasing power. Thus, they can access product in categories where there are supply constraints and pass along the higher cost of freight and raw materials to the customer, according to BoA.

E-Commerce Lifts Six Retail Technology Stocks to Buy

Certain retailers represented at the conference used e-commerce to gain significant growth in 2020, with some more than doubling their previous online sales, BoA reported. Whether demand continues to shift online or returns to brick-and-mortar stores, retailers have broadened the use of buy-online-pickup-in-store (BOPIS), curbside pickup and same-day or next-day delivery services.

Retail technology companies during the pandemic that produced heightened free cash flow — consisting of money remaining after paying for operating expenses and capital expenditures — are finding ways to invest those funds in future growth initiatives and share repurchases. Stepped-up incentive compensation and COVID-related costs in 2020 may fade, but increased wages are likely to stay, according to BoA.

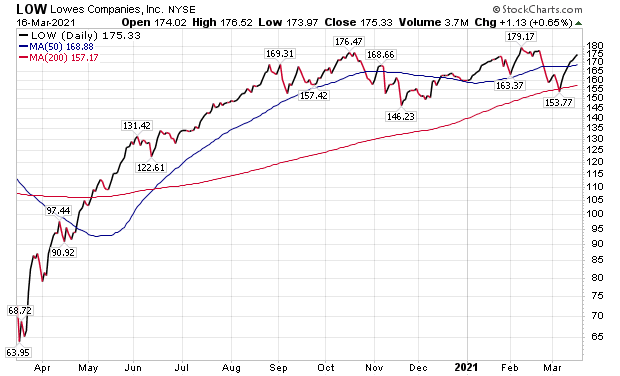

Six Retail Stocks to Buy: Lowe’s (LOW)

Founded in 1946, Lowe’s Companies (NYSE:LOW) is a home improvement retailer headquartered in Mooresville, North Carolina, with 1,970 stores in the United States and Canada. The company’s shares rose 0.65% on Tuesday, March 16, to close at $175.33, despite the S&P 500 Index dropping 0.16% to 3,962.71 and the Dow Jones Industrial Average sliding 0.39% to 32,825.95. It marked Lowe’s eighth consecutive trading day of capital appreciation.

Dave Denton, Lowe’s executive vice president and chief financial officer, fielded questions from BoA analysts March 10-11 and said that demand has not slowed in markets that are incurring enhanced mobility. His comments echoed those of fellow retail leaders from Floor & Décor (NYSE:FND) and Tractor Supply (NASDAQ:TSCO).

Lowe’s is among retail technology companies that have curbed new store opening plans to focus on productivity and ecommerce capabilities to grow market share. Even though certain commodities and other costs, such as freight, are up, LOW can leverage its scale to negotiate favorable terms and access products that may be in short supply nationally as it wields its pricing power against smaller competitors.

The period 2019-2020 encompassed investment and improvement in online capabilities, with LOW’s online sales doubling in 2020. Lowe’s keeps fueling its online business by dedicating more space within its retail stores to fulfill orders. However, growing online sales is a bit more expensive than doing so with in-store sales.

Source: Stock Rover. Click here to sign up for a free two-week trial for Stock Rover charts and analytics.

Six Retail Stocks to Buy Offer Alternatives to Home Depot

Lowe’s also is starting to attain gains from its restructuring initiatives and BoA predicts the home-improvement retailer will keep boosting its profitability and narrowing its long-term competitive gap with Home Depot (NYSE:HD) through product differentiation and other strategies. BoA maintains its Buy rating on LOW and a price objective of $215, which is based on 23x its estimate of the company’s 2021 earnings per share (EPS). In addition, LOW still may grow margins for several years with further productivity improvements and product differentiation.

BoA’s price objective is enhanced by improving consumer sentiment and other macro metrics tied to renovation spending, better-than-expected margin expansion from sales growth, cost savings and productivity initiatives. Its risks include rising interest rates that may erode investor sentiment towards housing, slower-than-expected improvement in year-over-year comparisons and slower-than-anticipated progress towards margin improvement goals.

