The three best renewable energy stocks to buy now include a worldwide distributor of power optimizers, inverters and other solar parts, a global pioneer in the electric vehicle market and the largest installer of residential solar systems in the United States.

Companies with a focus on renewable energy currently have some of the highest valuation multiples of any sector. It is not uncommon for a clean energy startup generating positive net income to attain a price-to-earnings ratio near or above 100. However, with solar and wind expected to surpass coal as the primary source of electricity worldwide by 2025 and electric and hybrid vehicles expected to account for a third of global vehicle sales by 2030, renewable energy is the future.

As a result, many corporations in this sector have some of the highest returns of any industry over the past decade. With the global economy beginning to recover from COVID-19 and energy demand reaching new heights every year, many renewable energy companies are at the brink of experiencing record-breaking years. Here are the three best renewable energy stocks to buy now.

3 Best Renewable Energy Stocks to Buy Now: #3

SolarEdge Technologies (NASDAQ:SEDG)

SolarEdge Technologies (NASDAQ:SEDG), founded in 2006, is a U.S.-domiciled corporation headquartered in Israel that specializes in developing and producing direct current optimized inverter systems for residential, commercial and utility solar installations. The company sells its various power optimizers, inverters and cloud-based monitoring platforms both directly and indirectly to engineers, solar installers and construction companies. SEDG currently has offices in Germany, Italy, Israel, the United States and Japan.

SolarEdge, which currently maintains a market capitalization (market cap) of $14.8 billion, has positioned itself as a leader in solar power optimizers and inverters, critical components in solar systems — having shipped products to over 130 countries by the end of 2020. However, SEDG has drastically expanded its business in recent years to capture as much of the renewable energy market as possible from on-grid battery solutions to automated energy management technology. The company even partnered with Tesla (NASDAQ:TSLA) in May 2015 on developing photovoltaic storage and backup power solutions for the residential solar market, producing approximately $800 million worth of orders. By the end of 2020, the company had grown non-optimizer, inverter and other solar-related products and solutions to $100 million.

Similar to the rest of the solar industry, SolarEdge has experienced a decline in sales of 9.6% in the past 12 months due to COVID-19, compared to the industry average of a 10.0% drop. However, over the past five years, with a return rate of 1299.2% and an average annual revenue growth rate of 25.3%, SEDG has performed well above both industry and S&P 500 benchmarks. The average five-year industry sales growth and return rates are -4.3% and 249.6%, respectively. The S&P 500 averages are 10.3% and 127.7%, respectively. SolarEdge is posed to ride the massively favorable incoming renewable energy tailwinds as the economy begins to recover.

With costs dropping dramatically, including by 70% over the past decade, solar installations in the United States are expected to more than double in the next five years. Globally, the solar synergy market is expected to reach $200 billion by 2026, compared to $50 billion in 2019. As a result, SolarEdge is projected to see a 30.2% jump in sales in 2021 and a 25.3% increase in 2022. For the last year, SEDG has skyrocketed by 107.5%, plotted below, alongside a 50-day moving average to display the upward trend.

Chart provided by Stock Rover.

Although SEDG is pricey compared to companies in other industries, with a trailing 12 months (share) price-to-earnings (P/E) ratio of slightly over 100, it is right at the solar industry’s P/E average. With forward 12 months P/E being significantly lower at 44.3 due to SolarEdge’s rapid growth and Stock Rover assigning a 94/100 growth rating on the stock, the upside of the fast-growing company is well worth the cost.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $312.56, 9.8% higher than its latest closing price of $284.66, earning SEDG a “Buy” recommendation from Stock Rover and a place among our three best renewable energy stocks to buy now.

3 Best Renewable Energy Stocks to Buy Now: #2

Nio (NYSE:NIO)

Nio (NYSE:NIO) is a Chinese-based electric vehicle (EV) manufacturer headquartered in Shanghai. The company, founded in November 2014, is the largest Chinese-based auto manufacturer trading on U.S. exchanges and is also commonly viewed as Tesla’s most prominent competitor in Asia. Nio has unveiled five EV models in total, sport utility vehicle (SUV) models EC6, ES6 and ES8, sedan ET7 and the super limited Nio supercar EP9. The company primarily distributes and sells its EVs through its network of Nio Houses, Nio Spaces and Nio app.

