Coming into the month of June, the noise level about runaway commodity prices was at a pretty high decibel reading.

Just about every hard and soft class of commodities was trading firmly higher due to the global reopening of several major economies, compounded by wide-ranging logistical bottlenecks and outright shortages.

This set of conditions lit up the inflation data that triggered the massive sector rotation into value and deep cyclical stocks, calling into question the Fed’s transitory inflation narrative. This past month saw most commodity prices pull back off their highs in a well-deserved round of consolidation, with the exception of a few very notable asset classes — namely crude oil, natural gas, cattle, coffee, sugar, cotton, fertilizer, iron ore and hot-rolled steel — which are all trading at or close to their 2021 highs.

Prices of corn, soybeans, lean hogs, gold, silver, copper, cocoa, orange juice, wheat and lumber fell well off their highs and look to be making technical bottoms as of this past week. The broad proclamation that “commodities have sold off” is really only half right if one just pans the weekly commodity charts. Regardless of the recent bout of consolidation, with the rest of the global economies working through the latter phases of COVID-19, there looks to be an increasingly bullish case for investing in commodities.

The global re-opening has not been synchronous and the reflation of growth domestic product (GDP) growth rates has been very uneven. That is starting to balance out with the pandemic data showing signs of improvement in India, Brazil and other key developed and emerging markets. As such, a more even-keeled, supply-demand relationship of commodities is unfolding as witnessed during much of June with prices starting to firm back up as of last week, with copper being the most notable of interest.

Source: TradingEconomics.com

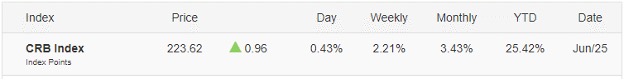

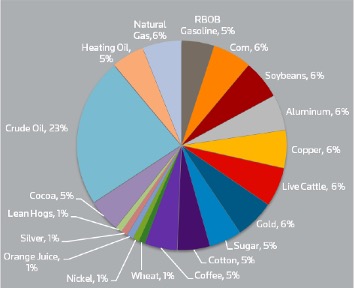

For more than 50 years, the CRB Index has served as the most recognized measure of global commodity prices and is calculated using the arithmetic average of commodity futures prices with monthly rebalancing. The index consists of 19 commodities: Aluminum, Cocoa, Coffee, Copper, Corn, Cotton, Crude Oil, Gold, Heating Oil, Lean Hogs, Live Cattle, Natural Gas, Nickel, Orange Juice, RBOB Gasoline, Silver, Soybeans, Sugar and Wheat.

Source: All Star Charts

Those commodities are sorted into four groups, with different weightings: Energy: 39%, Agriculture: 41%, Precious Metals: 7% and Base/Industrial Metals: 13%. Clearly, with the rise in the energy sector, the CRB index has soared above pre-COVID-19 highs.

Source: TradingEconomics.com

As the rest of the world economies come fully back online, the second half of 2021 looks to offer further upside potential for commodity-related assets. The gains could come either in the form of exchange-traded funds (ETFs) that track the CRB Index or in stocks and ETFs that are highly correlated to the broad commodity rally that is showing signs of investors buying the dip this month. The Fed has raised its inflation forecast to reflect a 3.4% annual rate that supports a bullish base case for stable-to-higher commodity prices.

On March 3, Goldman Sachs analysts, in a note to clients, stated, “It’s the beginning of a new structural bull market in commodities with every market with the exception of zinc and cocoa in a structural deficit.”

“We see supply across all of these markets chasing demand higher but not catching up, leading to demand-pull inflationary pressures, even in oil. Moreover, commodities are the crucial link between growing demand, a weaker dollar and inflation, which is why they have been statistically the best hedge against inflation,” Goldman Sachs reported.

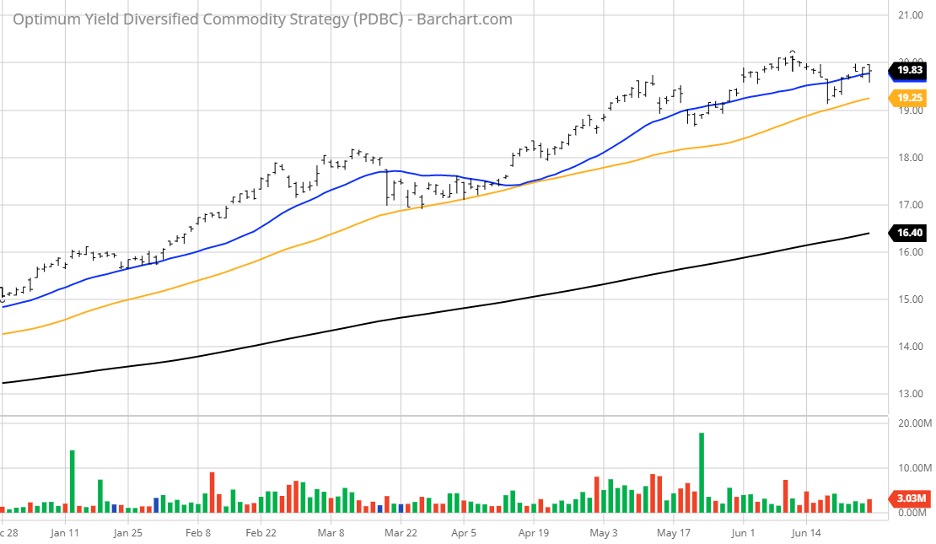

Investors looking for an inflation hedge that is liquid and tied to the CRB Index should consider ETFs such as Invesco Optimum Yield Diversified Commodity Strategy No. 1 ETF (PDBC) composed of futures contracts on 14 heavily traded commodities across the energy, precious metals, industrial metals and agriculture sectors.

For those seeking commodity-related income, the BlackRock Resources & Commodities Strategy Trust (BCX) might make for a good fit. BCX invests at least 80% of total assets in equities of commodity and natural resource companies and will use derivatives to exploit price movements of the underlying commodity prices, while also using an options writing (selling covered calls) strategy to enhance dividend yield. BCX uses no leverage and sports a 5.0% yield that pays out a monthly dividend.

There are several other ETFs and mutual funds to consider, but these two screened well for the fund managers, total assets, daily liquidity and year-to-date performance. I like to think we have a blanket pure play on the commodity prices themselves and on stocks within the commodity sectors to offer an attractive combination.

The means of gaining exposure to the rally in commodities is always up to the investor, but adding some allocation to portfolios looks timely even with modest inflation, as forecast by the Fed. To that point, if Goldman Sachs is right in its thesis, then there is plenty of room to run for the commodity rally and money to be made.