Chart courtesy of www.stockcharts.com

Six Retail Technology Stocks to Buy: Floor & Décor (FND)

Floor & Décor, founded during 2000 in Smyrna, Georgia, carries major categories of hard flooring that include tile, wood, laminate and stone, along with decorative items and accessories. The company had 133 stores at year-end 2020 and plans to expand to 400+ stores for the long term.

The company’s CFO Trevor Lang appeared at the conference on March 10 to share his vision. One observation in markets such as Florida and Texas, which are reopening and among the company’s largest, is that demand has not weakened. Since FND closed its stores for several weeks during 2020 in many markets, its year-over-year comparisons will be easier than for the home centers such as Lowe’s and Home Depot in the quarters ahead this year.

Lang expressed confidence that demand will stay strong and that the financial health of U.S. consumers, especially in FND’s average demographic of $100,000-$125,000 household income, will support its future growth. Even though FND does not have the level of exposure to rising lumber prices that home centers do, other sources of rising costs impact FND, such as international container expenses and tariffs on rigid-core vinyl that affect about 13% of its sales.

“As the low-price leader in the hard-surface flooring category, FND believes that it has a competitive advantage versus smaller independent peers to raise price while maintaining a superior value versus peers,” according to BoA.

Online Sales Aid Six Retail Technology Stocks to Buy

Online sales are becoming an increased part of overall revenues at FND. Pre-pandemic, about 11.5% of FND’s sales were online but that rose to 60% in Q2 2020, when stores were closed to in-person shopping for many weeks. Online sales for FND have normalized to around 16%, leaving company leaders agnostic about whether a sale is online or in its store, since most of its customers ultimately pick up the product in the store or pay for shipping.

FND has grown its store base at a 20% pace, up until the pandemic when new store growth was intentionally slowed. With store growth planned to return to a 20% pace in 2021, capital expenditures naturally will increase significantly. FND management views the investment as its top priority for capital as the brand grows and matures.

“Floor & Décor is a category killer with product assortment and service levels that exceed peers,” according to BoA. “In our view, FND has ample opportunity for market share gains and to grow its store base. We maintain our Buy rating and price objective of $110, which is based on 55x our 2021 EPS estimate.”

Downside risks to the BoA price objective are a weakening of the housing market beyond current forecasts, execution challenges due to aggressive store growth and supply chain diversification, along with rising competition and high labor costs. BoA’s upside factors for Floor & Décor are the elimination of import tariffs, a stronger housing and flooring market than expected and faster market share gains than now modeled.

Chart courtesy of www.stockcharts.com

Kramer Says Floor & Décor Offers Appeal

“Roughly 9 million Americans moved last year and many of them bought their new residences after only virtual walkthroughs, so it makes sense that they’d want to make a lot of renovations once they actually saw the brick and mortar,” said Hilary Kramer, who hosts the nationally aired “Millionaire Maker” radio program and heads the GameChangers and Value Authority advisory services. “And naturally, people trying to sell existing properties were standing in line with them at the supply store, so add it up and it’s no surprise that the home improvement stocks have been so hot.”

Paul Dykewicz conducts a pre-COVID-19 interview with Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.

Kramer continued that she recommends that investors focus on housing materials names like Floor & Décor as the U.S. construction boom continues. Décor is “important,” Kramer added.

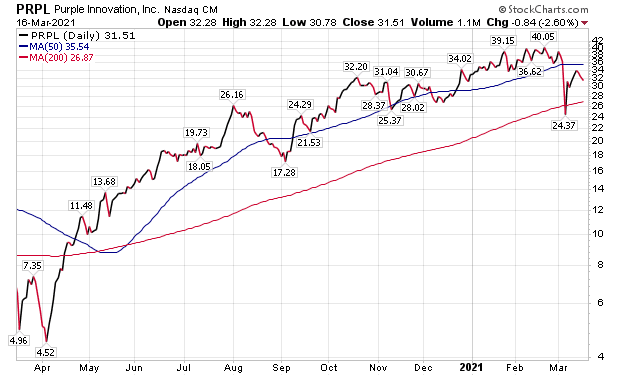

Six Retail Technology Stocks to Buy: Purple Innovation

Purple Innovation (PRPL) impressed the BoA analysts enough to receive an increased price objective after the conference. The “high-growth” bedding company, founded in 2016 and based in Alpine, Utah, generated nearly $650 million in 2020 sales. Since then, it has evolved from an online-only bedding company to a high-growth, omni-channel brand that sells multiple products at increasing price points, according to BoA.