Tesla’s record-breaking climb in share price over the past few years has revealed to many investors the potential of renewable energy in the automotive industry. However, China is the largest automotive industry and EV market globally, with China-based manufacturers accounting for over 50% of global EV deliveries in 2020. Demand for EVs is expected to accelerate as the Chinese government aims for 25% off all new cars sold in the country to be electric by 2025. The number currently sits at 5%. In June 2021, auto manufacturing rivals William Li, CEO of Nio, and Wang Chuanfu, founder of BYD, projected that by 2030 between 70% to 90% of all new car sales in China will be hybrid or fully electric.

Despite all three companies being founded within approximately a year of one another, Nio currently possesses a market cap of $73.8 billion, dwarfing competitors Xpeng ($33.8 billion) and Li Auto ($28.7 billion) — the next largest Chinese-based EV producers listed on American exchanges. While Nio has four mass-production models, Xpeng has two and Li Auto has one.

Like Tesla in America, demand for EVs in China is so high that sales are not defined by demand but instead by the production capabilities of auto manufacturers. Out of the three major companies, Nio boasts by far the most extensive manufacturing capabilities. The company has seen a 423% jump in year-over-year EV deliveries from 3,838 in Q1 2020 to 20,060 in Q1 2021. For comparison, Xpeng and Li Auto only saw 13,340 and 12,579 deliveries in Q1 2021, respectively.

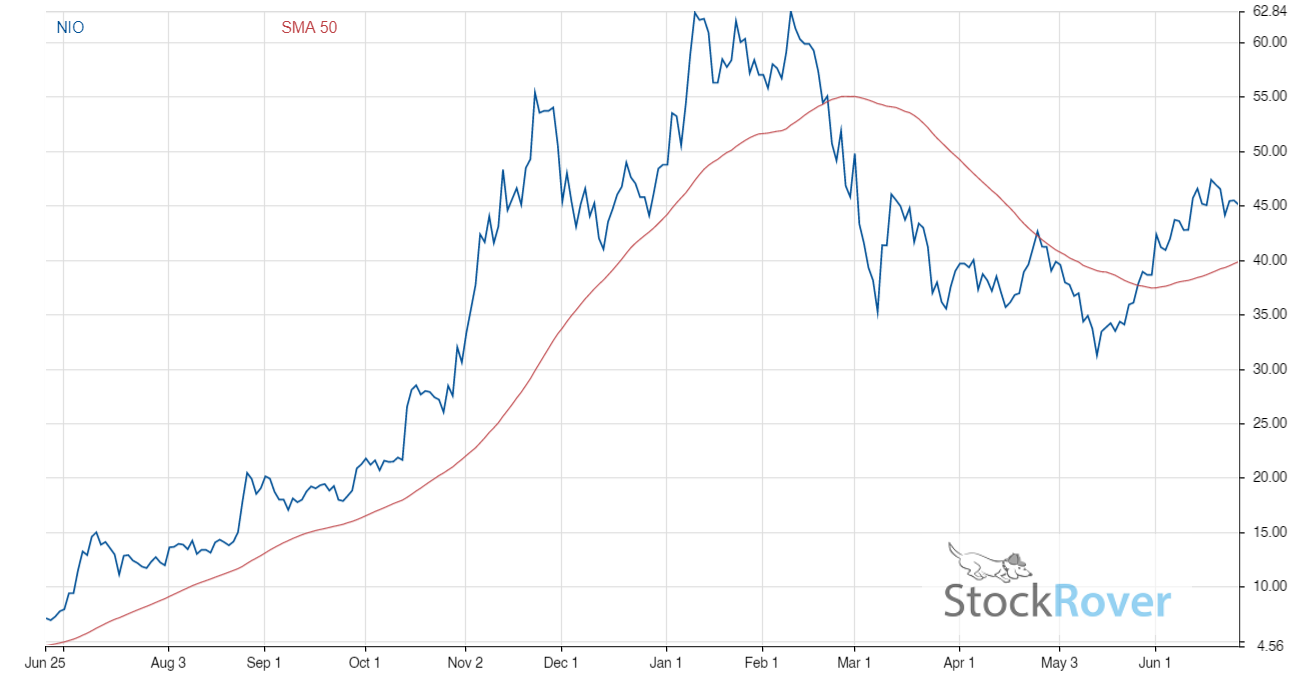

Despite sales in the Chinese auto industry suffering a slight decline due to the COVID-19 pandemic, Nio has produced a revenue compound annual growth rate (CAGR) of 81.2% in the past two fiscal years since its initial public offering (IPO) in September 2018. With sales increasing by 202.3% over the trailing 12 months, the company has seen its share price increase by 557.0% over the past year. This change, as well as a 50-day moving average line, are charted below.