PRPL’s traits and competitive advantages parallel established bedding brands that include vertical integration, a differentiated product and brand, as well as a multi-channel selling strategy, according to BoA. Purple Innovation’s Chief Executive Officer Joe Megibow and Chief Financial Officer Craig Phillips attended the conference on March 9 and voiced confidence in continued growth in units and pricing.

Management maintained that there has been no letup in underlying demand amid unexpected COVID restrictions hitting its new Canadian business and a sharp but short-lived drop in late December’s online sales, BoA commented. Purple Innovation’s management also said that while production capacity is no longer a constraint, supply of pocketed innerspring should start to ease and allow increased wholesale expansion.

Similar to its bedding retailing peers, PRPL is positive about the demand outlook coming out the COVID-19 crisis, according to BoA. In particular, expect growing evidence of the importance of sleep for health to keep consumer interest in the category strong and brands with strong product innovation such as PRPL to gain market share.

Six Retail Technology Stocks to Buy Find Growth

Purple Innovation’s direct-to-customer segment currently is nearly all online but is expected to dip to 70% of sales from 75% in 2020 due to a ramp up in wholesale orders, according to BoA. This will pressure gross margin but PRPL still sees opportunity to benefit from enhanced manufacturing and distribution.

PRPL is a fairly “young brand” with many years of growth ahead of it, BoA reported. PRPL currently has just 3% market share overall and 6% for premium beds, as it aims to become the industry’s No. 2 player behind Tempur in the premium bed space. PRPL will launch several new products this year including a new line of beds.

BoA reiterated its Buy rating on Purple Innovation as a differentiated and increasingly premium bedding brand to grow its market share. For 2021, PRPL laid out an impressive set of initiatives that should drive multi-year growth, including strong progress on manufacturing capacity expansion, new products, gains in owned-store growth, improved online capabilities and new customer relationship management tools, according to BoA.

Plus, BoA raised its price objective to $38, up from $32, and projected rising bedding demand. The company could surprise to the upside with higher-than-expected wholesale growth if it can add new third-party retail partners above expectations, boost online revenue growth and outperform on expected growth from the stores it owns. Downside risks include stiff competition from established peers and upstarts, historically high marketing costs, Tempur-Sealy’s new partnership with PRPL’s largest retailer partner, Mattress Firm, and additional secondary share offers by PRPL’s two founders who own more than 60% of the shares.

Chart Courtesy of www.stockcharts.com

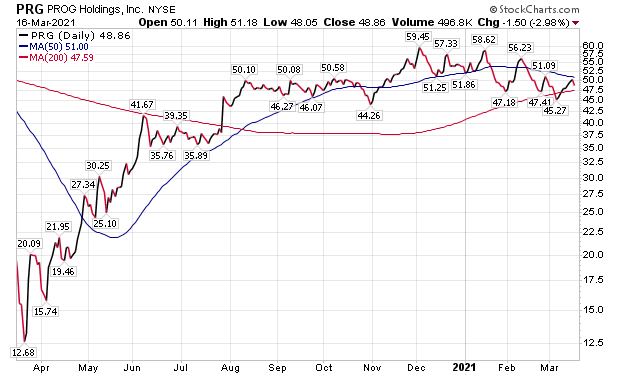

Six Retail Technology Stocks to Buy: PROG Holdings (PRG)

Atlanta-based PROG Holdings (PRG) is the market leader in the virtual lease-to-own (LTO) industry. PRG partners with retailers to offer LTO as a financing option at checkout. The company’s large retail partners include Best Buy (NYSE:BBY), Lowe’s and Big Lots (NYSE:BIG), while its largest product categories include furniture, electronics, appliances, jewelry and cell phones.

PROG Holdings was acquired by brick-and-mortar LTO store operator Aaron’s in 2014, but the buyer spun off into a separate public company in November 2020. Although the pandemic has been a temporary headwind to PRG’s growth, awareness of point-of-sale financing such as lease-to-own has picked up and management expressed confidence of a return to long-term growth rates.

“The reopening of the country will be a meaningful positive catalyst for PRG, although the impact may not be immediate,” BoA reported. “High savings rates during the pandemic have been a significant headwind to point-of-sale financing providers broadly, including PRG.”

PRG retains pricing power due to its strong position as the leader in virtual lease-to-own, with the best track record and capabilities for serving large national retailers, BoA reported. Ecommerce penetration hit mid-single digits in 2020 but exited 2020 at a higher rate and is expected to reach the low-mid teens in 2021 with further growth beyond. Plus, ecommerce is just as profitable as brick & mortar.

BoA described PRG as a high-quality, asset-light business with recurring and significant upside to revenue and earnings from its partnerships with Best Buy and Lowe’s. Additional partnership wins could lift its prospects further. BoA holds a Buy rating and a price objective of $80 on the stock.

Chart Courtesy of www.stockcharts.com

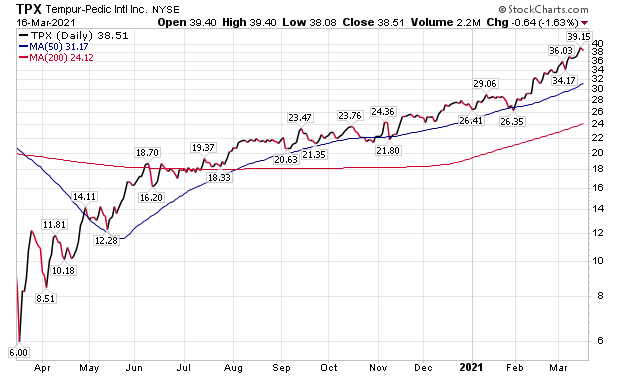

Six Retail Technology Stocks to Buy: Tempur Sealy (TPX)

Lexington, Kentucky-based Tempur Sealy International (NYSE:TPX), a global manufacturer and distributor of bedding products, produces a majority of the company’s sales in the United States, where it has roughly a 30% market share. The company acquired Sealy in March 2013 and generated around $3.7 billion of sales in 2020.

TPX management forecast continued growth in units and pricing, as did other bedding industry leaders at the conference. Its leaders eye international markets where the company’s share of customers is very low compared to the United States.

Despite a track record for under-promising and over-delivering, TPX management expressed it is comfortable with 10% annual revenue growth and 20% earnings gains for a multi-year period. If this is the case, this would make TPX shares extremely attractively priced, according to BoA.

Overall demand remains strong, with BoA expecting Asian economies to open up quicker than the United States and not hurt bedding demand. TPX production constraints from raw inputs are winding down, with shortages around pocketed innerspring coils “95% done,” according to BoA. TPX voiced confidence to pass through price increases to offset higher input costs, as occurred in December. Another price hike could come in April, BoA forecast.

TPX is making significant investments in capacity that would total $150 million in new production during the next three years to boost foam capacity by 50%. TPX should continue to structurally drive revenues by investing in product and marketing, sharing gains against both large and small competitors with weaker capital positions and pursue other gains in its international business, BoA reported.

“We see a continued opportunity for improved margins in all segments under a profit-oriented management team and ample internal opportunities,” BoA wrote. “We raise our price objective to $50 from $44.”

However, high-tech pillows and mattresses are relatively durable purchases.

“We don’t buy new ones very often, and once companies like TPX and PRPL book a sale, they can’t come back to the same consumer for several years,” Kramer said. “I’d look at relatively consumable décor categories instead.”