Chart provided by Stock Rover.

Nio teetered on the edge of bankruptcy in late 2019, with analysts predicting that the company was just weeks away from running out of cash. However, since then, Nio has seen its cash on the balance sheet skyrocket by 4761.5% to more than $7.3 billion, its debt-to-equity ratio drop from nearly 5.0x to 0.6x and its current ratio jump from 0.5 to 3.5.

With plans to expand commercial sales to Europe in September, the new ET7 begins production early next year and the company is expected to become profitable by the end of 2021. NIO’s climb is not over yet. Analysts predict sales to increase by 110.9% in 2021 and 62.5% in 2022 alone. Furthermore, with a (share) price-to-sales (P/S) of 16.7, lower than both Tesla’s 20.9 and Xpeng’s 25.8, Nio is currently a better value.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $50.49, 2.2% higher than its latest closing price of $49.90, earning NIO a “Buy” recommendation from Stock Rover and a place among our three best renewable energy stocks to buy now.

3 Best Renewable Energy Stocks to Buy Now: #1

Sunrun (NASDAQ:RUN)

Sunrun (NASDAQ:RUN), founded in January 2007, is an energy services company specializing in the design, installation, sale and maintenance of residential solar panel and battery systems. The company, headquartered in San Francisco, California, typically provides its services and products to homeowners through direct leasing and power-purchasing agreements.

Upon its founding, Sunrun pioneered the practice of providing long-term financing to solar installation consumers, allowing it to generate steady cash flow while simultaneously gaining market share. By lending directly to homeowners, customers can upgrade to solar and reduce their electricity costs for little-to-no upfront cost, while Sunrun, in exchange, receives a consistent long-term income stream from the monthly principal and interest payments. The company’s gross earning assets, or the present value of expected future cash flow from these loans, currently stand at $8.1 billion alone.

With a market cap of $11.6 billion, Sunrun owns approximately 20% of all residential solar systems in the United States through its installation and financing offerings. Since the company’s IPO in August 2015, Sunrun has doubled its market share and experienced an average annual revenue growth rate of 24.2%, including a 19.6% jump in sales over the past twelve months, despite the COVID-19 pandemic. Revenue figures for the company are projected to continue to increase as the economy rebounds, with sales expected to skyrocket by 58.3% in 2021.

Already a $14.8 billion industry, solar installations are expected to more than double over the next five years. SolarCity is Sunrun’s only comparable competitor in the United States in terms of market share. With that perspective, Sunrun seems positioned to capture and benefit from the expected boom in installations. As a result of the company’s strong outlook, RUN has seen a 206.3% increase in share price over the past year, charted below alongside a 50-day moving average.

Chart provided by Stock Rover.

However, the stock still has significant room to grow. Sunrun’s $3.2 billion acquisition in October 2020 of Vivint Solar, a full-service residential solar provider, has solidified the company’s position as the market leader in solar installation, while introducing an estimated $90 million worth of cost synergies annually. Meanwhile, RUN’s 1.9 price-to-book (P/B) ratio — a measure of its share price compared to its book value — also is considerably below the industry average of 4.2. The book value (total assets minus total liabilities) is an essential metric because most projected future revenue streams for Sunrun are derived from its gross earning assets.

Although Sunrun is not consistently profitable, its strong growth means that it is well within reach. The company has generated positive cash flow in three of the last seven quarters, and analysts predict a strong showing in 2021 could potentially allow the company to reach the profitability milestone.

However, Sunrun’s financing model has provided the company a significant cushion even if it does achieve profitability soon. With gross earning assets topping $8 billion, Sunrun can essentially stop new installations and rely solely on cash flows from collections and monthly lease and power-purchase agreements to become profitable for decades.

With steady future cash flow, strong projected revenue growth and profitability on the horizon, the market leader in solar installations is a must-buy stock.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $75.94, 33.4% higher than its latest closing price of $56.91, earning RUN a “Strong Buy” recommendation from Stock Rover and a place among our three best renewable energy stocks to buy now.

Capison Pang is an editorial intern who writes for www.stockinvestor.com and www.dividendinvestor.com.