Chart courtesy of www.stockcharts.com

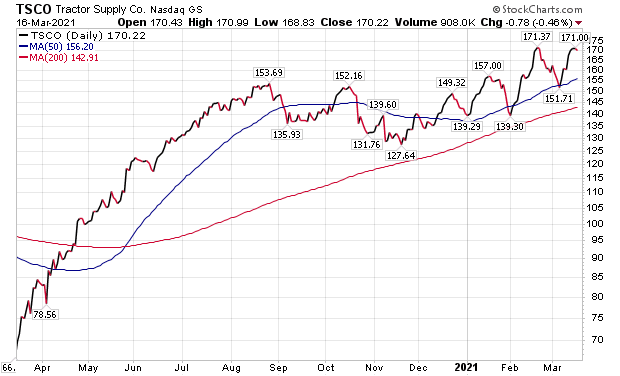

Six Retail Technology Stocks to Buy: Tractor Supply (TSCO)

Brentwood, Tennessee-based Tractor Supply (NASDAQ:TSCO) is the largest domestic operator of retail farm and ranch stores, with 2020 revenues of $11.1 billion. The company currently operates more than 1,900 stores, including 180 PetSense locations.

Ecommerce, as a percentage of total sales, has jumped at TSCO from about 3-4% in 2019 to roughly 6% in 2020. But since approximately 75% of online orders are picked up in store or curbside, there is little incremental shipping or delivery cost to Tractor Supply. Rising ecommerce demand is therefore a net benefit to profit, BoA commented.

Chart courtesy of www.stockcharts.com

TSCO generally can pass on inflation in commodities to its customers, given the needs-based nature of TSCO’s merchandise. At the same time, TSCO has a competitive advantage versus smaller rivals to negotiate with suppliers, as well as use localized production, distribution and data analytics.

The company remains a BoA favorite, as it sits squarely at the epicenter of several positive medium-term themes: Americans seeking more space in suburban and rural markets, the pandemic’s “pet boom,” a strong leisure trend and industry consolidation favoring large chains such as TSCO. BoA’s $190 price objective is reinforced through a Buy rating.

Positive catalysts for TSCO could be a significant economic rebound in TSCO’s core rural markets, an acceleration of the company’s store growth plan above its current outlook and price and gross margin inflation in TSCO’s core product categories. Negative risks are stepped-up reinvestment under a new CEO, a delayed impact from the slowdown in U.S. industrial markets, an inability to offset wage inflation and increased competition from mass merchants and online retailers.

Six Retail Technology Stocks to Buy Are Among ‘Best of Breed’

“When it comes to the next big wave of consumer spending, you can bet that the best-of-breed retailers are going to be big beneficiaries,” said Jim Woods, editor of Successful Investing, Intelligence Report and Bullseye Stock Trader, as well as co-editor of Fast Money Alert. Woods currently recommends Lowe’s (NYSE:LOW) as a long-term hold.

The owner of a small ranch in Southern California, Woods said he has traded Tractor Supply Co. (NASDAQ:TSCO) in the past.

“I do much of my shopping for feed and supplies at Tractor Supply,” Woods told me. “It’s one of the best-run retail operations around, and the best part for investors and traders is the shares are close to breaking out to new highs — always a bullish sign.”

Columnist and author Paul Dykewicz meets with stock picker Jim Woods before COVID-19.

COVID-19 Vaccinations Support Six Retail Technology Stocks to Buy

COVID-19 vaccinations are cutting the number of new cases and deaths in the United States, but the overall toll keeps climbing. The Food and Drug Administration (FDA) recently approved a third COVID-19 vaccine to in hopes of containing the virus.

U.S. COVID-19 cases have reached a devastating 29,549,010 and caused 536,914 deaths, as of March 17. Worldwide cases of 120,710,811 and deaths of 2,670,763 also have been reported so far by Johns Hopkins University. America has the sad distinction as the country with the most COVID-19 cases and deaths.

The six retail technology stocks to buy allow investors a chance to benefit from the federal stimulus money and the economic reopening as COVID-19 vaccines become increasingly available in the months ahead. BoA screened 18 companies and chose its top six to recommend as buys.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.